Score

coinbase

United States

10-15 years

MTL License|

EMI License|

Digital Currency License|

Common Financial Service License|

Canada Common Financial Service License Revoked|

Suspicious Overrun|

High potential risk

https://www.coinbase.com/

Website

Influence

C

Influence Index NO.1

United States 8.98

Biz Area

Search Statistics

Advertising

Social Media Index

Exchange License

NMLSRegulated

MTL License

FCARegulated

EMI License

NYSDFSRegulated

Digital Currency License

SECOver-Operation

Common Financial Service License

NYSDFSOver-Operation

Common Financial Service License

FINTRACOver-Operation

Common Financial Service License

FINTRACRevoked

Common Financial Service License

coinbase Exchange Info

WikiBit Risk Alerts

7The number of the negative comments received by WikiBit have reached 26 for this Exchange in the past 3 months, please be aware of the risk and the potential scam!

The number of this Exchange's nagitive field survey reviews has reached 4, please be aware of the risk and the potential scam!

CanadaFINTRAC (License No.: M20848651) The regulatory status is abnormal, the official regulatory status is Revoked, please be aware of the risk!

Website

Relationship Mapping

Social Media

Trade Type

Keywords

Time Machine

White Paper

Related Software

Github

Related Docs

All Corps

New Arrival

Trading statistics

Influence

Yesterday Vol

7 Days

Crypto Price Percentage

Exchange Market Research

coinbase User Reviews

| Aspect | Information |

| Company Name | Coinbase |

| Registered Country/Area | United States |

| Founded Year | 2012 |

| Regulatory Authorities | Regulated by the SEC and FinCEN and various state regulators. |

| Cryptocurrencies Available | Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), and more. |

| Fees | Vary from 0.5% to 4%. |

| Deposit & Withdrawal | Bank transfers (ACH), wire transfers, debit/credit cards, and cryptocurrency transfers. |

| Customer Support | Twitter,https://twitter.com/coinbase;Facebook,https://www.facebook.com/Coinbase |

Overview of coinbase

Established in 2012, Coinbase is a prominent U.S.-based virtual currency exchange regulated by the SEC, FinCEN, and state regulators. Offering a diverse range of cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum, and Litecoin, Coinbase prioritizes a secure and user-friendly environment for cryptocurrency transactions. Operating through Coinbase Exchange and Coinbase Pro, it supports various deposit methods like ACH transfers, wire transfers, debit/credit cards, and cryptocurrency transfers.

Pros and cons

| Pros | Cons |

| Strong regulatory standing | Lack of leveraged trading options |

| Wide range of supported cryptocurrencies | Availability of certain cryptocurrencies may be limited |

| Emphasis on security | Customer support response times during high market volatility |

Security

Coinbase places a strong emphasis on security and has implemented various measures to protect user funds and data. Some of the security features and measures include:

1. Two-Factor Authentication (2FA): Coinbase offers 2FA, which adds an extra layer of security by requiring users to enter a unique code in addition to their password when logging in.

2. Cold Storage: The majority of user funds held by Coinbase are stored offline in cold storage. This helps protect the funds from unauthorized access and potential cyber threats.

3. Insurance Coverage: Coinbase provides insurance coverage for cryptocurrencies held in its online storage in the event of a security breach or hacking incident.

4. Secure Asset Fund for Users (SAFU): Coinbase has established the SAFU fund, which is designed to offer additional protection to users in the unlikely event of a security breach or loss of funds.

Cryptocurrencies available

Coinbase offers a wide range of cryptocurrencies for trading and investment purposes. Some of the most popular cryptocurrencies available on Coinbase include Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), and more.

The prices of cryptocurrencies can be highly volatile and can fluctuate significantly on exchanges. The price of a cryptocurrency on Coinbase is based on market demand and supply dynamics, and can be influenced by various factors such as market sentiment, investor sentiment, regulatory developments, and macroeconomic factors.

In addition to cryptocurrency trading, Coinbase also offers other products and services. One such service is Coinbase Custody, which provides institutional clients with secure storage of their digital assets. Coinbase Custody is designed to meet the high security and regulatory standards required by institutional investors.

Coinbase APP

The Coinbase app is a mobile app that allows users to buy, sell, trade, and store cryptocurrencies. It is one of the most popular cryptocurrency apps in the world, with over 100 million users.

Here are the main functions of the Coinbase app:

Buy, sell, and trade cryptocurrencies: The Coinbase app allows users to buy, sell, and trade over 100 cryptocurrencies, including Bitcoin, Ethereum, Tether, and USD Coin.

