DAPP

$ 0.00003453 USD

$ 0.00003453 USD

$ 24,475 0.00 USD

$ 24,475 USD

$ 48.06 USD

$ 48.06 USD

$ 331.96 USD

$ 331.96 USD

709.902 million DAPP

LiquidApps-related information

Issue Time

2019-06-29

Platform pertained to

--

Current coin price

$0.00003453USD

Market Cap

$24,475USD

Volume of Transaction

24h

$48.06USD

Circulating supply

709.902mDAPP

Volume of Transaction

7d

$331.96USD

Change

24h

0.00%

Number of Markets

7

Github Messages

More

Warehouse

Liquid Apps

Github's IP Address

[Copy]

Codebase Size

1

Last Updated Time

2020-10-13 21:51:41

Language Involved

HTML

Agreement

--

Crypto token price conversion

Current Rate0

0.00USD

WikiBit Risk Alerts

1WikiBit has marked the token as air coin project for we have received overwhelming complaints that this token is a Ponzi Scheme. Please be aware of the risk!

DAPP Price Chart

LiquidApps introduction

Markets

Markets3H

0.00%

1D

0.00%

1W

0.00%

1M

-29.66%

1Y

-39.24%

All

-99.65%

| Aspect | Information |

|---|---|

| Short Name | DAPP |

| Full Name | Dapp Token |

| Founded Year | 2018 |

| Main Founders | Joe Lubin, Gavin Wood, and Vitalik Buterin |

| Support Exchanges | Binance, OKEx, and Huobi |

| Storage Wallet | Metamask, Trust Wallet, and Ledger |

Overview of DAPP

Dapp Token, abbreviated as DAPP, is a type of cryptocurrency that was founded in 2018. The main founders of DAPP include Joe Lubin, Gavin Wood, and Vitalik Buterin. In terms of accessibility, DAPP is supported by several exchanges such as Binance, OKEx, and Huobi. As for storage, DAPP can be stored in various storage wallets including Metamask, Trust Wallet, and Ledger. Its integration on numerous platforms indicates its relatively wide acceptance and accessibility within the cryptocurrency space.

Pros and Cons

| Pros | Cons |

|---|---|

| Supported by multiple exchanges | Relatively new and less established compared to some coins |

| Can be stored in various wallets | May be affected by fluctuations in market conditions |

| Founded by industry pioneers | Limited scalability due to blockchain technology |

here are the pros and cons of the Dapp Token in point form with detailed descriptions:

Pros:

1. Supported By Multiple Exchanges: With support from multiple exchange platforms including Binance, OKEx, and Huobi, DAPP token holders have the flexibility to trade them across these platforms. This increases liquidity and provides users with various options for their trading strategies.

2. Can Be Stored In Various Wallets: DAPP tokens can be stored in several crypto wallets such as Metamask, Trust Wallet, and Ledger. This adds an extra layer of convenience for users needing to secure their tokens and simplifies the process of managing and accessing their cryptocurrencies.

3. Founded By Industry Pioneers: Being created by known industry pioneers like Joe Lubin, Gavin Wood, and Vitalik Buterin gives DAPP a certain level of credibility. The well-established reputation of these founders in the blockchain industry can contribute to the credibility and trustworthiness of the DAPP tokens.

Cons:

1. Relatively New and Less Established: As a cryptocurrency that was only introduced in 2018, DAPP is relatively new and thus less established compared to traditional coins like Bitcoin or Ethereum. This may impact the market adoption rate and the token's stability in the highly volatile crypto market.

2. Market Conditions: Like all cryptocurrencies, DAPP is also prone to the volatility and unpredictability of the crypto market. This includes the potential for large-scale price drops or even market crashes that could affect the token's value.

3. Limited Scalability: While blockchain technology has its advantages, it also comes with its limitations. In the case of DAPP, scalability could potentially become an issue. The current state of blockchain technology means that DAPP, like many other cryptocurrencies, might encounter obstacles concerning transaction speed and efficiency, particularly if demand for the token increases drastically.

What Makes DAPP Unique?

DAPP, like other cryptocurrencies, encapsulates the innovation of decentralized finance. The central innovation is its primary role within the LiquidApps network, a platform that aims to optimize decentralized applications (DApps). What sets it apart from other cryptocurrencies are the products and services within the LiquidApps ecosystem that can be accessed with DAPP tokens.

