AAVE

$ 105.77 USD

$ 105.77 USD

$ 1.6807 billion USD

$ 1.6807b USD

$ 362.089 million USD

$ 362.089m USD

$ 3.9505 billion USD

$ 3.9505b USD

15.326 million AAVE

Aave-related information

Issue Time

2020-10-03

Platform pertained to

--

Current coin price

$105.77USD

Market Cap

$1.6807bUSD

Volume of Transaction

24h

$362.089mUSD

Circulating supply

15.326mAAVE

Volume of Transaction

7d

$3.9505bUSD

Change

24h

-1.34%

Number of Markets

1251

Github Messages

More

Warehouse

Aave

Github's IP Address

[Copy]

Codebase Size

24

Last Updated Time

2019-02-14 02:03:31

Language Involved

--

Agreement

--

Crypto token price conversion

Current Rate0

0.00USD

AAVE Price Chart

Aave introduction

Markets

Markets3H

-2.01%

1D

-1.34%

1W

-13.01%

1M

-33.5%

1Y

-55.4%

All

+115.4%

Cryptocurrency Overview

Aave is a leading decentralized finance (DeFi) protocol built on the Ethereum blockchain. It allows users to lend, borrow, and earn interest on cryptocurrencies in a permissionless and transparent manner. Aave is a powerful and versatile DeFi protocol that offers a range of opportunities for lending, borrowing, and earning interest on cryptocurrencies. However, it's crucial to understand the risks involved before participating in Aave or any DeFi protocol.

Introduction to AAVE exchanges

AAVE is not an exchange itself, but it's traded on various cryptocurrency exchanges.

Here's a breakdown of AAVE exchanges:

1. Centralized Exchanges (CEXs):

Binance: One of the largest cryptocurrency exchanges, offering a wide range of trading pairs, including AAVE.

Coinbase: A popular exchange with a user-friendly interface, also supporting AAVE trading.

Kraken: Known for its security and advanced trading features, Kraken also offers AAVE trading.

KuCoin: Another large exchange with a wide selection of cryptocurrencies, including AAVE.

Huobi: A global exchange with a strong presence in Asia, supporting AAVE trading.

2. Decentralized Exchanges (DEXs):

Uniswap: A leading DEX on Ethereum, allowing users to swap AAVE for other ERC-20 tokens directly on the blockchain.

SushiSwap: Another popular DEX on Ethereum, offering a similar functionality to Uniswap.

PancakeSwap: A leading DEX on Binance Smart Chain (BSC), allowing users to swap AAVE for other BEP-20 tokens.

AAVE Price Prediction

Based on historical trends and technical analysis, Aave's price is expected to experience fluctuations, with a projected range of $618.85 to $737.82 by 2030, expanding to $1,237.32 to $1,475.61 by 2040, and further reaching between $1,838.46 and $2,210.91 by 2050, with an average trading cost estimated at approximately $1,851.69 in 2050.

Mobile trading app for buying AAVE

1. Coinbase:

Pros: User-friendly interface, excellent security, widely available in many countries, supports fiat currency deposits (USD, EUR, GBP, etc.).

Cons: Higher fees compared to some other exchanges, limited trading pairs.

2. Binance

Pros: Wide selection of trading pairs, low fees, advanced trading features, supports fiat currency deposits in some regions.

Cons: Can be overwhelming for beginners, some features may be restricted in certain regions.

3. Kraken:

Pros: Known for security, advanced trading features, good customer support, supports fiat currency deposits.

Cons: Can be more complex for beginners, limited mobile app features compared to some other exchanges.

Why it's the best token

As the governance token of the Aave protocol, a leading decentralized finance platform, AAVE grants holders voting rights on protocol decisions and access to rewards. This direct influence on a thriving platform, coupled with the protocol's strong track record and growing user base, fosters confidence in AAVE's potential. Furthermore, AAVE's integration into various DeFi applications and protocols enhances its versatility, allowing for participation in lending, borrowing, yield farming, and other activities. The growing adoption and popularity of Aave within the DeFi space, coupled with the sector's anticipated growth, suggest potential for AAVE's value to appreciate. However, it's crucial to remember that cryptocurrency markets are volatile, and AAVE, like any other token, carries inherent risks associated with smart contract vulnerabilities and competition within the dynamic DeFi landscape.

