EUL

$ 0.8666 USD

$ 0.8666 USD

$ 20.154 million USD

$ 20.154m USD

$ 8.868 million USD

$ 8.868m USD

$ 79.409 million USD

$ 79.409m USD

24.282 million EUL

Euler Finance-related information

Issue Time

2022-06-24

Platform pertained to

--

Current coin price

$0.8666USD

Market Cap

$20.154mUSD

Volume of Transaction

24h

$8.868mUSD

Circulating supply

24.282mEUL

Volume of Transaction

7d

$79.409mUSD

Change

24h

0.00%

Number of Markets

136

Crypto token price conversion

Current Rate0

0.00USD

EUL Price Chart

Euler Finance introduction

Markets

Markets3H

0.00%

1D

0.00%

1W

0.00%

1M

-70.69%

1Y

-75.88%

All

-82.75%

| Aspect | Information |

| Short name | Euler (EUL) |

| Full name | Euler Finance |

| Support exchanges | KuCoin, Uniswap, SushiSwap, Gate.io, and more |

| Storage Wallet | Compatible with wallets that support Ethereum-based tokens such as MetaMask and Ledger |

| Customer Service | Euler Finance offers support primarily through community channels on GitHub and Discord |

Overview of Euler Finance

Euler Finance is a decentralized finance (DeFi) platform built on the Ethereum blockchain, offering a non-custodial, permissionless lending and borrowing protocol. It enables users to earn interest on deposits and take out loans by providing collateral in a flexible, open finance environment. Euler stands out due to its unique features like risk-based asset tiers, multi-collateral options, and dynamic interest rates that adjust based on market conditions. This approach aims to cater to a wide range of risk appetites and financial needs, making it a versatile choice in the DeFi landscape.

To obtain more information, you can visit their website: https://www.euler.finance and try to log in or register to use more services.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Pros:

Risk-Based Asset Tiers: Allows selection based on risk preference.

Protected Collateral: Offers security against market volatility.

Dynamic Interest Rates: Adjusts based on market supply and demand.

Multi-Collateral Options: Enables borrowing against various assets.

Decentralization: Supports permissionless financial activities.

Cons:

Complexity for Newcomers: Can be daunting for those new to DeFi.

High Ethereum Fees: Costs can be prohibitive during peak times.

DeFi Risks: Exposed to market volatility and protocol vulnerabilities.

User-Managed Security: Requires secure management of private keys.

Niche Appeal: Mainly attracts those already familiar with crypto.

What Makes Euler Finance Unique?

Risk-Based Asset Tiers: Unlike most DeFi lending protocols where all deposits go into the same pool, Euler uses a tiered system. This separates assets based on risk, allowing lenders to choose between higher potential returns for riskier assets and lower returns for safer ones. Borrowers get access to a wider range of interest rates depending on the collateral they provide.

Protected Collateral: A unique feature in Euler lets you deposit collateral that isn't used for lending. This protects those assets from potential liquidations in case the value of your borrowed assets drops.

Reactive Interest Rates: Interest rates on Euler are dynamic and adjust based on supply and demand. This can lead to more competitive rates for lenders and borrowers compared to fixed-rate protocols.

Multi-Collateral Stability Pools: Euler allows users to borrow against multiple assets deposited as collateral, providing more flexibility and potentially better borrowing rates.

Focus on Decentralization: Euler is built on the Ethereum blockchain and aims to be a permissionless, decentralized lending protocol.

How does Euler Finance Work?

Euler Finance operates like a peer-to-peer lending platform for crypto assets. Here's a simplified explanation:

Depositing & Lending: Users can deposit cryptocurrencies they hold into Euler's liquidity pools. These deposits earn interest based on supply and demand.

Borrowing: Users can borrow crypto against their deposited collateral (eTokens). The interest rate on borrowed assets depends on the chosen asset and the overall loan-to-value ratio (LTV). Higher LTVs (borrowing more relative to collateral) typically come with higher interest rates.

Liquidations: If the value of borrowed assets falls below a certain threshold relative to the collateral value, the borrower's collateral might be automatically liquidated to repay lenders. Euler's protected collateral feature allows users to avoid liquidation on these specific assets.

Risk-Based Tiers: Assets are categorized into tiers based on perceived risk. This allows lenders to choose between potentially higher returns on riskier assets and lower but safer returns on more stable assets.