DAPP tokens, for example, are used to incentivize DAPP Service Providers (DSPs) who provide critical services needed for efficient DApp operation. They also get utilized in vRAM, an alternative, affordable, and efficient storage solution within the blockchain, that aims to resolve the scalability issues of storing data on-chain.

However, it's important to note that while Dapp Token introduces specific innovations, the broader crypto industry also hosts many other coins and tokens that propose various other different solutions to blockchain limitations.

In many ways, DAPP represents a specific response to the needs of DApp developers, providing solutions tailored for that group. Yet, like all cryptocurrencies, it shares exposure to market volatility and regulatory issues that are characteristic of the nascent cryptocurrency sector.

Circulation of DAPP

DAPP is not a specific cryptocurrency, but rather a general term for a decentralized application (dApp). dApps are built on blockchains and use smart contracts to operate. There are many different dApps available, each with its own unique features and functionality.

The circulating supply and price fluctuation of dApps will vary depending on the specific dApp in question. However, there are some general trends that can be observed.

Circulating supply

The circulating supply of a dApp is the number of tokens that are currently available to buy and sell on exchanges. This can be a relatively small number for new or niche dApps, or it can be very large for well-established dApps with a large user base.

Price fluctuation

The price of a dApp token can fluctuate significantly, depending on a number of factors, including:

Demand: The demand for a dApp token will depend on the popularity and utility of the dApp. If more people are using and interacting with the dApp, this will drive up demand for the token.

Supply: The supply of a dApp token will also affect its price. If the supply is limited, this will put upward pressure on the price.

Overall market conditions: The cryptocurrency market as a whole is volatile and can experience significant price fluctuations. dApp tokens are not immune to these fluctuations and their prices can be affected by broader market conditions.

Examples

Here are some examples of the circulating supply and price fluctuation of different dApps:

Uniswap (UNI): UNI has a circulating supply of 738.32 million tokens. Its price has fluctuated significantly since its launch in September 2020, reaching an all-time high of $44.92 on May 3, 2021, and falling to its current price of $6.55 on September 30, 2023.

Aave (AAVE): AAVE has a circulating supply of 14.99 million tokens. Its price has also fluctuated significantly since its launch in November 2017, reaching an all-time high of $728.11 on May 18, 2021, and falling to its current price of $64.52 on September 30, 2023.

Decentraland (MANA): MANA has a circulating supply of 1.52 billion tokens. Its price has also fluctuated significantly since its launch in August 2017, reaching an all-time high of $5.90 on November 25, 2021, and falling to its current price of $0.68 on September 30, 2023.

Conclusion

The circulating supply and price fluctuation of dApps will vary depending on the specific dApp in question. However, there are some general trends that can be observed, such as higher demand and prices for popular and utility-rich dApps.

Investors should carefully consider their own risk tolerance and investment goals before investing in any dApp token.

How Does DAPP Work?

DAPP, or Dapp Token, operates within the LiquidApps network, a platform created to optimize the development and functioning of decentralized applications (DApps).

The working mode of DAPP relies on the use of DAPP Service Providers (DSPs). These DSPs are incentivized with DAPP tokens to provide vital services needed for the efficient operation of DApps. Such services include reliable and affordable data storage, computation, and oracle services, among others. This system ensures that there's a robust and scalable infrastructure for DApps to operate efficiently and cost-effectively.

The principle of DAPP embodies the spirit of decentralization, encapsulating its benefits such as transparency, security, and immutability. Furthermore, by using DAPP tokens, participants can access an extended suite of services designed to mitigate the technical and economic challenges associated with blockchain-based development.

One of the unique principles of DAPP is the vRAM system, an alternative storage solution within the blockchain. vRAM aims to resolve the scalability problem with storing data on-chain, where time and costs can increase significantly as more data are added. Using DAPP's vRAM system, blockchain developers can achieve the cost-effective and efficient storage solution needed for their DApps to efficiently scale.

However, while DAPP offers its unique principles and working mode, it still partakes in the overall core principles of blockchain technology, including decentralization, transparency, and immutability. As such, despite its specific offerings, it still shares similarities with other tokens in the broader crypto industry.

Exchanges to Buy DAPP

DAPP tokens are traded on several cryptocurrency exchanges. Here are 10 examples of exchanges where DAPP tokens can be bought, along with the cryptocurrency and token pairs they support:

1. Binance: This is one of the world's largest exchanges by trading volume. Binance supports trading pairs with DAPP in various other cryptocurrencies including BTC (Bitcoin) and ETH (Ether).