Token address

AAVE Token Address (Ethereum Network):

0x7Fc66500c84A76Ad7e9C93437bFc5Ac33E2DDaE9

This address is used to identify AAVE tokens on the Ethereum blockchain. You can use this address when interacting with AAVE on decentralized exchanges (DEXs) or other DeFi applications.

Token transfer

1. Choose Your Wallet:

You'll need a wallet that supports AAVE tokens. Popular options include:

Mobile Wallets: Valora, CeloWallet, Coinbase Wallet, MetaMask

Desktop Wallets: Exodus, Atomic Wallet

Hardware Wallets: Ledger Nano S Plus, Trezor Model T

2. Obtain the Recipient's Address:

Get the Ethereum address of the person or platform you want to send AAVE to.

This address will be a long string of alphanumeric characters, starting with “0x”.

3. Open Your Wallet and Navigate to Send:

Open your chosen wallet and find the “Send” or “Transfer” option.

You might need to select AAVE from a list of supported tokens.

4. Enter the Recipient's Address:

Carefully paste the recipient's Ethereum address into the designated field.

Double-check the address to avoid sending your AAVE to the wrong recipient.

5. Enter the Amount:

Specify the amount of AAVE you want to transfer.

Ensure you have enough AAVE in your wallet balance.

6. Set a Gas Fee (if applicable):

Depending on the wallet, you may need to set a gas fee.

This fee is paid to miners on the Ethereum network to process your transaction.

You can choose a lower gas fee for a slower transaction or a higher fee for a faster transaction.

7. Review and Confirm:

Carefully review all the details of your transaction before confirming it.

Once confirmed, your transaction will be broadcast to the Ethereum network.

8. Track Your Transaction:

You can track the progress of your transaction using a block explorer like Etherscan.

Enter your transaction ID (hash) into the search bar to see its status.

AAVE wallets

1. Mobile Wallets:

MetaMask: A popular mobile wallet that supports Ethereum and ERC-20 tokens like AAVE. It's known for its user-friendly interface and integration with various DeFi applications.

Coinbase Wallet: Another popular mobile wallet that supports Ethereum and ERC-20 tokens, including AAVE. It offers a good balance of security and user experience.

Trust Wallet: A mobile wallet developed by Binance, supporting Ethereum and ERC-20 tokens. It's known for its simplicity and integration with the Binance ecosystem.

CeloWallet: The official wallet for the Celo blockchain, which also supports Ethereum and ERC-20 tokens. It's a good option for users interested in the Celo ecosystem.

Valora: A mobile wallet designed specifically for the Celo blockchain, but it also supports Ethereum and ERC-20 tokens. It's known for its user-friendly interface and social features.

2. Desktop Wallets:

Exodus: A popular multi-currency wallet that supports Ethereum and ERC-20 tokens, including AAVE. It offers a user-friendly interface and a wide range of features.

Atomic Wallet: Another multi-currency wallet that supports Ethereum and ERC-20 tokens. It's known for its user-friendly interface and support for various cryptocurrencies.

MyEtherWallet (MEW): A popular web-based wallet for Ethereum and ERC-20 tokens. It's known for its security and flexibility, but it requires more technical knowledge to use.

Earning free AAVE

1. Aave Protocol Rewards:

Lending: Depositing cryptocurrencies like ETH, USDT, USDC, etc., into Aave's liquidity pools as a lender can earn you interest in the form of AAVE tokens.

Governance: Holding AAVE tokens allows you to participate in Aave's governance and vote on proposals. You might receive AAVE rewards for participating in governance activities.

Aave Grants: Aave occasionally offers grants to developers and projects that contribute to the Aave ecosystem.

2. Airdrops:

Airdrops: Cryptocurrency projects sometimes distribute free tokens to users as a way to promote their platform or reward early adopters. While not guaranteed, there's a chance you could receive AAVE tokens in an airdrop.

AAVE taxation

Tax obligations for trading AAVE on cryptocurrency exchanges depend on your local tax laws. In many jurisdictions, profits from trading cryptocurrencies like AAVE are treated as capital gains and are taxable. It's important to keep detailed records of your transactions, including dates, amounts, and the market value of AAVE at the time of each trade. Losses may also be deductible. Due to the complexity and variations in tax regulations, its advisable to consult with a tax professional familiar with cryptocurrency regulations in your area to ensure compliance.