Reactive Interest Rates: Interest rates for lending and borrowing are dynamic, adjusting based on supply and demand within each asset tier. This aims to achieve a balance between lenders and borrowers.

Market & Price

As of the most recent data(November 27, 2023), Euler Finance (EUL) is priced at approximately $6.42 USD. The price has seen fluctuations within a 24-hour range of $6.38 to $6.55 USD. Euler Finance has a market capitalization of about $63,786,199 USD, indicating its size and presence in the market. This cap is derived from a circulating supply of around 9,931,059 EUL tokens out of a total supply of 27,182,818 EUL.

Exchanges to Buy Euler Finance

You can purchase Euler Finance (EUL) from several cryptocurrency exchanges. Some of the notable exchanges where EUL is listed include:

· KuCoin

· Uniswap

· SushiSwap

· Gate.io

These platforms allow you to buy and trade EUL, often in exchange for other cryptocurrencies like Ethereum.

How to Store Euler Finance?

There are two main approaches to storing your Euler Finance (EUL) tokens, each with its own advantages and security considerations:

1. Custodial Wallets (Exchange Wallets):

Convenience: This is the simplest option. When you buy EUL on a Centralized Exchange (CEX), the tokens are automatically stored in a wallet managed by the exchange.

Security: The security of your EUL depends on the exchange's security practices. Reputable CEXs implement robust security measures, but there's always a risk of exchange hacks.

Here's what to consider when using a custodial wallet:

Choose a reputable exchange: Opt for a CEX with a strong track record of security and user satisfaction.

Understand exchange fees: Be aware of any fees associated with depositing, trading, and withdrawing EUL on the exchange.

Limited control: You don't have direct control over your private keys with a custodial wallet.

2. Non-Custodial Wallets (Self-Custody):

Control: You have complete control over your private keys with a non-custodial wallet. This is generally considered the most secure option.

Responsibility: You are responsible for the safekeeping of your private keys. Losing them means losing access to your EUL.

Is It Safe?

Euler Finance offers a unique lending experience with risk tiers, protected collateral, and reactive rates. However, security is a shared responsibility. While Euler undergoes audits to minimize smart contract risks, you also need to consider exchange security (if using a custodial wallet) and take strong measures to safeguard your private keys with a non-custodial wallet. Remember, DeFi is an evolving space with inherent risks, so conduct your own research, invest cautiously, and stay informed.

Conclusion

Euler Finance represents a significant innovation in the DeFi space, offering a flexible and dynamic platform for lending and borrowing on the Ethereum network. Its unique features like risk-based asset tiers and protected collateral cater to diverse user needs, from conservative lenders to aggressive borrowers seeking efficiency and high returns. While the platform provides robust opportunities for yield generation and liquidity provision, it also demands a high degree of user engagement with security and market risk management. As such, Euler is best suited for users who are familiar with DeFi mechanisms and are willing to navigate its complexities for potentially higher returns.

Frequently Asked Questions

What is Euler Finance?

Euler Finance is a DeFi lending protocol on Ethereum that allows users to lend and borrow cryptocurrencies without a central authority.

How does Euler Finance ensure user safety?

Euler employs various security measures, including smart contract audits and a permissionless system, though users must manage their own security, especially when using non-custodial wallets.

Can anyone use Euler Finance?

Yes, Euler is permissionless, meaning anyone with an Ethereum wallet can participate in lending or borrowing activities.

What makes Euler Finance unique?

Its use of risk-based asset tiers and protected collateral sets it apart from many other DeFi platforms, allowing more tailored risk management.

What types of assets can I use as collateral on Euler Finance?

Euler Finance supports a variety of Ethereum-based tokens. Users can check the platform for the latest supported assets, which are categorized into different risk tiers to accommodate various lending and borrowing strategies.

Risk Warning

Investing in cryptocurrencies requires an understanding of potential risks, including unstable prices, security threats, and regulatory shifts. Thorough research and professional guidance are advised for any such investment activities, recognizing these mentioned risks are just part of a wider risk environment.

