USDC

$ 1.0004 USD

$ 1.0004 USD

$ 72.8136 billion USD

$ 72.8136b USD

$ 13.1156 billion USD

$ 13.1156b USD

$ 147.412 billion USD

$ 147.412b USD

72.8265 billion USDC

USD Coin-related information

Issue Time

2018-09-24

Platform pertained to

--

Current coin price

$1.0004USD

Market Cap

$72.8136bUSD

Volume of Transaction

24h

$13.1156bUSD

Circulating supply

72.8265bUSDC

Volume of Transaction

7d

$147.412bUSD

Change

24h

0.00%

Number of Markets

37294

Crypto token price conversion

Current Rate0

0.00USD

USDC Price Chart

USD Coin introduction

Markets

Markets3H

+0.02%

1D

0.00%

1W

+0.02%

1M

-0.05%

1Y

+0.1%

All

+0.23%

| Aspect | Information |

| Short Name | USDC |

| Full Name | USD Coin |

| Founded Year | 2018 |

| Main Founders | Centre consortium (Circle and Coinbase) |

| Support Exchanges | Many exchanges including Binance, Coinbase, Bitfinex, Kraken,Gemini, Crypto.com, OKEx, Huobi Global, Bybit, Gate.io etc. |

| Storage Wallet | Multiple wallets including Coinbase wallet, Metamask, Ledger, etc. |

| Contact method | subpoenas@circle.com |

Overview of USDC

USD Coin, or USDC, is a type of cryptocurrency known as a stablecoin. It was established in 2018 by the Centre consortium, a collaboration between the Circle and Coinbase platforms. USDC's aim is to maintain a stable value, closely tied to the US dollar, offering a one-to-one ratio. This cryptocurrency is supported on a wide variety of exchanges, including Binance, Coinbase, Bitfinex, and Kraken among others, allowing for broad accessibility. USDC is used for a variety of purposes, including participating in decentralized finance (DeFi) applications and purchasing non-fungible tokens (NFTs).

Pros and Cons

| Pros | Cons |

| Stable value tied to USD | No capital growth due to stability |

| Wide acceptance on many exchanges | Dependent on trust in dollar value |

| Can be stored in multiple wallets | Regulatory risks due to centralization |

| Useful for risk-averse crypto investors | May not appeal to investors seeking high risk/reward |

USDC Price Prediction

Over the coming decades, USDC's price is expected to experience fluctuations. By 2030, the trading range is projected to be between $1.00 and $1.00. In 2040, our forecast suggests USDC could reach a peak price of $1.00,with a potential minimum around $1.00.Looking ahead to 2050, technical analysis indicates that USDC's price could range from $1.00 to $1.00,with an estimated average trading price of about $1.00.

Crypto Wallet

Circle USD Coin Wallet is a secure and easy-to-use crypto wallet that enables users to store, send, and receive digital currencies, NFTs, and other blockchain-powered experiences. It also offers simplified global transactions with reduced costs, deeper customer engagement through unique NFT experiences, and a developer-friendly platform with familiar REST APIs, iOS and Android SDKs, and blockchain agnostic support.

Additionally, it provides flexible infrastructure options, operations monitoring, instant access with pay-as-you-go pricing, and a delightful Web3 user experience with familiar UX, simple access, advanced security, and gas-free transactions.

Exchanges to Buy USDC

Coinbase: Coinbase is one of the largest and most popular cryptocurrency exchanges in the world. It supports a wide variety of currencies, including USD, EUR, GBP, and CAD, and it allows you to buy USDC using these currencies.

See this link for details on how to buy USDC: https://www.coinbase.com/how-to-buy/usdc

Create an account on a cryptocurrency exchange that supports USDC.

There are many different cryptocurrency exchanges to choose from, so it is important to do your research and find one that is reputable and has a good track record. Some popular exchanges that support USDC include Coinbase, Binance, Kraken, and Gemini.

Deposit funds into your account.

Once you have created an account, you will need to deposit funds into it. You can do this by linking your bank account to the exchange or by using a credit card or debit card.

Buy USDC.

Once you have funds in your account, you can buy USDC. The process for doing this will vary depending on the exchange you are using, but it is generally a straightforward process.