AAVE security

The security of AAVE cryptocurrency relies on robust blockchain technology, which uses encryption to protect transactions and prevent unauthorized access. Users should enhance security by using reputable wallets, enabling two-factor authentication, and being cautious of phishing attempts. Regular software updates and vigilant monitoring of account activity are also recommended to safeguard investments.

Currency login

AAVE is a cryptocurrency, and you don't “log in” to it directly. Instead, you would interact with AAVE through:

Cryptocurrency Exchanges: If you bought AAVE on an exchange like Binance, Coinbase, or Kraken, you'd log in to your exchange account to access your AAVE holdings.

Wallets: If you hold AAVE in a wallet like MetaMask, Trust Wallet, or Ledger, you'd log in to your wallet to access your AAVE tokens.

Decentralized Exchanges (DEXs): If you're using a DEX like Uniswap or SushiSwap, you'd connect your wallet to the DEX to interact with AAVE.

Supported Payment Methods for Purchasing

1. Fiat Currency:

Bank Transfers: Many exchanges allow you to deposit funds from your bank account using a wire transfer or ACH transfer.

Debit/Credit Cards: Some exchanges accept debit and credit cards, but they might charge higher fees.

PayPal: A few exchanges support PayPal, but it's not as common as other methods.

Apple Pay/Google Pay: Some exchanges offer mobile payment options like Apple Pay and Google Pay.

2. Cryptocurrencies:

Bitcoin (BTC): Most exchanges accept Bitcoin as a payment method for buying AAVE.

Ethereum (ETH): Ethereum is widely accepted as a payment method for purchasing AAVE.

Other Stablecoins: Stablecoins like USDT, USDC, and BUSD are often used to buy AAVE.

Online purchase of USD/USDT

To buy AAVE using USA/USDT online, you'll need to access a cryptocurrency exchange that lists both AAVE and USDT pairs. First, ensure your account is funded with USDT. Then, navigate to the AAVE/USDT trading pair on the exchange and place a buy order for the desired amount of AAVE tokens. Confirm the transaction details and execute the trade. Always check for transaction fees and security protocols of the exchange.

Buying cryptocurrency with a bank credit card

To buy AAVE tokens using a bank credit card, start by selecting a cryptocurrency exchange that supports credit card purchases and lists AAVE. Register for an account and complete any required identity verification processes. Once your account is set up, add your credit card as a payment method by entering the card details. Navigate to the purchase section, select AAVE from the available cryptocurrencies, enter the amount you wish to buy, and proceed to checkout. Review the transaction details, including any fees charged by the exchange or your bank for credit card usage, and confirm your purchase. Be aware that some banks may have restrictions on using credit cards for cryptocurrency transactions.

Buying with loans/financing

To borrow funds to buy AAVE cryptocurrency, you can use crypto lending platforms that offer loans in fiat or digital currencies. First, create an account on a platform that supports AAVE and provides lending services. Deposit collateral, usually in another cryptocurrency, then apply for a loan in your desired currency. Once approved, use the funds to purchase AAVE either directly through the platform or transfer them to an exchange where AAVE is listed. Always consider the interest rates and repayment terms.

About support for monthly payments of tokens

While it's not a widely available feature yet, here's a breakdown of options and considerations:

1. Recurring Buy Orders on Exchanges:

Limited Support: Some exchanges offer recurring buy orders, but not all support AAVE specifically.

Example: Binance allows you to set up a “Dollar-Cost Averaging (DCA)” order for AAVE, buying a fixed amount at regular intervals.

Check Exchange Policies: Verify if your chosen exchange supports recurring AAVE purchases.

2. Third-Party Services:

Crypto Bots: Automated trading bots can be programmed to buy AAVE at regular intervals based on pre-defined schedules or market conditions.

Example: Coinrule, 3Commas, and other platforms offer bot services for automated AAVE trading.

Risk and Security: Ensure the bot service is reputable and secure, as you're entrusting it with your funds.

3. Manual Purchases:

Self-Discipline: You can manually buy AAVE at regular intervals using your chosen exchange or wallet.

Calendar Reminders: Set up calendar reminders to remind yourself to make the purchases.

Potential for Inconsistency: Manual purchases might not be as consistent as automated methods.