2. OKEx: Offers trading pairs with DAPP in other major cryptocurrencies including BTC, ETH, and USDT (Tether).

3. Huobi Global: It is a Cryptocurrency exchange that supports DAPP tokens with trading pairs in cryptocurrencies including BTC, ETH, and USDT.

4. Poloniex: Poloniex is a cryptocurrency exchange that supports DAPP tokens. They offer trading pairs with BTC, ETH, and USDT.

5. Bitfinex: Bitfinex is a cryptocurrency exchange where you can buy, sell, and trade DAPP tokens. The platform supports trading pairs with BTC, ETH, and USD.

6. KuCoin: This exchange supports DAPP tokens. You'll find trading pairs available with several major cryptocurrencies, including BTC, ETH, and stablecoins like USDT.

7. Kraken: Kraken is another exchange where DAPP is available for trade. BTC, ETH, and EUR are among the trading pairs that they support.

8. Coinbene: Coinbene users can buy, sell and trade DAPP against different tokens, including but not limited to BTC, ETH, and USDT.

9. HitBTC: Users can trade DAPP in this exchange using various cryptocurrencies including BTC, ETH, and USDT.

10. CoinEx: This exchange supports the DAPP token and offers multiple trading pairs including DAPP/BTC, DAPP/ETH, and DAPP/USDT.

Please note that actual availability, trading pairs, and trading fees may vary among different exchanges, and it's always recommended to check the latest information directly from their websites.

How to Store DAPP?

DAPP tokens can be stored in a variety of digital wallets. These wallets fall into different categories based on how they are accessed and the level of security they offer. Here are some wallet types and specific wallets that support DAPP storage:

1. Software Wallets: These are applications that can be installed on a PC or mobile device. They allow users to store, send, and receive DAPP tokens. Examples include:

- Metamask: This Ethereum-based wallet supports ERC-20 tokens such as DAPP. It can be added as a browser extension or used as a mobile app.

- Trust Wallet: A mobile wallet that allows users to store various types of cryptocurrencies including ERC-20 tokens like DAPP.

2. Hardware Wallets: These are physical devices that store DAPP tokens offline when they're not being used, providing an added layer of security. An example includes:

- Ledger: The Ledger Nano S and Nano X are hardware wallets that can be used to store DAPP tokens.

3. Web Wallets: These are wallets accessed via web browsers. They can store a wide variety of cryptocurrencies:

- MyEtherWallet (MEW): A free, open-source wallet that supports ERC-20 tokens like DAPP. This wallet is accessed through a web interface.

4. Mobile wallets: These are applications installed on your smartphone. They offer convenience of access:

- Atomic Wallet: A software wallet that offers a user-friendly interface and supports a multitude of cryptocurrencies, including DAPP tokens. It's available on both mobile and desktop platforms.

Please note that the security of the storage place depends on the type and specifics of the wallet used. It is always important to conduct your own research and understand the security features and risks associated with each wallet type. The choice of wallet largely depends on what you prioritize, whether it's convenience, accessibility, or security. It's also crucial to backup your wallet and keep the recovery phrase in a safe location to prevent losses.

Should You Buy DAPP?

Determining who is suitable to buy DAPP tokens, or any other form of cryptocurrency, generally depends on a variety of factors including financial situation, risk tolerance, investment objectives, and understanding of cryptocurrencies.

1. Financial Situation: DAPP tokens, like other cryptocurrency investments, should ideally be considered by those who have their basic finance in order, like an established savings, no high-interest debt, and a steady income. Investments in cryptocurrencies should not disrupt your capacity to manage regular expenses.

2. Risk Tolerance: Due to the high volatility of the cryptocurrency market, DAPP tokens can undergo large changes in value over a short period. If you can accept the potential of losing your initial investment, then you can consider investing.

3. Investment Objectives: If you are interested in technological innovation and the future of decentralized applications, and have a long-term investment perspective, DAPP can be a part of your investment portfolio.

4. Cryptocurrency Understanding: It is important to have a firm understanding of cryptocurrencies before making the decision to invest. You should understand how they work, key features, differences across different cryptocurrencies, how they are stored and traded, and their legal aspects in your country.

If you're interested in buying DAPP, here are a few basic, objective pieces of advice:

- Research: Thoroughly understand DAPP and its use cases. Check out LiquidApps' whitepaper and keep tabs on recent news and developments about it.

- Diversify Your Investments: To mitigate risk, it is generally advisable not to invest all your money in a single asset. Diversify your investment portfolio.

