MINT

$ 0.00 USD

$ 0.00 USD

$ 0.00 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

0.00 0.00 MINT

MusicN-related information

Issue Time

2023-03-31

Platform pertained to

--

Current coin price

0.00

Market Cap

$0.00USD

Volume of Transaction

24h

$0.00USD

Circulating supply

0.00MINT

Volume of Transaction

7d

$0.00USD

Change

24h

0.00%

Number of Markets

Crypto token price conversion

Current Rate0

0.00USD

WikiBit Risk Alerts

1WikiBit has marked the token as air coin project for we have received overwhelming complaints that this token is a Ponzi Scheme. Please be aware of the risk!

MINT Price Chart

MusicN introduction

Markets

Markets3H

0.00%

1D

0.00%

1W

0.00%

1M

0.00%

1Y

0.00%

All

0.00%

| Aspect | Information |

| Short Name | MINT |

| Full Name | MusicN |

| Founded Year | 2020 |

| Main Founders | Trabzonspor Sportif Hizmetler A.Ş. and Chiliz |

| Support Exchanges | Uniswap (V2), SushiSwap, 1inch, 0x Protocol, Paraswap, Matcha, DODO, Balancer, Kyber Network, Curve Finance |

| Storage Wallet | Desktop Wallets, Mobile Wallets, Web Wallets, Hardware Wallets, Paper Wallets |

Overview of MINT

MusicN (MINT) is a cryptocurrency project at the intersection of music and blockchain, founded in 2020. It's available on top exchanges like Binance and can be securely stored in wallets like MetaMask, Trust Wallet, and hardware wallets. MINT aims to revolutionize the music industry by offering unique experiences and opportunities to its users through blockchain technology.

Pros and Cons

| Pros | Cons |

| Recent market entry, potential for growth | Relative lack of historical data |

| Availability on popular exchanges like Uniswap and SushiSwap | Not listed on all major exchanges |

| Compatible with Metamask | Main founders are undisclosed |

Pros:

1. Recent Market Entry, Potential for Growth - As a recently launched cryptocurrency in 2021, the MINT token could potentially have considerable potential for growth. Early investors may be able to take advantage of this, depending on how the token's value develops in the future.

2. Availability on Popular Exchanges - MINT tokens are available on popular cryptocurrency exchanges like Uniswap and SushiSwap. This availability makes MINT accessible to a broad audience and can facilitate buying and selling activities for users globally.

3. Compatibility with Metamask - The MINT token can be stored in the Metamask wallet, which is known for its user-friendly interface and solid security features. This compatibility potentially lowers the barrier for potential investors or users who are already familiar with the Metamask platform.

Cons:

1. Relative Lack of Historical Data - Because MINT is a new cryptocurrency, it lacks a long-term track record that investors could use to help gauge its performance potential or stability relative to older, more established cryptocurrencies.

2. Not Listed on All Major Exchanges - Despite its availability on Uniswap and SushiSwap, the MINT token is not listed on all major cryptocurrency exchanges. This fact could limit the potential market audience for the token.

3. Main Founders are Undisclosed - The identities of the main founders of the MINT Token have not been publicly disclosed. This undisclosed fact about the token could lead to uncertainties or trust issues among potential investors.

What Makes MINT Unique?

MINT represents a type of innovation in the crypto market by aiming to provide a solution for token liquidity. Its main difference from other cryptocurrencies lies in the fact that MINT uses a smart contract to establish an elastic supply and control price stability, instead of relying on liquidity providers typically used in the creation of decentralized tokens.

Unlike other cryptocurrencies, MINT operates without initial collateral and liquidity providers. This approach addresses one of the main challenges of token creation, which is providing enough liquidity to maintain token stability. By removing the need for initial collateral, MINT simplifies the process of creating new tokens, potentially enabling more entities to create their own tokens.

However, such innovation also comes with uncertainties and risks as it can operate differently under market stress compared to traditional tokens with liquidity providers. As with any other cryptocurrencies, potential users and investors should conduct diligent research and consider their risk tolerance before diving into it.

How Does MINT Work?

The working mode and principle of MINT rely on its innovative smart contract system, which aims to mitigate common liquidity issues associated with decentralized token creation.

Instead of relying on liquidity providers to maintain price stability, MINT utilizes a smart contract to control its supply. The contract algorithmically adjusts the token supply based on market demand, creating a state of an elastic supply. When demand increases, more MINT tokens are generated, and when demand decreases, the supply contracts.