4. DeFi Protocols (Emerging):

Limited Options: Some DeFi protocols are exploring automated savings and investment features, but support for AAVE is still limited.

AAVE Good investment market

- 1

- 2

- 3

- 4

- 5

Aave User Reviews

Aave News

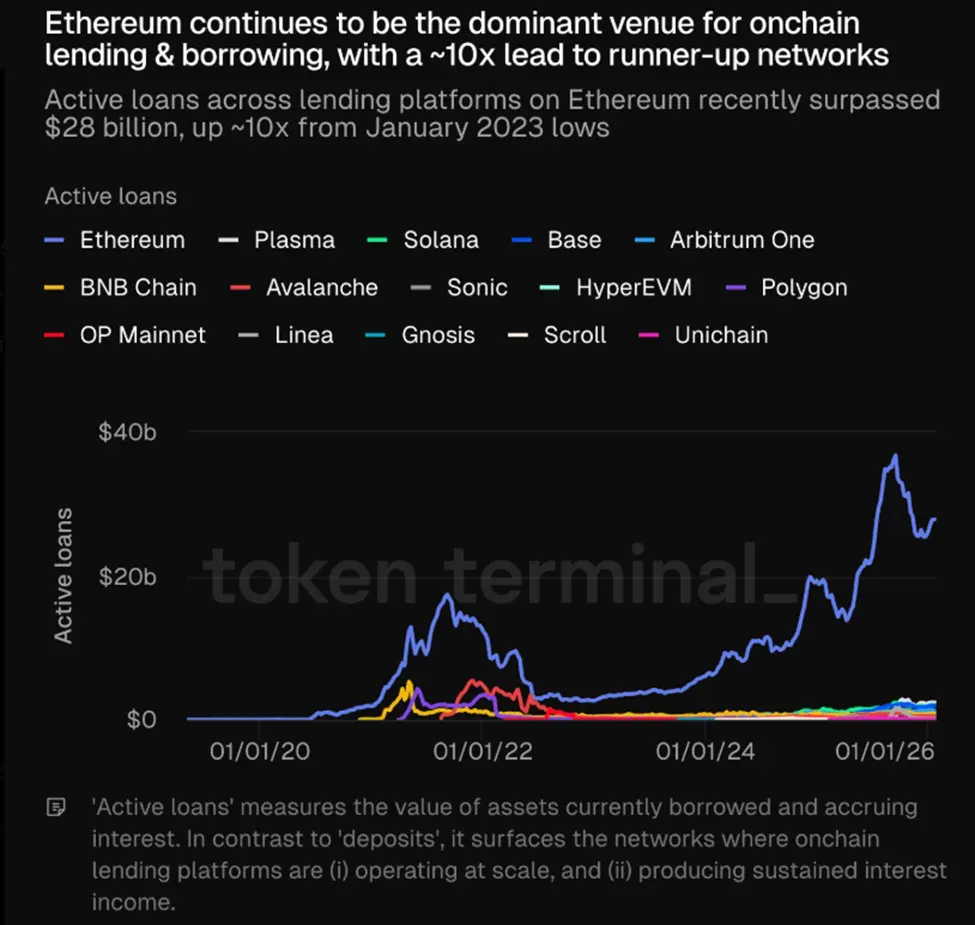

TokenEthereum Lending Hits $28 Billion After Aave Proves DeFis Crisis Shield in Weekend Crash

Ethereums on-chain lending ecosystem has reached a new milestone, with active loans surpassing $28 b

