ARB

$ 0.1148 USD

$ 0.1148 USD

$ 700.698 million USD

$ 700.698m USD

$ 58.369 million USD

$ 58.369m USD

$ 577.437 million USD

$ 577.437m USD

5.8267 billion ARB

Arbitrum-related information

Issue Time

2021-09-09

Platform pertained to

--

Current coin price

$0.1148USD

Market Cap

$700.698mUSD

Volume of Transaction

24h

$58.369mUSD

Circulating supply

5.8267bARB

Volume of Transaction

7d

$577.437mUSD

Change

24h

0.00%

Number of Markets

1252

Crypto token price conversion

Current Rate0

0.00USD

ARB Price Chart

Arbitrum introduction

Markets

Markets3H

0.00%

1D

0.00%

1W

0.00%

1M

-46.8%

1Y

-76.05%

All

-90.91%

| Aspect | Information |

| Short Name | ARB |

| Full Name | Arbitru |

| Founded | 2018 |

| Main Founders | Offchain Labs, a New York-based development company |

| Support Exchanges | Binance, Coinbase, KuCoin, Bybit, Kraken, Bitfinex, etc. |

Overview of ARB

Arbitrum is a layer-2 scaling solution for Ethereum developed by Offchain Labs. It improves the functionality of Ethereum by increasing transaction speed and reducing gas fees without sacrificing the security and decentralization aspects of the main Ethereum network.

Arbitrum operates by taking transactions off the Ethereum mainnet and processing them on its own network, essentially lightening the load on the main Ethereum network. Arbitrum 'rollup' arms the Ethereum blockchain with efficient computational proofs to increase the number of transactions per second.

Arbitrum is suitable for a broad range of decentralized applications (dApps), from simple games to complex DeFi protocols, and allows them to run at a significantly increased speed and lower cost while retaining the same level of security provided by Ethereum.

Pros and Cons

| Pros | Cons |

| · Scalability | · Complexity |

| · Compatibility | · Dependence on Ethereum |

| · Security | · Adoption |

ARB Price Prediction

Over the coming decades, ARB's price is expected to experience fluctuations. By 2030, the trading range is projected to be between $0.2310 and $2.01. In 2040, our forecast suggests ARB could reach a peak price of $1.07,with a potential minimum around $0.01845.Looking ahead to 2050, technical analysis indicates that ARB's price could range from $0.005818 to $1.44,with an estimated average trading price of about $1.18.

What Makes ARB Unique?

Arbitrum's uniqueness lies in its approach to scaling the Ethereum network. Unlike other Layer-2 solutions, Arbitrum uses an optimistic rollup technology which allows it to handle smart contracts without requiring any modifications. This means that any existing Ethereum applications can be migrated to Arbitrum without making any code changes, which is a huge advantage for developers.

Additionally, by batching transactions together and rolling them up in a single proof on the Ethereum mainnet, Arbitrum is able to significantly reduce gas fees and increase transaction speeds while maintaining the security architecture of Ethereum Layer-1.

How Does ARB Work?

Arbitrum works as a Layer-2 solution for the Ethereum blockchain, improving its scalability and speed by processing most transactions “off-chain” and then sending a summary of those transactions to the Ethereum mainnet as single batches. This method is called a rollup.

Here's a more detailed process:

Off-Chain Execution: Users send transactions to the off-chain Arbitrum network where they are batch-processed. These transactions can include operating smart contracts, token swaps or any other operation that can be done in Ethereum Layer-1.

Rollups: These off-chain transactions are then 'rolled up' into a single proof that is submitted to the Ethereum mainnet.

Dispute Resolution: Arbitrum employs 'optimistic' rollups. This means they assume off-chain transactions are honest and accurate, but they provide a disputing period where anyone can challenge and counter-prove the accuracy of the rollup within a specified time window.

Finalization on Ethereum: Once the disputing period ends and if no successful challenges were made, the rollup is finalized on the Ethereum mainnet.

Ultimately, by processing most transactions off-chain and having only a single proof submitted on-chain, Arbitrum helps Ethereum in handling more transactions per second and significantly reduces the associated gas fees while maintaining security and decentralization of the Ethereum network.

Exchanges to Buy ARB

You can acquire ARB on various centralized trading platforms such as Binance, Coinbase, KuCoin, Bybit, Kraken, and Bitfinex, among others. In addition, it's also tradeable on decentralized exchanges like Uniswap V3 (both on Ethereum and Arbitrum) and SushiSwap (Arbitrum).

ARB Good investment market

- 1

- 2

- 3

- 4

- 5

Arbitrum User Reviews

Arbitrum News

TokenArbitrum price forecast: whats next amid 45% ARB downturn?