Store your USDC in a secure wallet.

Once you have purchased USDC, you will need to store it in a secure wallet. There are many different types of wallets available, so it is important to choose one that is right for you. Some popular wallet options include hardware wallets, software wallets, and exchange-based wallets.

Binance: Binance is another major cryptocurrency exchange that supports USDC. It is known for its low fees and its wide variety of trading pairs. You can buy USDC using a variety of currencies, including USD, EUR, GBP, and BTC.

Kraken: Kraken is a well-established cryptocurrency exchange that is known for its security and its focus on institutional investors. It supports USDC and a variety of other cryptocurrencies. You can buy USDC using USD, EUR, GBP, and other currencies.

Gemini: Gemini is a regulated cryptocurrency exchange that is known for its compliance with US regulations. It supports USDC and a variety of other cryptocurrencies. You can buy USDC using USD or EUR.

How to Store USDC?

USDC can be stored in various types of digital wallets that support ERC20 tokens, given that it is an ERC20 token on the Ethereum blockchain. Here are some types of wallets generally used:

1. Software Wallets: These are applications that can be installed on your computer or mobile device. Software wallets like Metamask and MyEtherWallet are widely used due to their user-friendly interfaces and security measures.

2. Online Wallets: These are wallets that can be accessed via a web browser. The Coinbase Wallet, for instance, allows users to store, send, and receive USDC directly on the web.

3. Hardware Wallets: They are physical devices designed to securely store cryptocurrency offline. Popular hardware wallets like Ledger and Trezor support USDC.

4. Paper Wallets: They involve printing out a wallet's public and private keys on a piece of paper. While they might not be as common for USDC storage, they provide an offline means of keeping cryptocurrency.

Is It Safe?

The safety of USDC (USD Coin) depends on a number of factors, including the security of the Circle platform, the backing of the USDC tokens, and the overall stability of the cryptocurrency market.

Security of the Circle platform

Circle is a regulated financial institution that is subject to a variety of oversight requirements. This means that Circle must take steps to protect its customers' assets, including USDC tokens. Circle has implemented a number of security measures to protect its platform, including multi-signature wallets, cold storage, and regular security audits.

Backing of USDC tokens

USDC tokens are fully backed by US dollars held in reserve accounts at reputable financial institutions. This means that for every USDC token in circulation, there is a corresponding US dollar held in a reserve account. This backing helps to ensure the stability of the USDC price.

Overall stability of the cryptocurrency market

The cryptocurrency market is still relatively young and volatile. This means that there is always a risk that the price of USDC could decline significantly. However, USDC is one of the most stable cryptocurrencies, and its price has historically been closely tied to the price of the US dollar.

USDC Good investment market

- 1

- 2

- 3

- 4

- 5

USD Coin User Reviews

USD Coin News

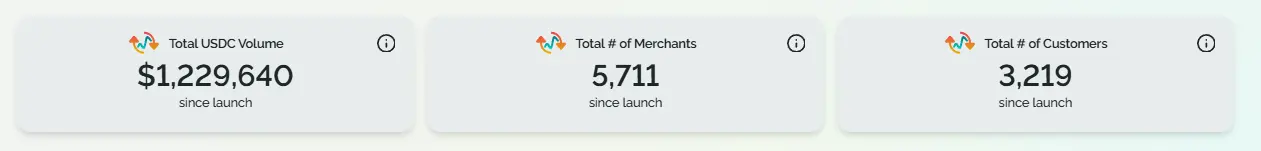

ExchangePayments Protocol by Coinbase, Shopify Processes Just $1.2M USDC Since June: growthepie

Just over six months after Shopify partnered with Coinbase, payments using $USDC on Base via the int

2026-02-05 03:00

TokenCronos, USDC, and Bitget Token see surge in whale transactions

Crypto.com‘s Cronos, Bitget Token, and Circle’s USDC have seen a surge in whale activity over the pa

2026-01-23 19:03

ExchangeCircle CEO says USDC is a neutral layer, not a rival to Visa or Mastercard

Circle CEO Jeremy Allaire said the company views its dollar-pegged stablecoin as neutral financial i