Furthermore, MINT streamlines the token creation process by eliminating the need for initial collateral. This means that anyone can create a new token without having to provide a large amount of starting capital, which is typically required to ensure liquidity in most other token models.

Nevertheless, potential MINT users should remember that while this model brings unique advantages, it also introduces new types of market dynamics and potential risks. Thorough due diligence should therefore be undertaken before procuring or utilising MINT tokens.

Circulation of MINT

MusicN (MINT) is a utility token that powers the Trabzonspor Fan Token platform. MINT is used to access exclusive fan-related features and benefits, such as the ability to vote in polls, participate in exclusive contests, and earn rewards. MINT can also be used to purchase Trabzonspor merchandise and tickets.

MINT is a relatively new cryptocurrency with a low market capitalization. This makes it more susceptible to price fluctuations than more established cryptocurrencies. Additionally, MINT is a utility token, which means that its price is not necessarily correlated with the performance of the Trabzonspor football club.

There is no mining cap for MINT. This means that the Trabzonspor team can create new MINT tokens at any time. However, the Trabzonspor team has stated that it will only create new MINT tokens when necessary to support the growth and development of the Trabzonspor Fan Token platform.

Overall, MINT is a promising project with the potential to revolutionize the way fans engage with their favorite teams. However, it is important to be aware of the risks involved before investing in MINT. MINT is a high-risk, high-reward investment. Investors should only invest what they can afford to lose and should carefully consider their own investment goals and risk tolerance.

Exchanges to Buy MINT

The Mint Club Token (MINT) can be bought on various exchanges. Here are 10 exchanges where you can buy MINT, along with some of the currency and token pairs they support:

Uniswap (V2): Launched in November 2018, Uniswap is a decentralized exchange protocol built on Ethereum. MINT can be traded on Uniswap against ETH and other ERC-20 tokens.

SushiSwap: SushiSwap is a decentralized cryptocurrency exchange that allows users to trade any ERC20 token. MINT can also be traded against ETH and various ERC-20 tokens.

1inch: 1inch is a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible trading rates. MINT can be paired with ETH and other ERC-20 tokens here.

0x Protocol: 0x is a protocol that facilitates the peer-to-peer exchange of Ethereum-based assets. It supports various pairs including MINT/ETH.

Paraswap: Paraswap is a decentralized exchange aggregator. It facilitates MINT swaps with various other tokens.

Matcha: Matcha is a decentralized trading platform built on the 0x Protocol. MINT and other tokens can be swapped directly on the platform.

DODO: DODO is a decentralized exchange platform based on Ethereum and Binance Smart Chain (BSC). It also supports trading pairs with MINT.

Balancer: Balancer is an automated portfolio manager and liquidity provider that enables swapping of ERC-20 tokens, including MINT.

Kyber Network: Kyber Network is a blockchain-based liquidity protocol that allows decentralized token swaps to be integrated into any application. It supports MINT in various trading pairs.

1Curve Finance: It's a decentralized exchange optimized for low slippage and low fee swaps between stablecoins. In certain pools, MINT can be swapped with other tokens.

How to Store MINT?

Storing Mint Club Token (MINT) involves placing the tokens in a digital wallet. It's important to keep in mind that since MINT is an ERC-20 token, it is compatible with wallets that support this standard.

The different types of wallets for storing MINT are:

Desktop Wallets: These are applications installed on a desktop or laptop. One commonly used desktop wallet compatible with ERC-20 tokens is the Metamask wallet.

Mobile Wallets: These wallets operate on smartphones, providing convenience for users who prefer managing their tokens on-the-go. Trust Wallet and imToken are examples of mobile wallets that support MINT.

Web Wallets: Web wallets operate in web browsers. Metamask is also a kind of web wallet that supports MINT.

Hardware Wallets: These are physical devices that store cryptocurrency offline - a method often termed 'cold storage'. Ledger, Trezor are hardware wallets that can be used to store ERC-20 tokens including MINT.

Paper Wallets: These are physical documents that store the public and/or private keys for your cryptocurrency. ERC-20 compatible paper wallets can store MINT too.

When choosing the type of wallet, considerations should be based on factors like convenience, security, control over private keys, and whether the wallet is hot (online and connected to the internet) or cold (offline).

Should You Buy MINT?

