USDT

$ 0.99996 USD

$ 0.99996 USD

$ 184.454 billion USD

$ 184.454b USD

$ 90.7803 billion USD

$ 90.7803b USD

$ 1.0061 trillion USD

$ 1.0061t USD

184.572 billion USDT

Tether-related information

Issue Time

2014-11-26

Platform pertained to

--

Current coin price

$0.99996USD

Market Cap

$184.454bUSD

Volume of Transaction

24h

$90.7803bUSD

Circulating supply

184.572bUSDT

Volume of Transaction

7d

$1.0061tUSD

Change

24h

-0.07%

Number of Markets

170565

Github Messages

More

Warehouse

Tether.id

Github's IP Address

[Copy]

Codebase Size

51

Last Updated Time

2020-02-16 16:49:46

Language Involved

--

Agreement

--

Crypto token price conversion

Current Rate0

0.00USD

USDT Price Chart

Tether introduction

Markets

Markets3H

-0.06%

1D

-0.07%

1W

-0.05%

1M

-0.01%

1Y

-0.03%

All

-0.11%

| Aspect | Information |

|---|---|

| Short Name | USDT |

| Full Name | Tether |

| Founded Year | 2014 |

| Main Founders | Brock Pierce, Craig Sellars, Reeve Collins |

| Support Exchanges | Binanace, Bitfinex, Poloniex, Kraken, Huobi etc. |

| Storage Wallet | Any wallet that supports ERC20 tokens (like Tether) such as Metamask, MyEtherWallet, Ledger Nano S etc. |

Overview of USDT

Tether (USDT) is a type of cryptocurrency that is known as a stablecoin. It was founded in 2014 by Brock Pierce, Craig Sellars, and Reeve Collins. USDT aims to maintain a value of one US dollar per Tether coin, providing stability in the otherwise volatile cryptocurrency market. Tether operates on several different blockchains, including Ethereum, where it is implemented as an ERC20 token. This means it can be stored in any wallet that supports ERC20 tokens such as Metamask or MyEtherWallet. It is primarily used to facilitate value transfers between different exchanges, such as Binance, Bitfinex, Poloniex, Kraken, and Huobi, among others.

Pros and Cons

| Pros | Cons |

|---|---|

| Stable Value | Potential for Centralization |

| Wide Exchange Support | Reliance on Trust |

| Ease of Transfer | Regulatory Scrutiny |

| Integration with ERC20 Wallets | Issue Transparency |

USDT Price Prediction

Tether's price predictions for the years 2030, 2040, and 2050 indicate a stable value for the USDT token, with expected fluctuations between a maximum and minimum of $1.00 across all three decades, suggesting a consistent trading price of around $1.00.

Exchanges to Buy USDT

Numerous cryptocurrency exchanges support the buying, selling, and trading of Tether (USDT). Some of the most notable ones include:

1. Binance: Known for its substantial volume and variety of cryptocurrency pairs. It provides options for direct purchase of USDT with fiat currencies or exchange from other cryptocurrencies.

2. Bitfinex: An exchange closely linked to Tether as they share common management. It supports direct buying of USDT as well as trading pairs with other prominent cryptocurrencies.

3. Poloniex: Offers various USDT trading pairs and has strong support for Tether.

4. Kraken: A reputable exchange that provides the option to directly purchase USDT using common fiat currencies like USD and EUR.

5. Huobi: Based in Singapore, Huobi offers a variety of trading pairs with USDT and also allows direct purchase of Tether.

How to Store USDT?

USDT can be stored in any digital wallet that supports the specific blockchain protocols on which it operates. Since Tether is implemented on multiple blockchains, like Bitcoin's Omni Layer, Ethereum (as an ERC20 token), Tron, EOS, and others, the storage choices are diverse. Here are a few examples:

Desktop Wallets: These are installed on a desktop computer and offer complete control over your assets. An example is the Omni Wallet, which is a web-based platform designed for storing digital assets, including USDT.

Hardware Wallets: These store a user's private keys on a hardware device like a USB. They are considered very secure since they are immune to computer viruses and your coins are stored offline. Ledger Nano S and Trezor are examples of hardware wallets that support USDT.