2026-02-05 17:03

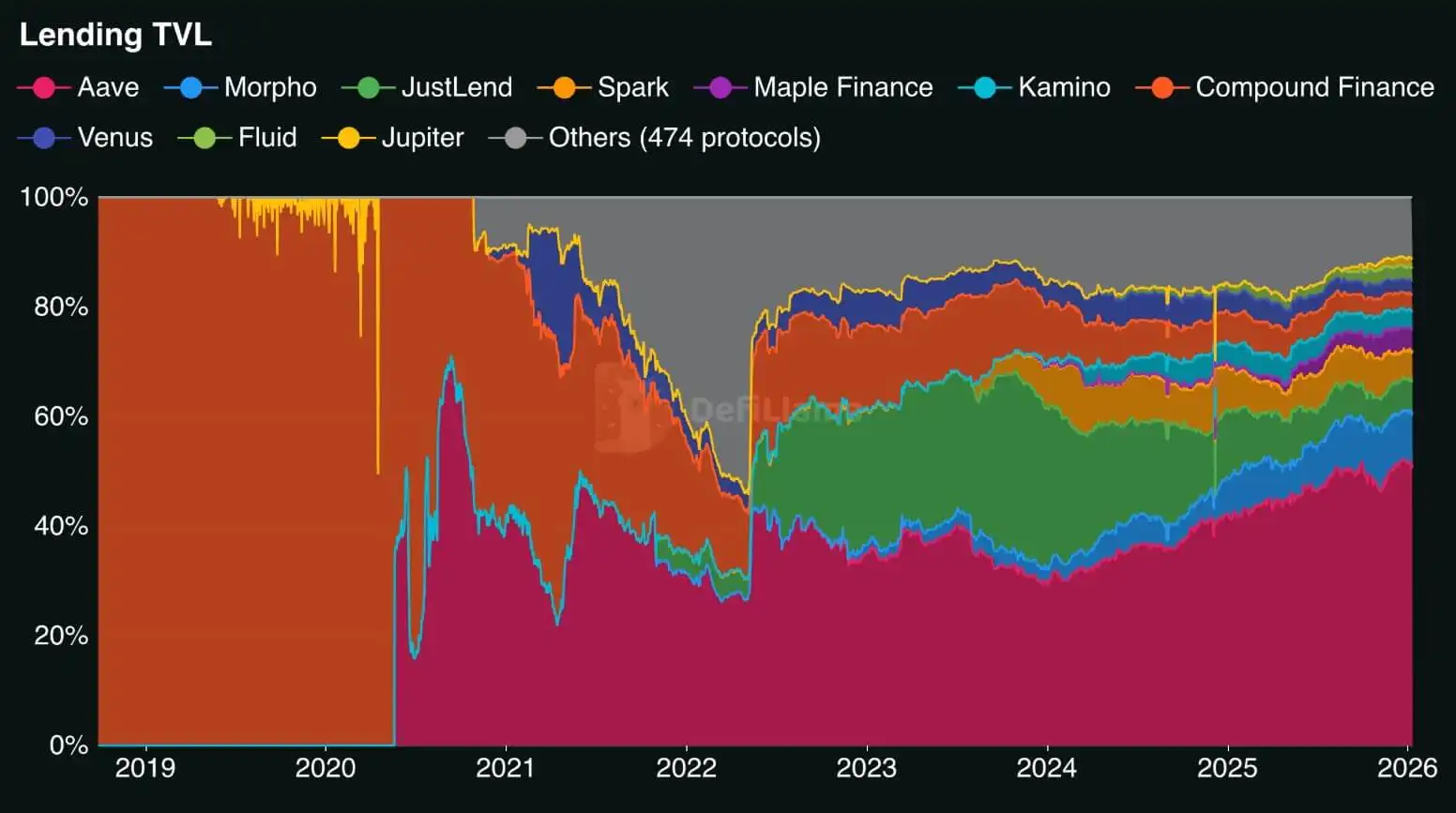

TokenAave DeFi lending monopoly reaches 51%, creating a systemic feedback loop with only a $460M backstop

Aave now controls 51.5% of the DeFi lending market share, the first time any protocol has crossed th

