PENDLE

$ 1.1414 USD

$ 1.1414 USD

$ 185.216 million USD

$ 185.216m USD

$ 34.607 million USD

$ 34.607m USD

$ 424.492 million USD

$ 424.492m USD

164.42 million PENDLE

Pendle-related information

Issue Time

2021-04-29

Platform pertained to

--

Current coin price

$1.1414USD

Market Cap

$185.216mUSD

Volume of Transaction

24h

$34.607mUSD

Circulating supply

164.42mPENDLE

Volume of Transaction

7d

$424.492mUSD

Change

24h

0.00%

Number of Markets

565

Crypto token price conversion

Current Rate0

0.00USD

PENDLE Price Chart

Pendle introduction

Markets

Markets3H

0.00%

1D

0.00%

1W

0.00%

1M

-45.57%

1Y

-61.13%

All

-31.29%

| Aspect | Information |

| Short Name | Pendle |

| Full Name | PENDLE |

| Founded Year | 2020 |

| Support Exchanges | Binance,Kraken,MEXC,KuCoin, LATOKEN, LBank, Hotbit, ZT, CoinTiger, and BitMart |

| Storage Wallet | Hardware Wallet,Software Wallet,Paper Wallet,Online Wallet,Desktop Wallet,Mobile Wallet.etc |

| Customer Support | https://x.com/pendle_fi |

Overview of Pendle(PENDLE)

The Pendle token serves as the central utility and governance token within the Pendle finance ecosystem, designed for the innovative management of yield-bearing assets.

The token facilitates operations like trading future yield and participating in protocol governance, allowing holders to vote on key decisions and upgrades. Users can lock Pendle tokens in exchange for vePENDLE, granting them a stake in the protocol's operations and potentially earning rewards.

The token's utility extends across various functionalities within the platform, including staking, liquidity provision, and fee generation, aligning with the platform's focus on decentralized finance (DeFi) innovations and yield optimization strategies.

Pros and Cons

| Pros | Cons |

| Innovative Yield Management | Market Risks |

| Flexibility in Investment | Complexity of Products |

| Cross-Chain Functionality | Regulatory Uncertainty |

| Decentralized Governance | Dependence on Crypto Market Health |

| Security and Trust | Competition |

Pendle Price Prediction

Pendle's price predictions for the future show a potential increase in value, with estimates ranging from $3.63 to $9.35 by 2030, $7.30 to $12.08 by 2040, and $10.10 to $18.32 by 2050, indicating a steady growth trajectory for the PENDLE cryptocurrency.

Crypto Wallet

The Pendle app is a decentralized finance (DeFi) platform that specializes in the management and trade of tokenized future yield. It allows users to separate yield-bearing assets into their yield and principal components, offering unique investment strategies and flexibility.

The app features an Automated Market Maker (AMM) specifically designed for trading yield tokens, which incorporates concentrated liquidity and a dual fee structure to address impermanent loss concerns effectively.

Additionally, Pendle supports cross-chain functionality, enabling operations on Ethereum, Arbitrum, BNB Chain, and Optimism, enhancing user accessibility and engagement across different blockchain environments.

Exchanges to Buy Pendle(PENDLE)

Pendle (PENDLE) can be purchased on a variety of cryptocurrency exchanges, each offering different trading pairs and features. Here is a list of platforms where you can buy and sell Pendle based on the support exchanges you provided:

Binance: As one of the largest global exchanges, Binance offers extensive trading pairs for Pendle, including PENDLE/USDT, with high liquidity and advanced trading options.

See these links to buy Pendle:https://www.binance.com/en/how-to-buy/pendle

To buy Pendle (PENDLE) on Binance, you can follow these straightforward steps:

Create and Verify Your Account: If you don't already have a Binance account, you will need to sign up at Binance.com. Complete the registration process, which includes verifying your email and undergoing necessary identity verification (KYC) for security and regulatory compliance.

Deposit Funds: Once your account is set up and verified, deposit funds into your Binance account. You can do this by navigating to the 'Fiat and Spot' page under 'Wallet' and selecting 'Deposit'. Binance allows deposits in various currencies and via different methods, including bank transfer and credit card.

Search for Pendle: Go to the 'Trade' section and select either the 'Basic' or 'Advanced' trading platform on Binance. Enter 'PENDLE' in the search box to bring up the available trading pairs. Select the pair that matches the currency you deposited (e.g., PENDLE/USDT).

Buy Pendle: On the trading page, enter the amount of PENDLE you wish to buy. You can choose to place a market order (to buy at the current best market price) or a limit order (to specify the price at which you want to buy). Once you decide on your order type and the amount, click 'Buy PENDLE' to execute your order.