Should You Buy USDT?

USDT is suitable for a wide range of cryptocurrency users due to its stable nature and flexibility. Here are a few categories of users who might find it suitable:

1. Traders: Those involved in frequent trading often need stability to protect their assets against volatile market conditions. Since USDT is pegged to the value of the US dollar, it can serve as a stable store of value amidst market turbulence.

2. Cross-platform Users: Individuals who want to move funds between exchanges quickly and efficiently can use USDT as a medium of transfer.

3. ICO Investors: Initial Coin Offering (ICO) participants often need to use stablecoins like USDT to participate in token sales.

4. Blockchain Developers: Those building on blockchains and need stable digital currency for dApp operations can consider using USDT.

USDT Good investment market

- 1

- 2

- 3

- 4

- 5

Tether User Reviews

Tether News

TokenTether Expands Empire With 140 Investments and $185B USDT

Tether reveals a 140-investment portfolio spanning AI, energy, media, and sports as USDT grows to $185B and 500M users.

2026-02-08 22:45

ExchangeXRP and Shiba Inu (SHIB) in Focus: Is Latest $1,000,000,000 USDT Mint a Bear Market Turning Point?

According to Whale Alert, a fresh $1,000,000,000 $USDT mint has entered the crypto market today, lan

2026-02-07 02:00

TokenTether expands support for USDT, Tether Gold in Operas MiniPay wallet

Stablecoin issuer Tether and web browser provider Opera have partnered to expand financial access in

2026-02-03 13:02

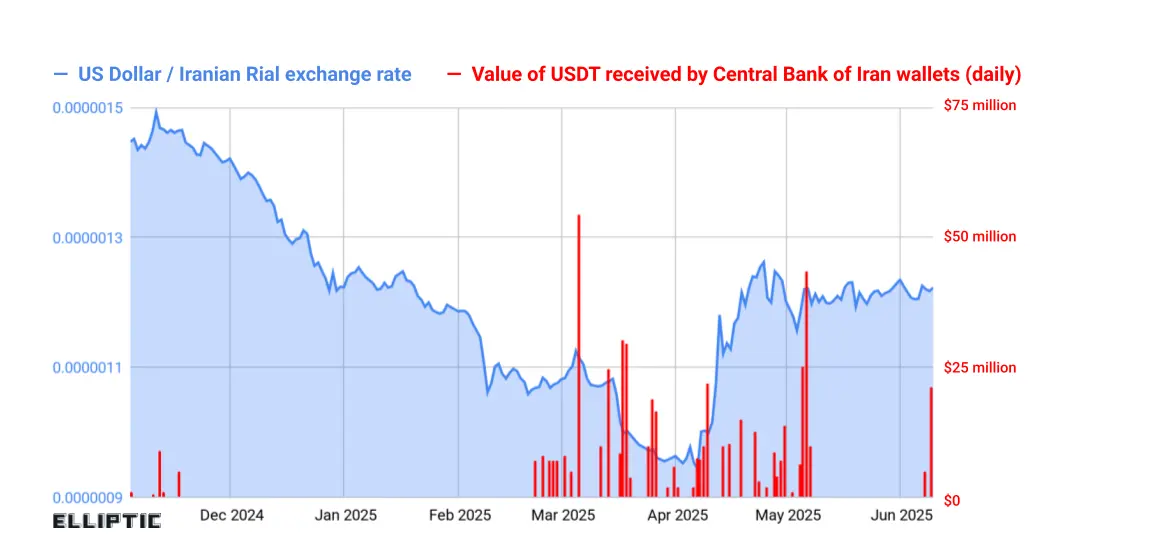

TokenIrans Central Bank Bought $500 Million in USDT Stablecoin to Prop Up Rial

Iran‘s Central Bank secretly purchased more than $500 million worth of Tether’s USDT stablecoin as t