2026-01-23 05:00

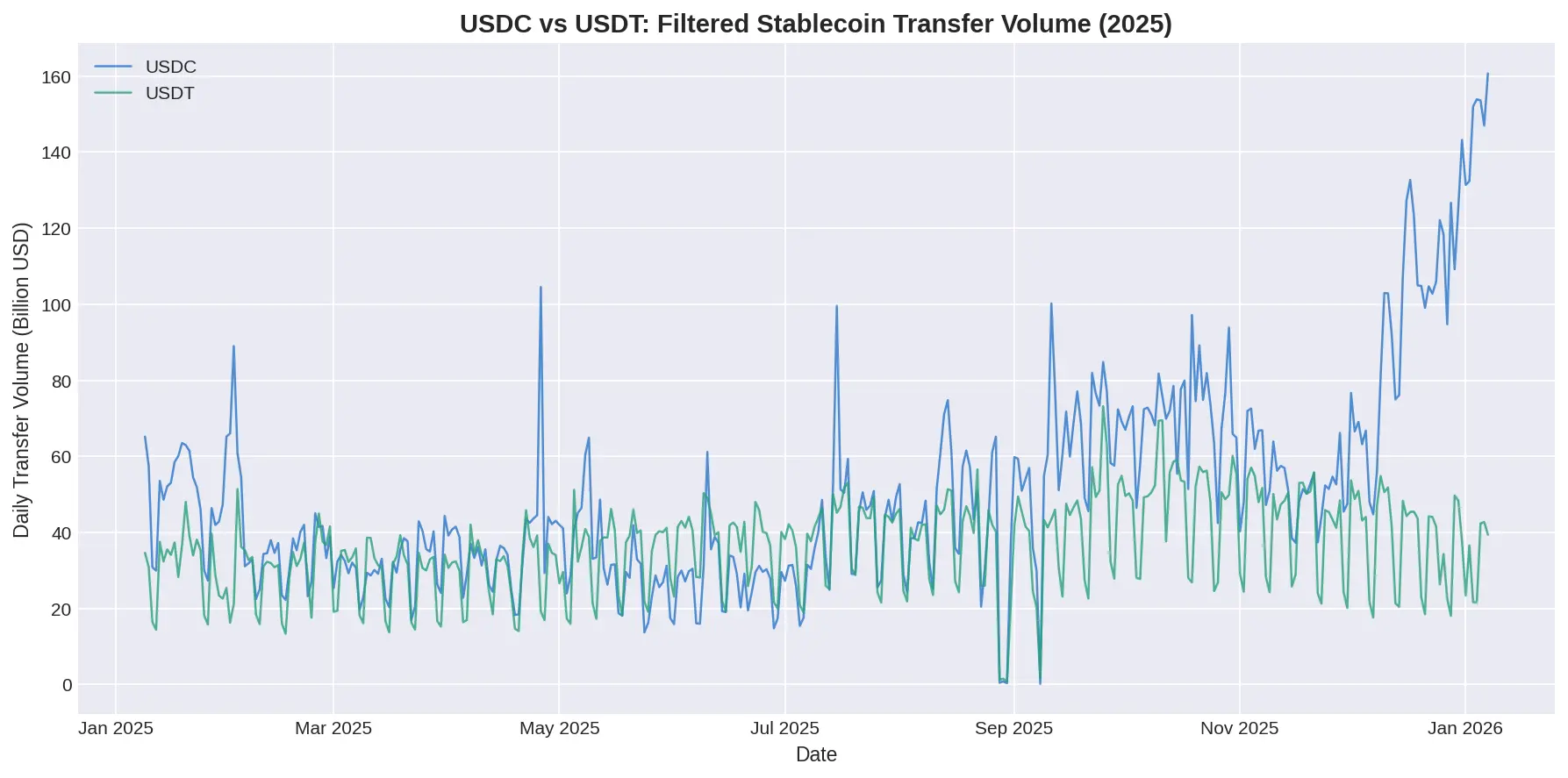

TokenUSDC Finally Beats USDT: Heres How Solana and Trump Made It Happen

Circle‘s USDC has overtaken Tether’s USDT in annual transaction volume for the first time, marking a