Kraken: While Kraken is known for its security and a wide range of supported cryptocurrencies, Pendle is not currently listed for trading on this platform.

See these links to buy Pendle::https://www.kraken.com/learn/buy-pendle-pendle

MEXC: This exchange offers Pendle trading and is known for its user-friendly interface and a variety of trading options.

KuCoin: Known for listing a wide range of cryptocurrencies, KuCoin provides trading options for Pendle, appealing to both novice and experienced traders.

How to Store Pendle(PENDLE)?

To store Pendle(PENDLE) securely, follow these general steps adapted to fit the specifics of CROAT's available wallet options:

Choose Your Wallet Type:

Desktop Wallet: For a more secure storage option, download and install the official CROAT desktop wallet from the CROAT community website. This type of wallet stores your funds on your computer, giving you full control over your private keys.

Online Wallet (Light Wallet): For easier access and convenience, use the light wallet provided by CROAT, which can be accessed through a web browser. Remember, this is less secure than a desktop wallet because it's online

Download and Install the Wallet:

Visit the official CROAT website to download the appropriate wallet version for your operating system (Windows, Mac, or Linux for desktop wallets).

Secure Your Wallet:

Set a strong password for your wallet. Consider using a password manager to generate and store your password securely.

Backup your wallet by writing down the seed phrase or backup keys and store them in a secure location. This will allow you to recover your wallet in case of computer failure or other issues.

Transfer CROAT to Your Wallet:

Obtain your wallets receiving address.

From the exchange or place where you have purchased CROAT, transfer the tokens to your wallet's address.

Maintain Wallet Security:

Regularly update your wallet software to the latest version to ensure it has the latest security enhancements.

Use security software on your computer to protect against malware and viruses.

Is It Safe?

Smart Contract Security: Pendle has undergone security audits by reputable firms such as PeckShield, which is a positive sign. These audits are crucial for identifying vulnerabilities and ensuring that the smart contracts that manage PENDLE tokens and other interactions on the platform are secure.

Blockchain Security: Pendle operates on the Ethereum blockchain, a well-established platform known for its robust security measures. However, like any blockchain platform, it's susceptible to the overall security of the Ethereum network.

Wallet Security: The security of PENDLE also depends on how users manage their wallets. Utilizing secure wallets like MetaMask or Ledger and following best practices for private key management are essential to safeguard your tokens.

Market Risks: As with any cryptocurrency, PENDLE is subject to market volatility. Prices can fluctuate widely based on market trends, investor sentiment, and broader economic factors, which doesn't necessarily reflect the security of the token itself but can affect investment safety.

Regulatory Risks: The evolving regulatory landscape for cryptocurrencies can also impact PENDLE. Changes in regulations can affect the usability, exchange, and value of PENDLE.

How To Earn Pendle(PENDLE)?

Earning Pendle (PENDLE) involves a few strategic methods aligned with its decentralized finance (DeFi) functionalities, particularly focusing on its yield tokenization and trading platform:

Staking: Pendle allows users to stake their tokens as a way to participate in the network's security and operations. By staking PENDLE, users can earn rewards, which are typically distributed as additional PENDLE tokens.

Yield Farming: Users can engage in yield farming by providing liquidity to the various Pendle liquidity pools. This involves locking up Pendle and other assets in exchange for liquidity provider (LP) tokens, which then earn trading fees and sometimes additional rewards in PENDLE.

Trading: Given Pendles unique proposition for trading future yields, users can speculate on the price movements of yield tokens. Buying low and selling high, or taking advantage of price discrepancies through arbitrage, are ways traders can earn profits.

Participating in Governance: By holding PENDLE, users will also have the opportunity to participate in governance decisions, potentially earning rewards for active participation and voting on key protocol decisions.

Liquidity Provision: By adding your assets to Pendles Automated Market Maker (AMM), you can earn fees generated from the trading activities. This is particularly lucrative in markets with high trading volumes and volatility.

FAQs

What is the primary function of Pendle?

Pendle allows users to tokenize the future yields of yield-bearing assets and trade these tokenized yields on its platform.

How can I start trading or staking on Pendle?

To start trading or staking on Pendle, you need to connect a compatible wallet such as MetaMask to the Pendle platform, deposit your assets, and then engage in activities like staking or providing liquidity to earn rewards or trade yield tokens.

Is Pendle secure?

Yes, Pendle prioritizes security with multiple audits from reputable security firms, ensuring that the platform's smart contracts and operational practices are safe for users.