2026-01-22 08:02

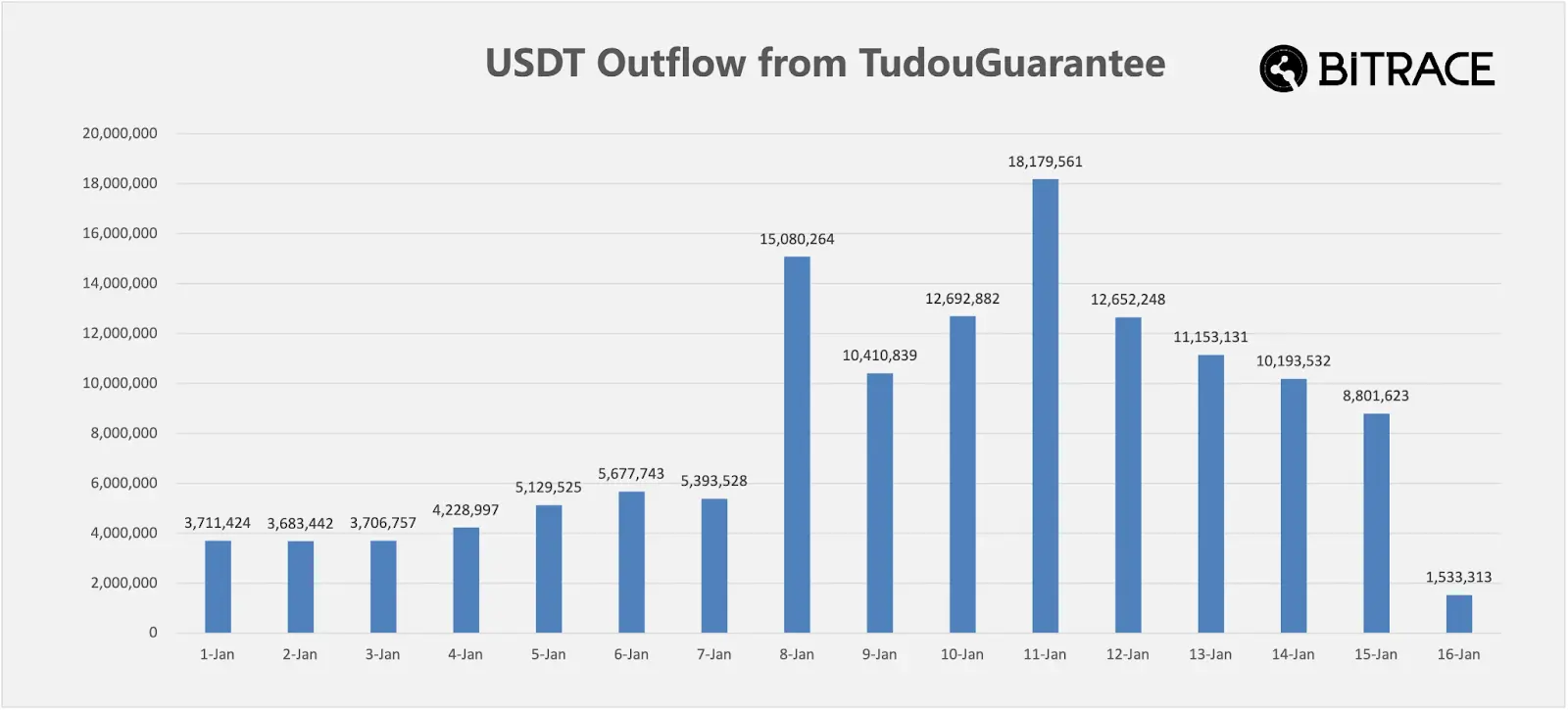

TokenHuione-linked Tudou Guarantee winds down amid $130M USDT refunds: Bitrace

A Telegram-based escrow service linked to an illicit online marketplace appears to be winding down o

2026-01-16 22:02

TokenMarket structure for Ethereum crypto (ETH/USDT) stays cautiously bullish above $3,100

While broader sentiment is still locked in fear, Ethereum crypto is quietly holding a constructive s