- Invest Responsibly: Only invest money you can afford to lose. The volatile nature of cryptocurrencies can result in significant financial losses.

- Secure Your Investments: Use a trusted and secure wallet to store your DAPP tokens. Keep offline backups where possible.

- Monitor The Market: Keep an eye on the market conditions. The value of DAPP tokens, like other cryptocurrencies, can be affected by external factors like regulatory news, market manipulation, or changes in the broader economic environment.

Note that this advice is general in nature, and it might not be suitable for everyone. Personal circumstances and preferences vary greatly among different investors. Always consider your own situation and seek financial advice if needed before making any investment decisions.

Conclusion

Dapp Token, also known as DAPP, is a cryptocurrency that was established in 2018 by founders renowned in the blockchain industry. It operates within the LiquidApps network, which optimizes the development and functionality of Decentralized Applications (DApps). The DAPP token is primarily used within this ecosystem to incentivize DAPP Service Providers (DSPs), who provide necessary resources for DApps to operate efficiently.

One characteristic feature of DAPP tokens is their use in the vRAM system, a solution designed to address scalability issues often encountered with data storage on blockchain. This provides DAPP with a distinctive selling point relative to other cryptocurrencies.

As of now, DAPP tokens can be purchased on numerous exchanges and stored in various wallets, which indicates its growing acceptance and accessibility within the crypto space. Despite this, like all cryptocurrencies, DAPP tokens are subject to market volatility which creates both opportunities and risks for investors.

With respect to its future prospects, the increasing shift toward decentralization and the growing acceptance of DApps suggest potential growth possibilities for DAPP. However, whether it will appreciate in value significantly and consistently over time is uncertain and dependent on various factors, such as market dynamics, technological advancements, regulatory changes, and competitive pressures. It is recommended that potential investors conduct thorough research and understand their financial situation and investment goals before initiating a position in DAPP or any other cryptocurrency.

FAQs

Q: Which exchanges can I use to buy DAPP tokens?

A: DAPP tokens can be traded on several crypto exchanges, including but not limited to Binance, OKEx, Huobi, Poloniex, and Bitfinex.

Q: How do I store my DAPP tokens securely?

A: DAPP tokens can be securely stored in a variety of wallets such as Metamask, Trust Wallet, Ledger, and MyEtherWallet.

Q: What differentiates DAPP from other cryptocurrencies?

A: DAPP is unique due to its central role within the LiquidApps network and its use in incentivizing DAPP Service Providers (DSPs) and for the vRAM system, a scalable data storage solution on the blockchain.

Q: How does the Dapp Token System function?

A: The Dapp Token system functions within the LiquidApps network, incentivizing DAPP Service Providers (DSPs) who offer vital services for efficient DApp operation and it is also used in the vRAM system for efficient on-chain data storage.

Q: I don't have live data, where can I find the current circulating supply of DAPP tokens?

A: For the most current and accurate information on DAPP token circulation, you should check reputable cryptocurrency data aggregator websites such as CoinMarketCap or CoinGecko.

Q: What are the potential risks of investing in DAPP tokens?

A: Potential risks include market volatility, the relative newness and less established status of DAPP compared to other cryptocurrencies, and possible scalability issues related to blockchain technology.

Q: Who is the ideal buyer for DAPP tokens?

A: Ideal buyers for DAPP tokens are those who have a sound financial situation, a high risk tolerance, long-term investment objectives, a comprehensive understanding of blockchain technology, and a keen interest in the future of decentralized applications.

Q: What future potentials does DAPP show?

A: The future potential of DAPP is associated with the growing demand for decentralized applications (DApps) and increased usage of blockchain-based storage solutions, although it's highly dependant on market trends and overall acceptance of the technology.

Q: Is it guaranteed to profit from my investment in DAPP tokens?

A: Profit from investing in DAPP tokens, like any other investment, is not guaranteed due to factors such as market volatility, regulatory changes, and competitive dynamics.

Risk Warning

Investing in cryptocurrencies requires an understanding of potential risks, including unstable prices, security threats, and regulatory shifts. Thorough research and professional guidance are advised for any such investment activities, recognizing these mentioned risks are just part of a wider risk environment.

DAPP Good investment market

- 1

LiquidApps User Reviews

LiquidApps News

TokenEther fights to hold $4.3K as corporate ETH treasury growth, DApp activity provide hope

Soaring DApps activity and the growth of ETH-based digital asset treasuries could reinforce Ethers $4,300 level.