2026-01-28 19:03

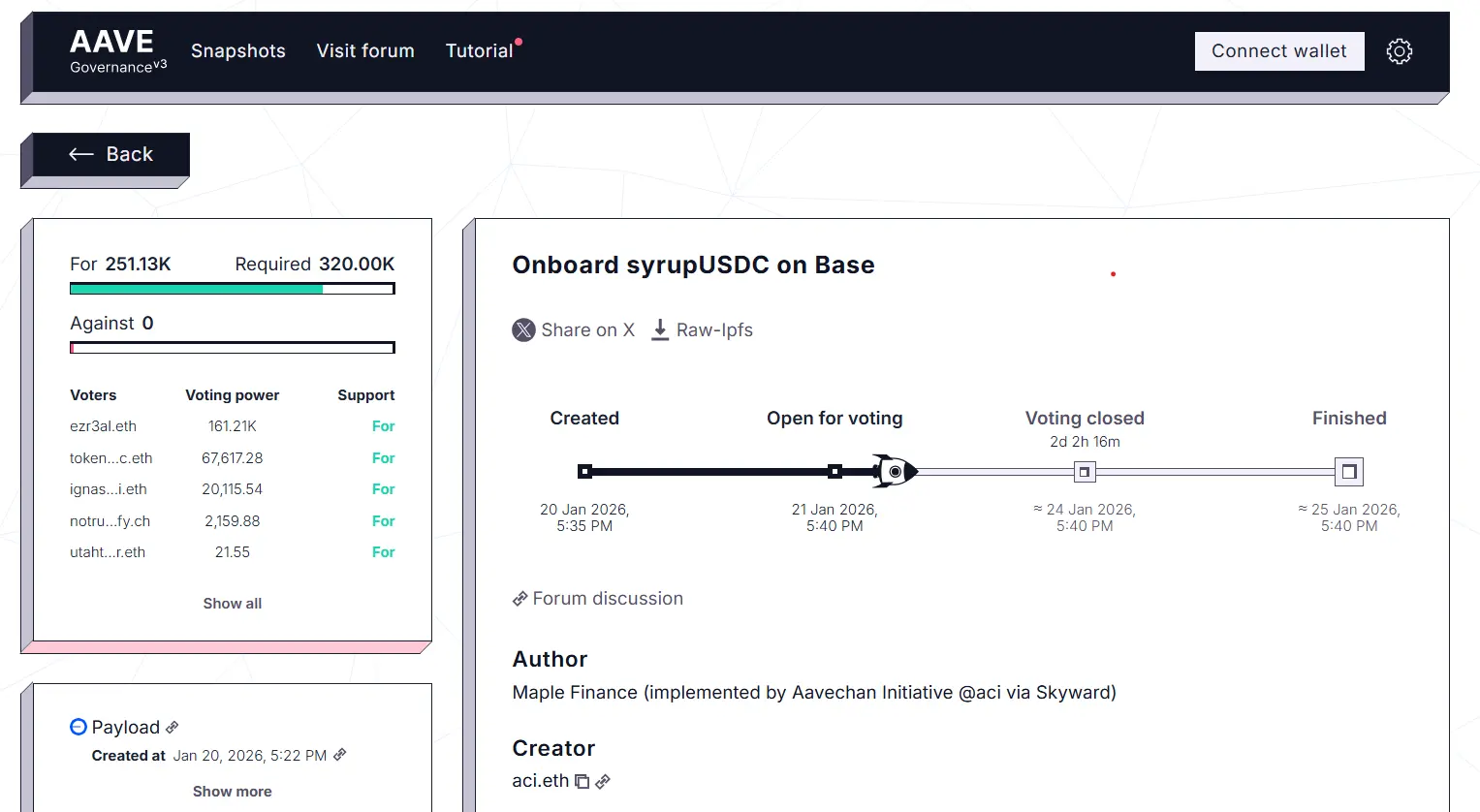

TokenMaple brings syrupUSDC to Base, targets Aave V3 listing

Onchain asset manager Maple is extending its yield-bearing US dollar token, syrupUSDC, to Coinbases

