Score

DEFI

China

2-5 years

Suspicious Regulatory License|

Medium potential risk

https://www.defieo.co/#/

Website

Exchange License

DEFI Exchange Info

WikiBit Risk Alerts

1It has been verified that this Exchange currently has no valid regulation, please be aware of the risk!

Website

Relationship Mapping

Social Media

Trade Type

Keywords

Time Machine

White Paper

Related Software

Github

Related Docs

All Corps

New Arrival

DEFI User Reviews

Crypto Exchange

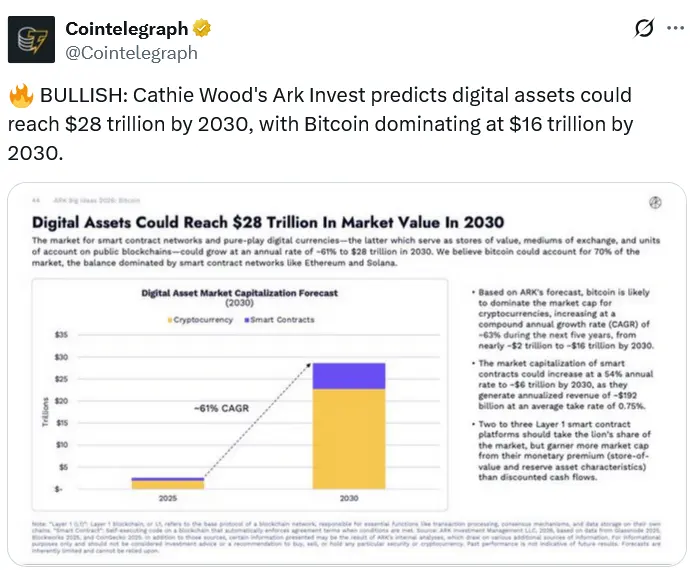

Decentralized finance, or DeFi for short, is a blockchain-based form of finance that does not rely on central financial intermediaries such as brokerages, exchanges, or banks to offer traditional financial instruments. Instead, it utilizes smart contracts on blockchains, the most common being Ethereum.

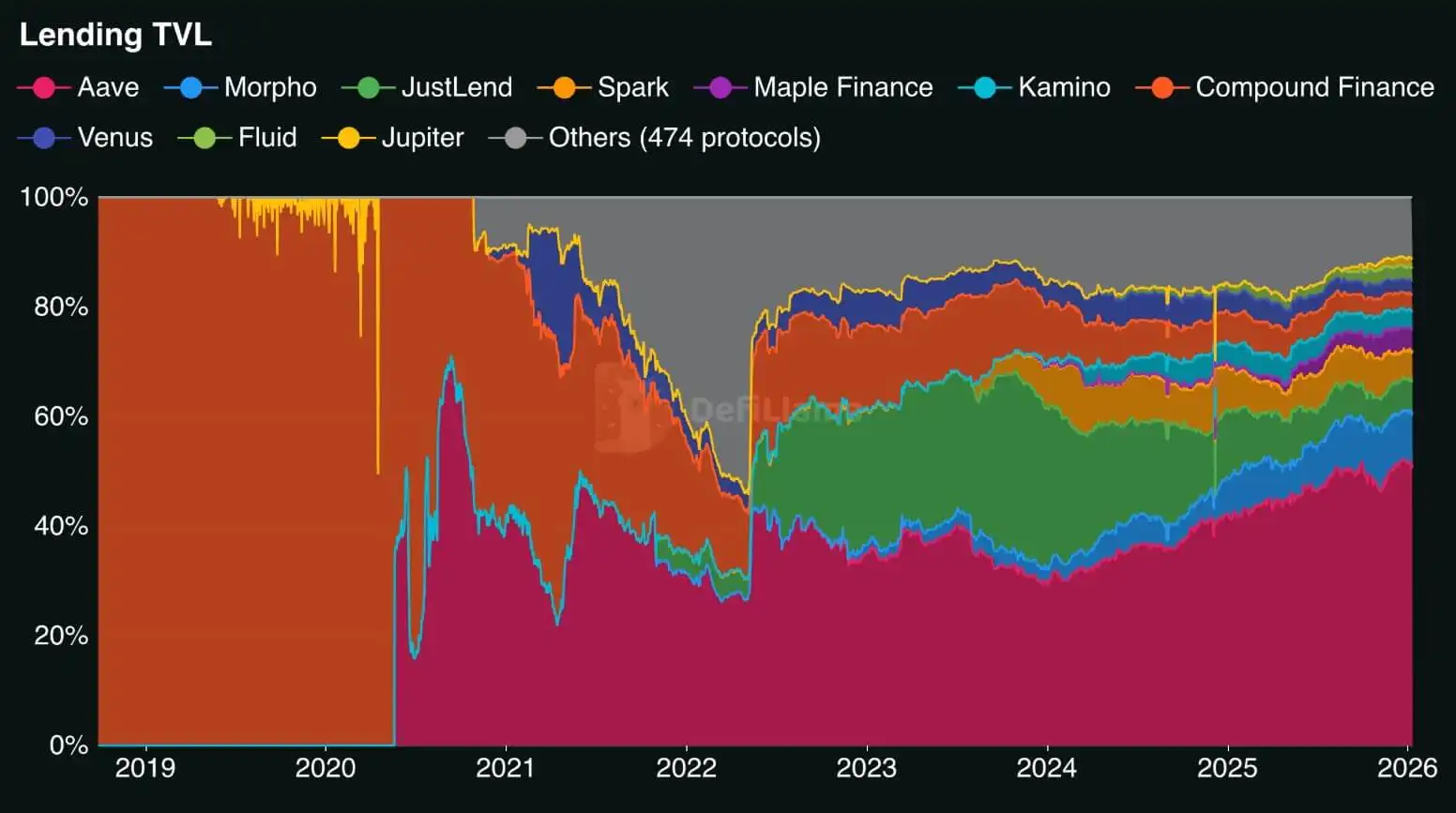

DeFi platforms allow people to lend or borrow funds from others, speculate on price movements on a range of assets using derivatives, trade cryptocurrencies, insure against risks, and earn interest in a savings-like account. These decentralized financial systems aim to democratize finance by eliminating intermediaries and allowing individuals to control their own wealth.