PENDLE Good investment market

- 1

- 2

- 3

- 4

- 5

Pendle User Reviews

Pendle News

TokenArthur Hayes Again on a Buying Spree: Bags ENA, ETHFI, PENDLE

Key NotesArthur Hayes aggressively accumulated ENA, ETHFI, and PENDLE.His wallet shows multiple rapi

2025-11-27 22:03

TokenPendle price forecast: why PENDLE could soon reclaim $6 level

Pendle (PENDLE) has surged by over 12% to see bulls retest levels above $2.45.Gains come amid a broa

2025-11-25 23:01

TokenPENDLE price breaks above $5 as volume spikes 35%

Pendle price jumped more than 5% to break above the $5 level amid a notable surge in daily volume, a

2025-09-12 14:03

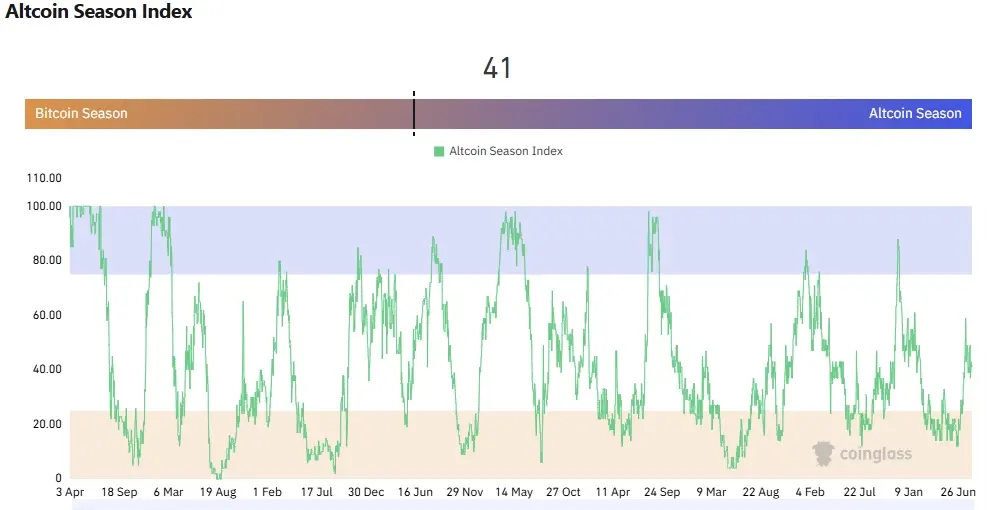

TokenLDO and PENDLE Join ETH as Arthur Hayes Builds on His Altcoin Stack for 2025

BitMEX co-founder and major crypto influencer Arthur Hayes is betting big on an imminent altcoin sea

2025-08-11 21:02

TokenPendle Rallies on the Back of KHYPE Market Success

Pendles token is rallying to the highest level in seven months after the staking token linked to Kin

2025-08-09 15:01

TokenPendle Rallies 21% in a Day After Bullish Ethena Collaboration

PENDLE surged over 21% in 24 hours, topping the gainer list following a bullish partnership with Eth

2025-08-09 03:04

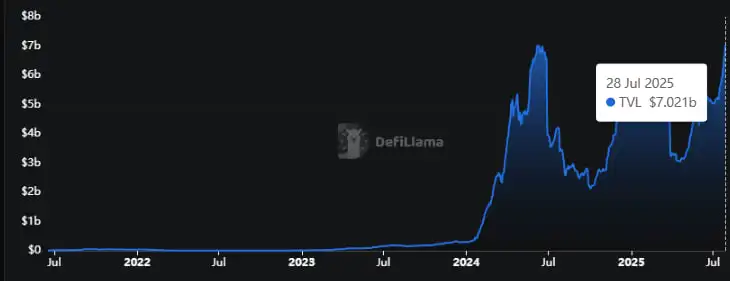

TokenPendle TVL surpasses $7B ATH as new catalysts emerge: whats next?

The protocol‘s TVL touched $7.02 billion today.Upcoming developments like Boros, HyperEVM, and Conve

2025-07-29 02:01

TokenAethir Unleashes Revolutionary DeFi Strategies with Pendle Partnership

The decentralized finance (DeFi) landscape is constantly evolving, bringing forth innovative collabo

2025-06-26 20:01

TokenCan PENDLE Crypto Surpass $20 Amid Increased Fund Deposits, Whale Activity?

PENDLE crypto showed a promising ascending triangle pattern over the past year, indicating sustained

2024-12-19 20:04

4 ratings