2026-01-13 20:03

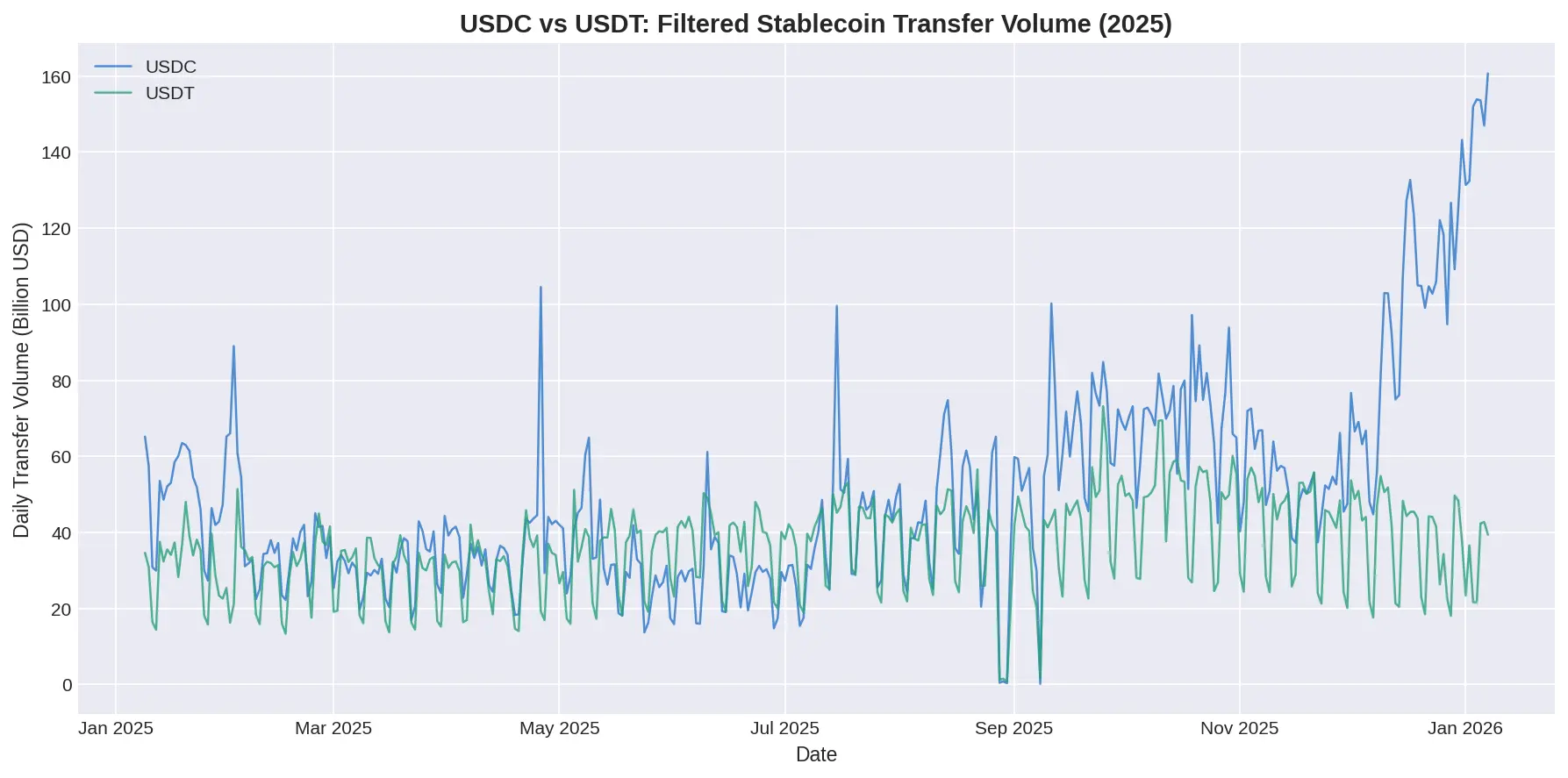

TokenUSDC Finally Beats USDT: Heres How Solana and Trump Made It Happen

Circle‘s USDC has overtaken Tether’s USDT in annual transaction volume for the first time, marking a

2026-01-10 01:02

TokenHow a single copy-paste mistake cost a user $50M in USDt

A crypto user lost $50 million in USDt after copying a poisoned address from transaction history, showing how address poisoning exploits human habits, not protocol flaws.