Store cryptocurrencies: The Coinbase app allows users to store their cryptocurrencies in a secure wallet.

Earn interest on cryptocurrencies: The Coinbase app allows users to earn interest on their cryptocurrency holdings by staking or lending them out.

Learn about cryptocurrency: The Coinbase app offers a variety of educational resources to help users learn about cryptocurrency.

To download the Coinbase app, simply visit the App Store or Google Play and search for “Coinbase”. Once you have found the app, tap the “Get” or “Install” button to download it. Once the app has been downloaded, open it and create an account. Once you have created an account, you will be able to start buying, selling, trading, and storing cryptocurrencies.

The Coinbase app is a powerful and easy-to-use tool for managing your cryptocurrency portfolio. It is a good choice for both beginners and experienced cryptocurrency users.

How to open an account?

The registration process for Coinbase can be summarized in six simple steps:

1. Create an account: Visit the Coinbase website and click on the “Sign up” button. Enter your email address, create a strong password, and agree to the terms of service.

2. Verify your email: After creating an account, Coinbase will send a verification email to the address you provided. Click on the verification link to confirm your email.

3. Provide personal information: Fill out the necessary personal information, including your full name, date of birth, and phone number. This information is required for identity verification purposes.

4. Verify your identity: Upload a copy of a valid government-issued ID, such as a passport or driver's license. Coinbase will use this information to verify your identity.

5. Set up payment method: Add a payment method, such as a bank account or credit card. This will allow you to deposit funds and purchase cryptocurrencies on the platform.

6. Complete account verification: Coinbase may require additional verification steps, such as uploading a selfie or providing proof of address. Follow the instructions provided to complete the verification process and activate your account.

How to Buy Cryptos?

To buy cryptocurrencies on Coinbase, you can follow these step-by-step processes on both the PC and mobile app:

On Coinbase.com (PC):

Sign in to Coinbase.

Click on “Buy Sell” on the upper right-hand side.

In the Buy panel, select the cryptocurrency you want to purchase.

Enter the amount in either crypto or your local currency that you wish to buy.

Choose your preferred payment method.

Click “Preview Buy” to review your purchase details. You can go back if you need to make any changes.

Confirm your purchase by clicking “Buy.”

If you want to set up a recurring purchase, click “One-time purchase” and select the frequency.

On Coinbase Mobile App:

Open the Coinbase mobile app and tap on the “Buy” icon on the Home tab.

Choose the cryptocurrency you want to buy.

Enter the amount in crypto or your local currency.

Tap “Preview Buy” to review your purchase details. Use the back button to make any necessary changes.

If all details are correct, tap “Buy now” to complete your purchase.

For recurring purchases, tap “One-time purchase” and set the frequency.

These steps ensure a straightforward process for buying cryptocurrencies on both the Coinbase website and mobile app.

Fees

Coinbase charges various fees for different services on its platform. Here is a breakdown of the trading fees and other fees associated with Coinbase:

1. Trading Fees: Coinbase employs a fee structure known as a “spread” for cryptocurrency trading. The spread is the difference between the buying and selling prices on the platform, and it varies depending on market conditions and the specific cryptocurrency being traded. The spread can range from as low as 0.5% to as high as 4% for certain cryptocurrencies.

2. Deposit and Withdrawal Fees: Coinbase does not charge fees for cryptocurrency deposits. However, there may be network fees associated with transferring cryptocurrencies from external wallets to Coinbase. These network fees are determined by the blockchain network and can vary depending on network congestion and the specific cryptocurrency.

For fiat currency deposits and withdrawals, Coinbase may charge fees depending on the payment method used. Bank transfers (ACH and SEPA) are usually free, while credit/debit card purchases may incur additional fees.

Deposit & Withdrawal

Coinbase supports a variety of payment methods for both deposits and withdrawals. The specific payment methods available will vary depending on your country or region.

Deposits

Bank Account (ACH): This is the most popular payment method on Coinbase. It is also the slowest, with deposits taking 3-5 business days to process.

Wire Transfer: This is a good option for large investments. Deposits are processed within 1-3 business days, but there is a fee for using this payment method.

PayPal: This is a good option for small investments and cashouts. Deposits are processed instantly, but there is a fee for using this payment method.

Withdrawals

Bank Account (ACH): This is the most popular payment method for withdrawals on Coinbase. Withdrawals are processed within 3-5 business days.