2026-01-10 01:02

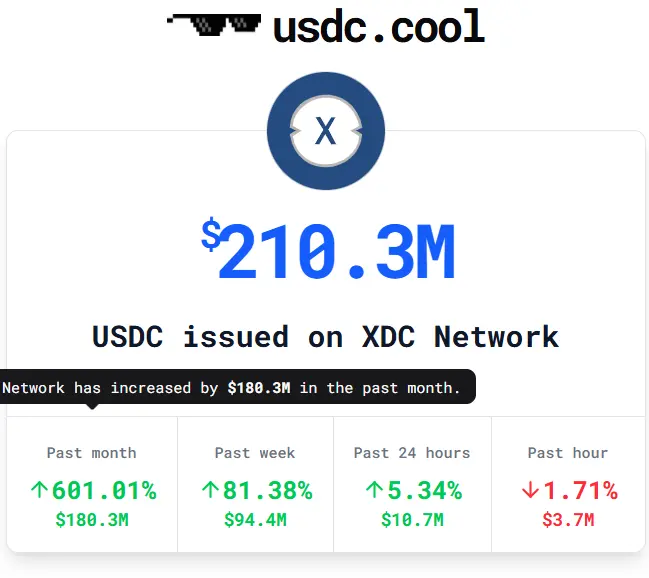

TokenUSDC Is Being Used for More Than Trading, and Bybit Is Expanding Support on XDC

As 2025 winds down, stablecoins like USDC are being used for more than just trading. They are increa

2025-12-25 20:02

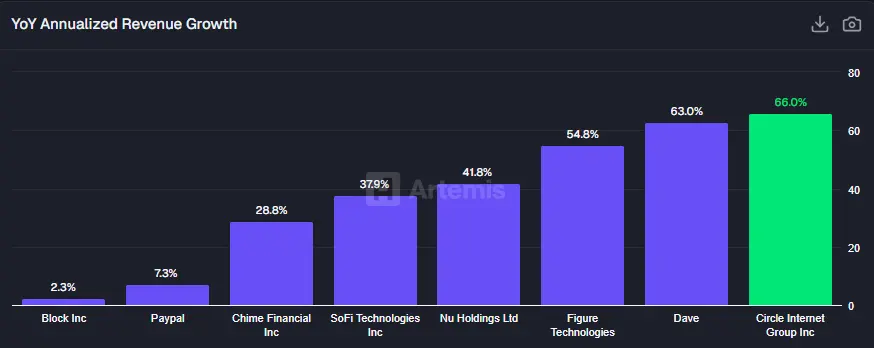

TokenCircle posts 66% revenue growth in 2025 as USDC adoption accelerates

Circle had a challenging year, with rapid growth and economic headwinds. For 2025, Circle Internet G

2025-12-19 01:06

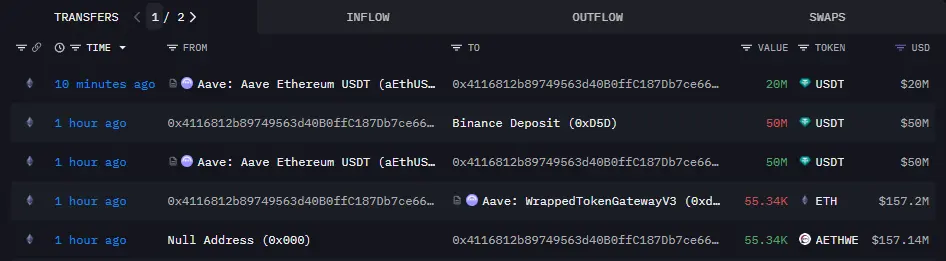

Token1011 short-selling whale returns with $70M USDC after ETH deposit to Aave

The insider whale that shorted the market just before the October 11 liquidations is back with new m

2025-12-02 04:07

TokenCompound Resumes Withdrawals from USDC, USDS Markets

Decentralized crypto lending platform Compound has resumed withdrawals from two out of three of its

2025-11-07 15:03

ExchangeCoinbase stock surges after JPMorgan upgrade on Base, USDC potential

Coinbase stock jumped after JPMorgan upgraded COIN, citing monetization from its Base blockchain and a new rewards structure that could add $374 million in annual earnings.

2025-10-25 05:22

34 ratings

View all comments