2026-01-22 23:02

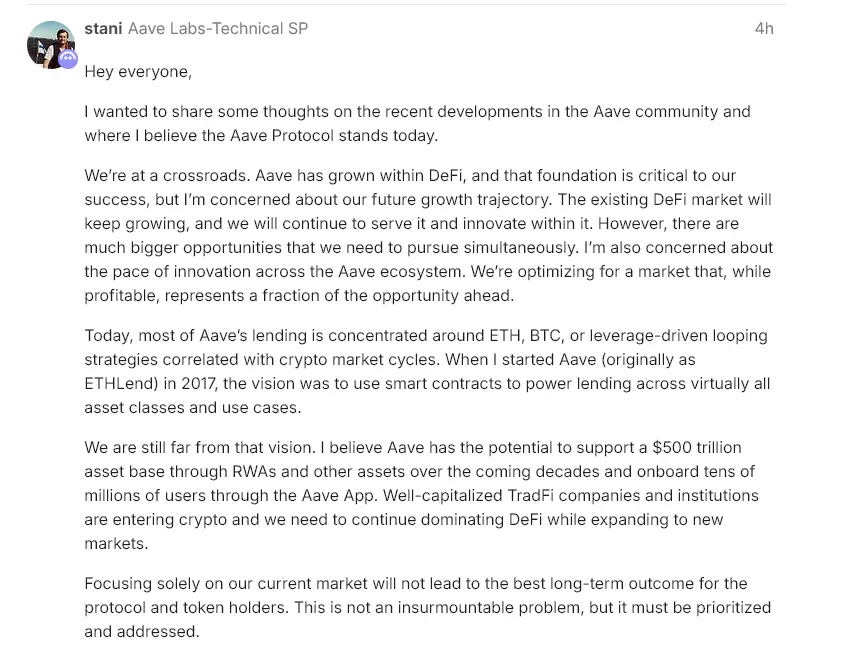

TokenAave refocuses on DeFi, hands Lens stewardship to Mask Network

Decentralized finance (DeFi) protocol Aave transferred stewardship of the social infrastructure prot

2026-01-21 18:02

TokenAave Price Jumps Amid Revenue Sharing Plans With Token Holders

Aave is preparing for a major governance vote, as the platform will explore sharing part of its off-

2026-01-03 22:03

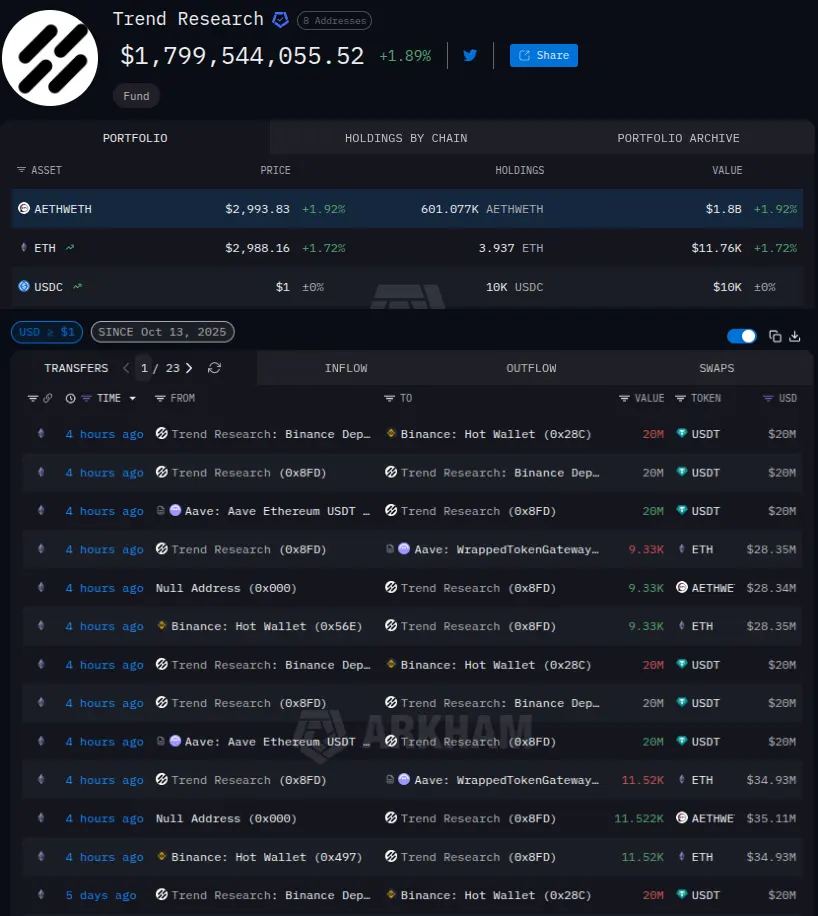

TokenInvestment Firm Borrows $1B in Stablecoins on Aave to Buy Ethereum

Key NotesTrend Research‘s ETH position has a $3,265 dollar cost average, having borrowed $958 millio