Instant Cashouts to bank accounts: This is a new payment method that Coinbase offers in partnership with Plaid. It allows you to withdraw funds from your Coinbase account to your bank account instantly, for a fee.

Debit Card: This is a good option for small investments and cashouts. Withdrawals are processed instantly, but there is a fee for using this payment method.

Wire Transfer: This is a good option for large investments. Withdrawals are processed within 1-3 business days, but there is a fee for using this payment method.

PayPal: This is a good option for small investments and cashouts. Withdrawals are processed instantly, but there is a fee for using this payment method.

The processing times for deposits and withdrawals on Coinbase vary based on the chosen payment method. Transactions made through credit/debit cards are typically processed instantly, providing users with immediate access to their funds. On the other hand, bank transfers may take up to 3 business days for processing.

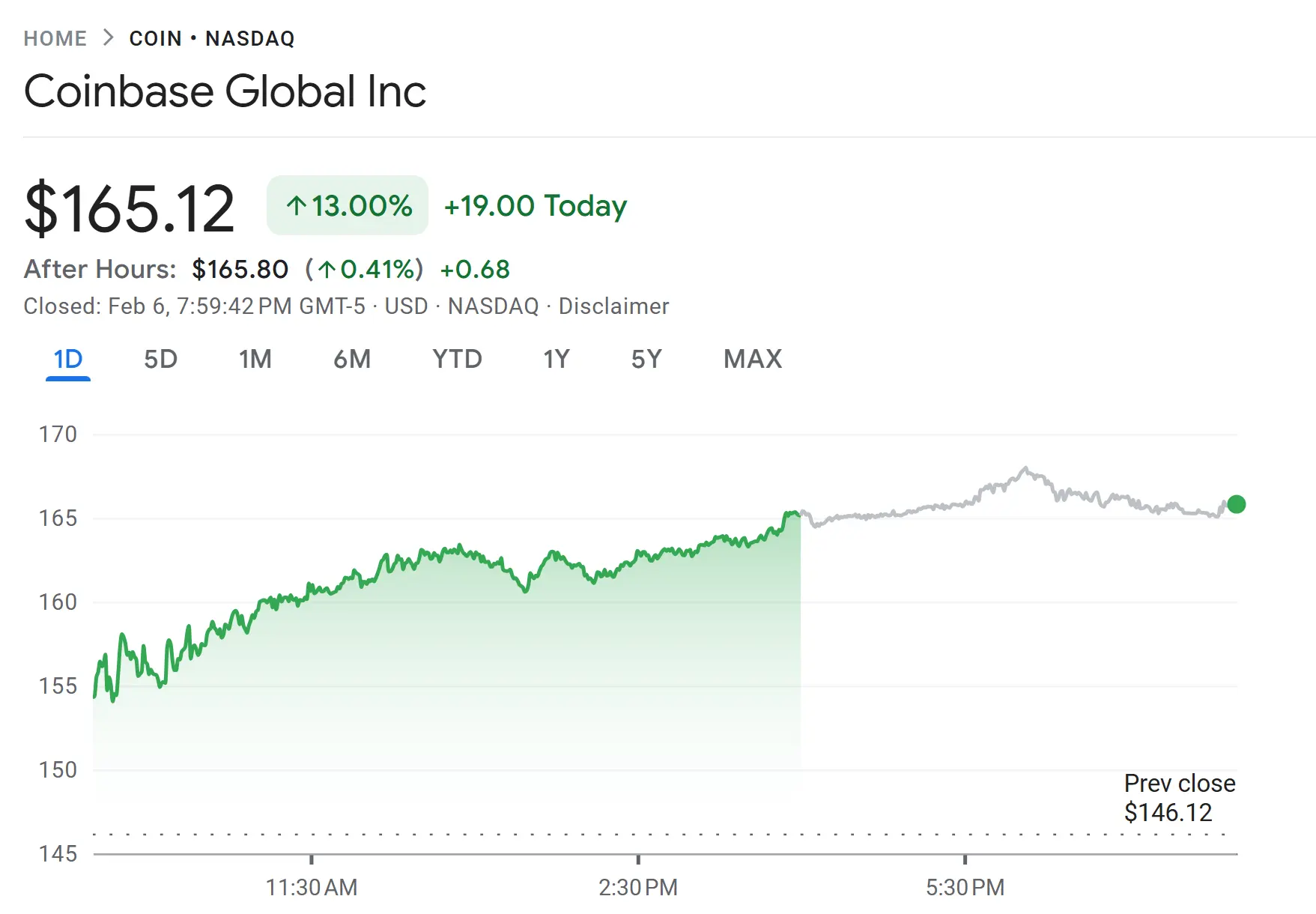

2026-02-08 21:00

2026-02-06 22:00

2026-02-06 21:00

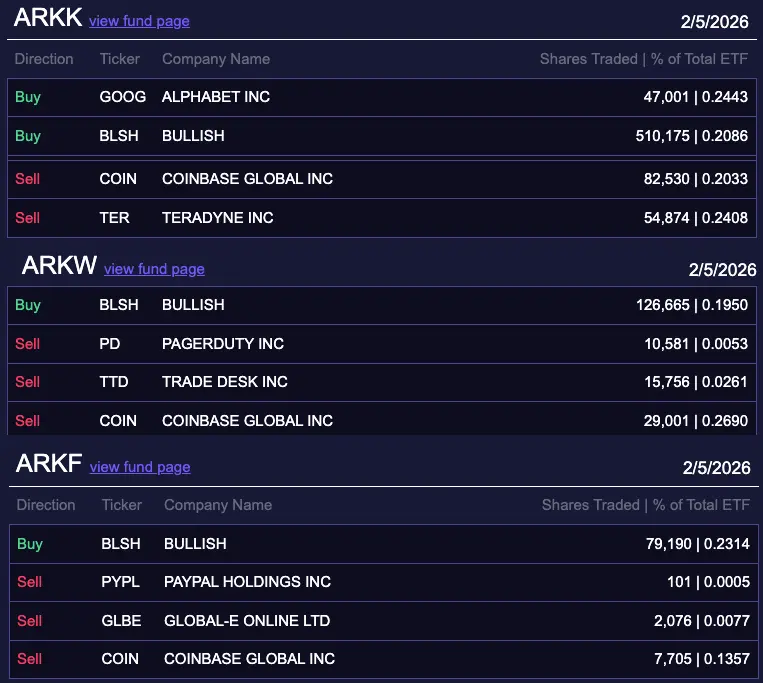

2026-02-05 22:00

2026-02-05 18:00

2026-02-05 17:00

2026-02-05 03:00

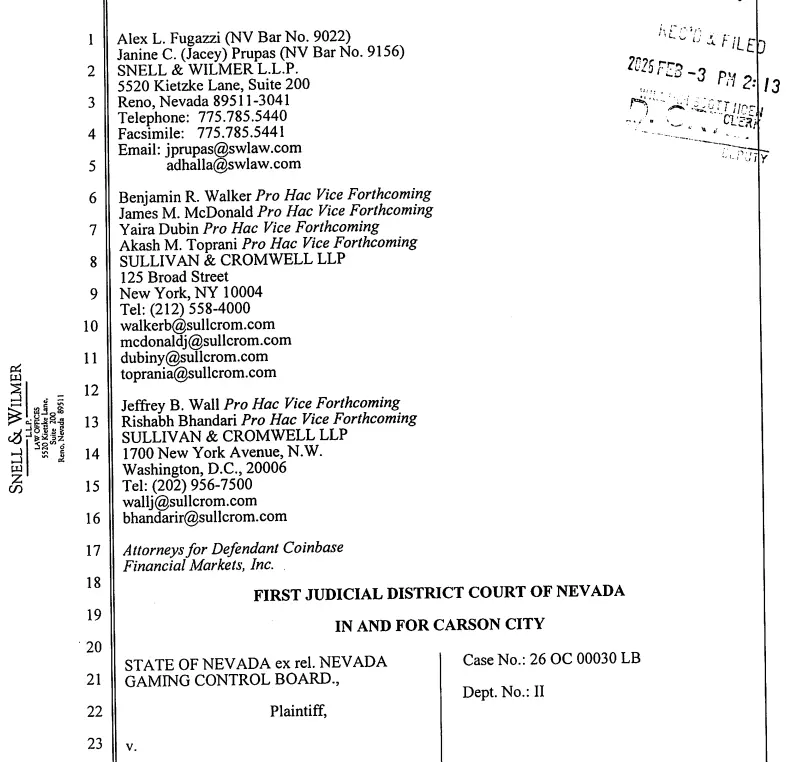

2026-02-03 20:01

2026-01-31 18:00

Company Name

Company Name Phone of the company

Phone of the company Company Website

Company Website X

X Facebook

Facebook Customer Service Email Address

Customer Service Email Address United States

United States United Kingdom

United Kingdom

845 ratings

View all comments