EUL Good investment market

- 1

- 2

- 3

Euler Finance User Reviews

Euler Finance News

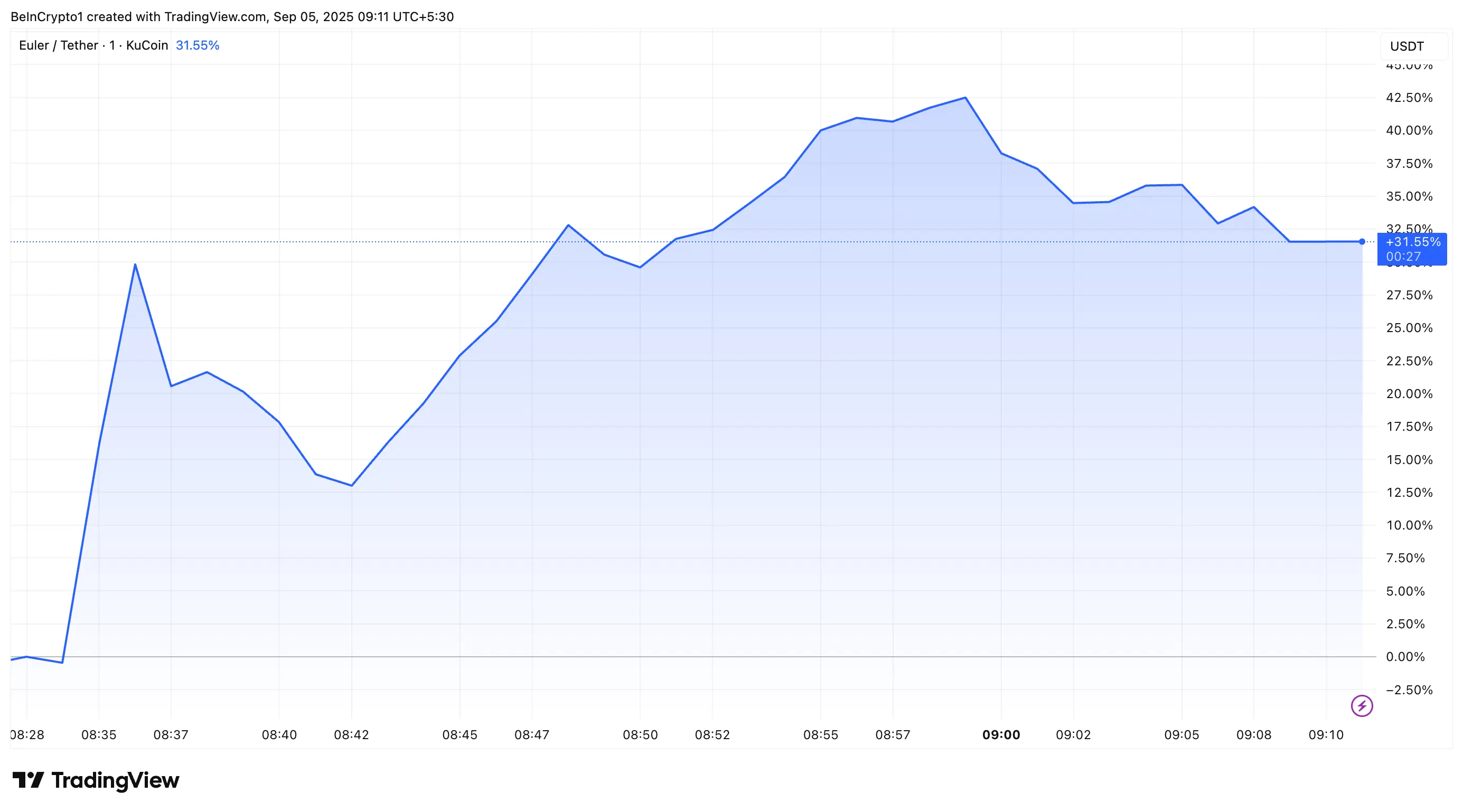

TokenBithumb Debut Sends Euler (EUL) Prices Up 44% Amid DeFi Boom

South Koreas second-largest cryptocurrency exchange, Bithumb, announced today that it will be listin

2025-09-05 17:03

ExchangeCoinbase adds BIO and EUL to its asset roadmap, how are these tokens performing?

Coinbase has included Bio Protocol and Euler in its asset roadmap, indicating they could be listed o

2025-07-29 21:00

NewsHacker Jacob Returns Funds and Apologizes for Euler Finance’s $200 Million Exploit

The hacker behind Euler Finance's $200m exploit has returned more funds to the protocols and seemingly apologized on the blockchain. The attacker, who identified themselves as Jacob, sent 7,000 ether and $10m worth of DAI stablecoins to the protocol, bringing the total returned to over $120m.

2023-03-28 17:47

9 ratings