Pros and Cons

| Pros | Cons |

|---|---|

| Permissionless and high accessibility | Risks associated with smart contract vulnerabilities |

| No middlemen, reducing costs | Potential for lower liquidity |

| Transparency and auditability due to blockchain | Regulatory uncertainty |

| Increased privacy and security | Technical understanding required |

| Innovative and flexible services | Risks related to lack of insurance or legal protection |

Regulatory Authority

The regulatory environment for crypto exchanges—especially for decentralized exchanges like DeFi ones—is currently in flux. Many jurisdictions do not have specific rules or regulations pertaining to these exchanges. This lack of regulation has certain consequences.

An unregulated exchange may struggle with security due to the absence of systematic oversight and requirements for safeguards. This leaves them vulnerable to hacking, theft, and even insider manipulation. Furthermore, these exchanges may also lack consumer protection protocols, leaving you, as a trader, with few recourses if anything goes wrong. This is in stark contrast to a regulated exchange where you have some degree of protection or potential avenues for recourse.

Security

Security is an essential facet of decentralized finance systems. Due to their reliance on blockchain technologies, they have potential advantages over traditional banking systems, but they are not without their risks.

The security robustness of DeFi applications is largely dependent on the security of the underlying smart contracts they run on. Smart contracts are self-executing contracts with the agreement terms directly written into code. They're stored and replicated on the blockchain, and their execution is effectively irreversible. However, flaws or bugs in smart contract design can lead to severe consequences, including hacking or financial loss. Numerous projects invest heavily in audits and other security checks to ensure these contracts are as secure as possible.

Cryptocurrencies Available

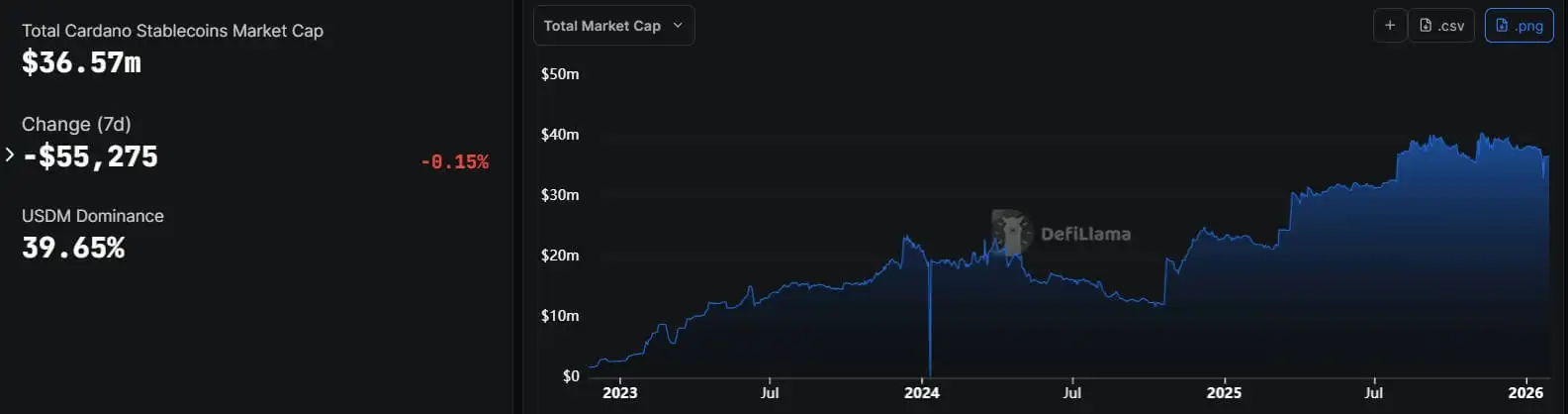

Decentralized finance (DeFi) platforms support a wide range of cryptocurrencies, including but not limited to Bitcoin (BTC), Ethereum (ETH), and many others. Importantly, they often support stablecoins - cryptocurrencies designed to minimize price volatility, usually by being pegged to reserve assets like the US dollar. Popular stablecoins such as Tether (USDT), USD Coin (USDC), and DAI are frequently used in DeFi transactions

Payment Methods

DeFi platforms typically rely on cryptocurrency as the primary method of payment. This entails that users usually need to have certain cryptocurrencies, such as Ether (ETH), in their digital wallets before they can participate in DeFi activities. Cryptocurrencies can be purchased on traditional crypto exchanges, such as Coinbase or Binance, using standard methods such as credit card, debit card, or bank transfer.

2026-02-07 02:03

2026-02-04 08:02

2026-02-01 03:02

2026-01-31 06:02

2026-01-30 00:02

2026-01-29 21:03

2026-01-28 19:03

2026-01-22 12:02

2026-01-21 22:01

Company Name

Company Name Phone of the company

Phone of the company Company Website

Company Website X

X Facebook

Facebook Customer Service Email Address

Customer Service Email Address

9 ratings