2025-12-20 18:09

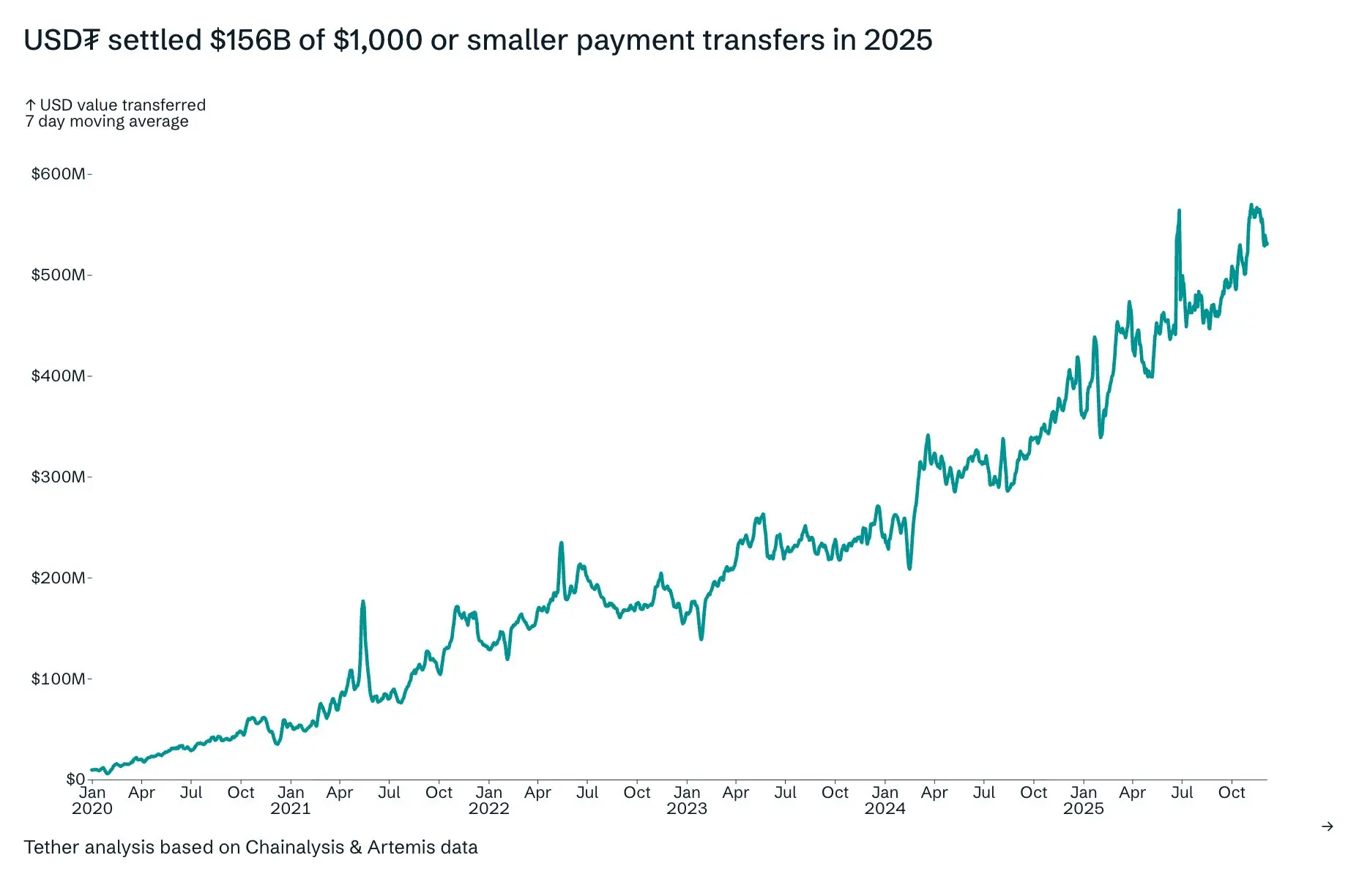

TokenTethers USDT Payment Stats Show the Real State of Crypto Adoption in 2025

Tethers USDT processed $156 billion in payments of $1,000 or less in 2025, according to figures shar

2025-12-18 12:02

253 ratings

View all comments