Arbitrum price hovered near $0.10 as cryptocurrencies saw fresh declines.The token was down nearly 2

2026-02-12 03:03

ExchangeTop 6 Altcoins with Important Events Worth Noting This Week: MegaETH, MON, SOLV, ARB, DOGE, and XRP

This week in crypto, several altcoins may be primed for significant moves, catalyzed by ecosystem-sp

2025-11-24 17:00

TokenArbitrum (ARB Token) Flashes Bullish Signal After Retesting Long-Term Bottom Range

Key Insights:Arbitrum (ARB) forms bullish divergence, signaling that it could be in an aggressive ac

2025-11-11 05:03

TokenArbitrum (ARB) Price Prediction for August 24, 2025: ARB Faces Resistance at $0.60 Amid Rising Volatility

The Arbitrum price today stands at $0.588, slipping 0.9% intraday after a strong breakout rally earl

2025-08-23 21:02

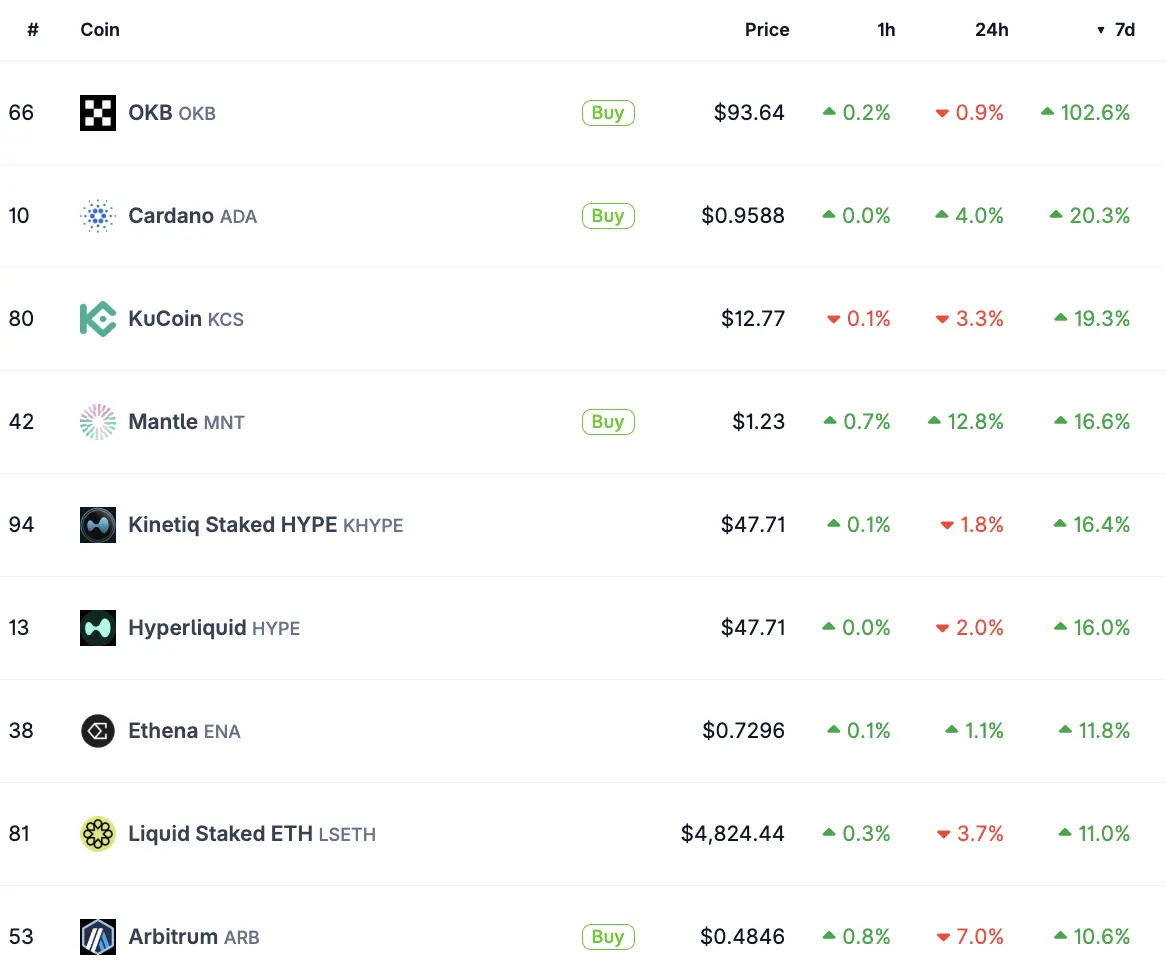

TokenChart of the week: OKB, KCS, ADA, HYPE and ARB could extend gains

Bitcoin holds steady above $117,000, and Ethereum is trading close to $4,500 on Friday. Several altc

2025-08-17 04:04

TokenARB eyes reversal after a double bottom: will support hold for another rally?

ARB is showing signs of a potential double bottom formation, but recent price action has lost key su

2025-07-29 04:01

TokenAltcoins to Watch as Ethereum Breaks Higher: UNI, ARB, LINK, RNDR

The cryptocurrency market is starting to show signs of a shift, with Ethereum gaining momentum aroun

2025-07-10 22:06

TokenCrypto Watch: Will LINK, ARB, TAO, PEPE, and ONDO Break Key Resistance Levels This Week?

The altcoin market is facing a crucial turning point, as tokens such as Chainlink (LINK), Arbitrum (

2025-05-30 21:05

TokenOffchain Labs Plans To Acquire Arbitrums Native Token ARB For Its Treasury

Offchain Labs, the company building the Arbitrum ecosystem, has announced a “strategic purchase plan

2025-03-12 01:00

4 ratings