2025-12-30 04:03

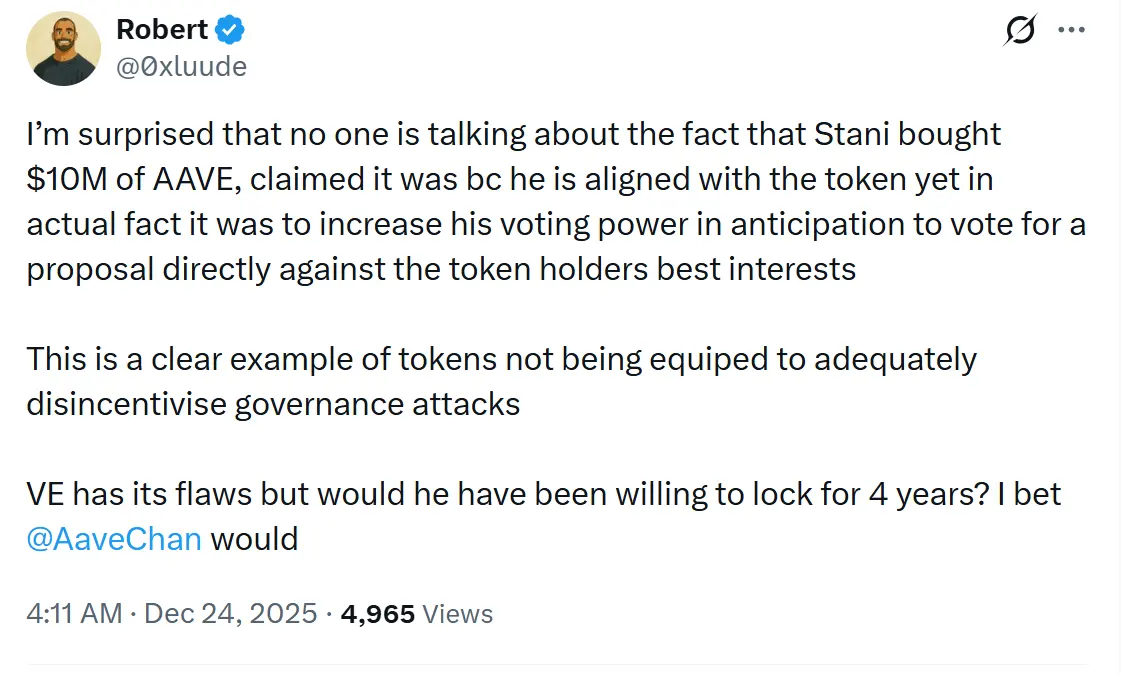

TokenAave founder under scrutiny for $10M token purchase amid governance drama

Aave founder Stani Kulechov is facing scrutiny over his recent $10 million purchase of AAVE tokens,

2025-12-24 23:03

TokenWhales Add $3 Million in AAVE as Governance Uncertainty Pressures Price

The AAVE price has been under steady pressure. The token is down nearly 5% over the past 24 hours an

2025-12-24 04:02

TokenAAVE Price Slides 10% as DAO Governance Dispute Triggers Sell-Off

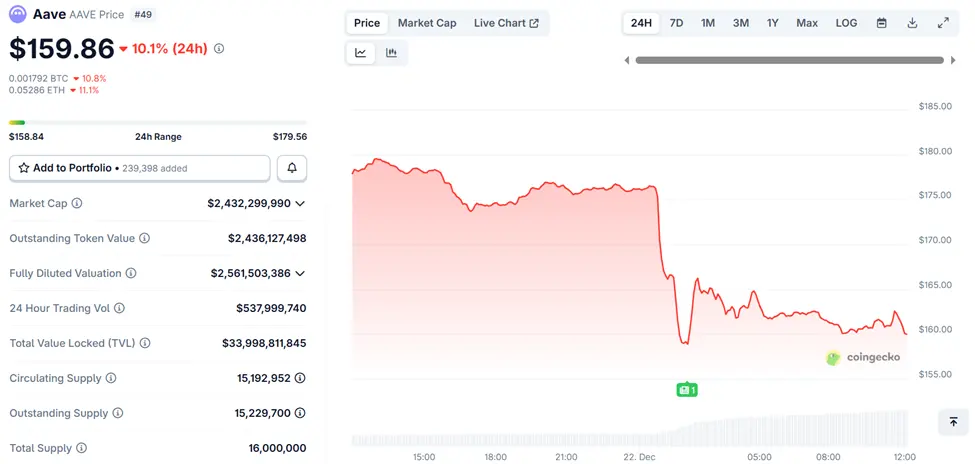

AAVE fell 10% during the early hours of the Asian session on Monday, following a $50 million sell-of

2025-12-22 15:02

24 ratings

View all comments