2025-09-03 06:54

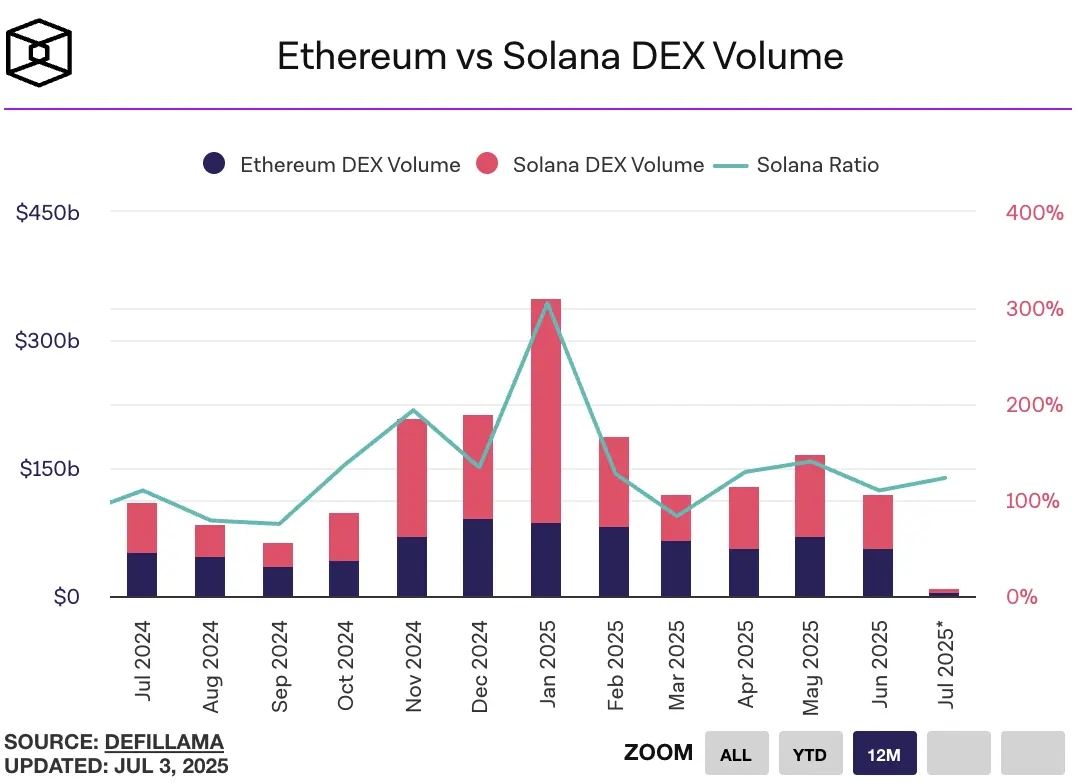

TokenEthereum loses to rival Solana in dApp revenue: Will SOL rally to $200 in July?

Solana, Ethereums most significant rival, leads among cryptos with the highest dApp (decentralized a

2025-07-06 07:03

TokenSoneium dApp Analysis Shows a Decline in Users but Sustained Transaction Volume

Recent data from the Soneium blockchain ecosystem reveals a significant divergence between user enga

2025-06-21 03:04

ExchangeEthereum Leads in DApp Fee Revenue in Q1 2025

In Q1 2025, Ethereum solidified its leading position in the decentralized application (DApp) platfor

2025-04-16 12:00

ExchangeEthereum Dominates Dapp Revenue in Q1 2025 Raking in Over $1 Billion

Ethereum dApps led the pack in Q1 2025, generating over $1 billion in fees, far outpacing competitor

2025-04-15 08:00

TokenEthereum-based Operating System ethOS unveils dGEN1 Hardware Device For Blockchain dApp Interaction

Ethereum-based operating system ethOS has unveiled dGEN1, a hardware device for blockchain dApp inte

2024-10-18 22:28

TokenMultiversX and Helios Staking Partner to Launch Helios Connect dApp for Unified Cross-Chain Identity

Costa Brava, Spain – In a groundbreaking move to drive collaboration over competition in the Web3 sp

2024-09-20 03:04

TokenLiFi integrates with Solana to enhance dApp cross-chain interactions

DeFi protocol Li.Fi has announced its expansion into the Solana ecosystem, aiming to enhance user ex

2024-08-07 22:05

TokenForthewin Network becomes first dApp to launch on Neo X with Smith

Forthewin Network has deployed its Smith feature to Neo X, Neos new EVM-based sidechain, becoming th

2024-07-26 22:06

8 ratings