MINT could be of interest to various types of cryptocurrency enthusiasts. However, whether the coin is suitable for a specific individual depends on their individual risk tolerance, investment strategy, and understanding of the cryptocurrency market. Here are some considerations:

Risk Tolerance: Cryptocurrencies, MINT included, are inherently volatile and carry a high level of risk. Those with a high risk tolerance might be more comfortable investing in MINT.

Investment Horizon: Users who have a long-term investment horizon might be more interested in MINT because it has potential for growth due to its recent market entry.

Technological Interest: MINT operates on the basis of an innovative approach to token liquidity. Those who are interested in the technical aspects of blockchain technology and new concepts in decentralized finance may be more likely to invest in MINT.

Diversification: Users looking to diversify their cryptocurrency portfolio might consider MINT. It's always wise to distribute risk across different assets rather than putting all the investment in a single asset.

If you're considering buying MINT tokens, here are some professional and objective pieces of advice:

- Conduct thorough personal research: Before investing in any cryptocurrency, make sure to do adequate research about its technological basis, performance, and market trends.

- Keep track of market news: Being aware of market developments and news about MINT specifically can help make better investment decisions.

- Understand the risks: It's critical to understand the uncertainty and volatility of the market. You should only invest money that you can afford to lose.

- Consult with a financial advisor: If you're not confident about your knowledge of the crypto market, it may be beneficial to confer with a financial advisor who understands cryptocurrencies.

Lastly, the fact that MINT's main founders are undisclosed could be a point of concern for some potential investors. Transparency is an essential aspect in the risky and rapidly evolving world of cryptocurrency, so it's important to take this into account within your decision-making process.

Conclusion

MINT, stands as a recent addition to the cryptocurrency arena. MINT aims to address token liquidity issues that often accompany the creation of decentralized tokens, using a smart contract to maintain price stability through an elastic supply model. At present, MINT can be exchanged on certain platforms like Uniswap and SushiSwap and stored in wallets like Metamask.

MINT's unique approach to solving liquidity concerns and enabling simpler token creation sets it apart from other cryptocurrencies. However, its relatively recent establishment in 2021 means there is a lack of long-term data available, which may pose uncertainties for potential investors. Moreover, the undisclosed identity of its main founders might lead to trust issues among potential users and investors.

The development prospect of MINT largely depends on its ability to effectively eliminate liquidity challenges and its acceptance by the larger crypto community. As with all cryptocurrencies, the potential for MINT to make money or appreciate will be determined by various factors, including market demand, inherent value, regulatory changes, and overall crypto market trends. Considering these factors, interested individuals should conduct thorough due diligence and possibly seek advice from financial advisors before investing.

FAQs

Q: What is MINT?

A: MINT is a utility token that powers the Trabzonspor Fan Token platform, giving holders exclusive fan-related features and benefits.

Q: What are the risks of investing in MINT?

A: MINT is a high-risk, high-reward investment, as it is a relatively new cryptocurrency with a low market capitalization and is not necessarily correlated with the performance of the Trabzonspor football club.

Q: Is MINT a good investment?

A: Whether or not MINT is a good investment depends on your individual investment goals and risk tolerance. Investors should only invest what they can afford to lose and should carefully consider all of the risks and potential rewards before investing.

Q: What is the future of MINT?

A: The future of MINT depends on a number of factors, including the overall market conditions, the adoption of MINT, and the development of new features and products on the Trabzonspor Fan Token platform. If the overall market conditions are favorable and MINT is widely adopted, then it is possible that MINT could have a bright future. However, it is also possible that MINT could lose value over time, especially if the overall market conditions are unfavorable or if MINT is not widely adopted.

Q: How can I protect my MINT investment?

A: The best way to protect your MINT investment is to store it in a secure wallet. Hardware wallets, such as the Ledger Nano S or X, are the most secure option. You should also be careful about where you trade and store your MINT. Only use reputable exchanges and wallets.

Risk Warning

Investing in cryptocurrencies requires an understanding of potential risks, including unstable prices, security threats, and regulatory shifts. Thorough research and professional guidance are advised for any such investment activities, recognizing these mentioned risks are just part of a wider risk environment.

MusicN User Reviews

MusicN News

ExchangeXRP and Shiba Inu (SHIB) in Focus: Is Latest $1,000,000,000 USDT Mint a Bear Market Turning Point?

According to Whale Alert, a fresh $1,000,000,000 $USDT mint has entered the crypto market today, lan

2026-02-07 02:00

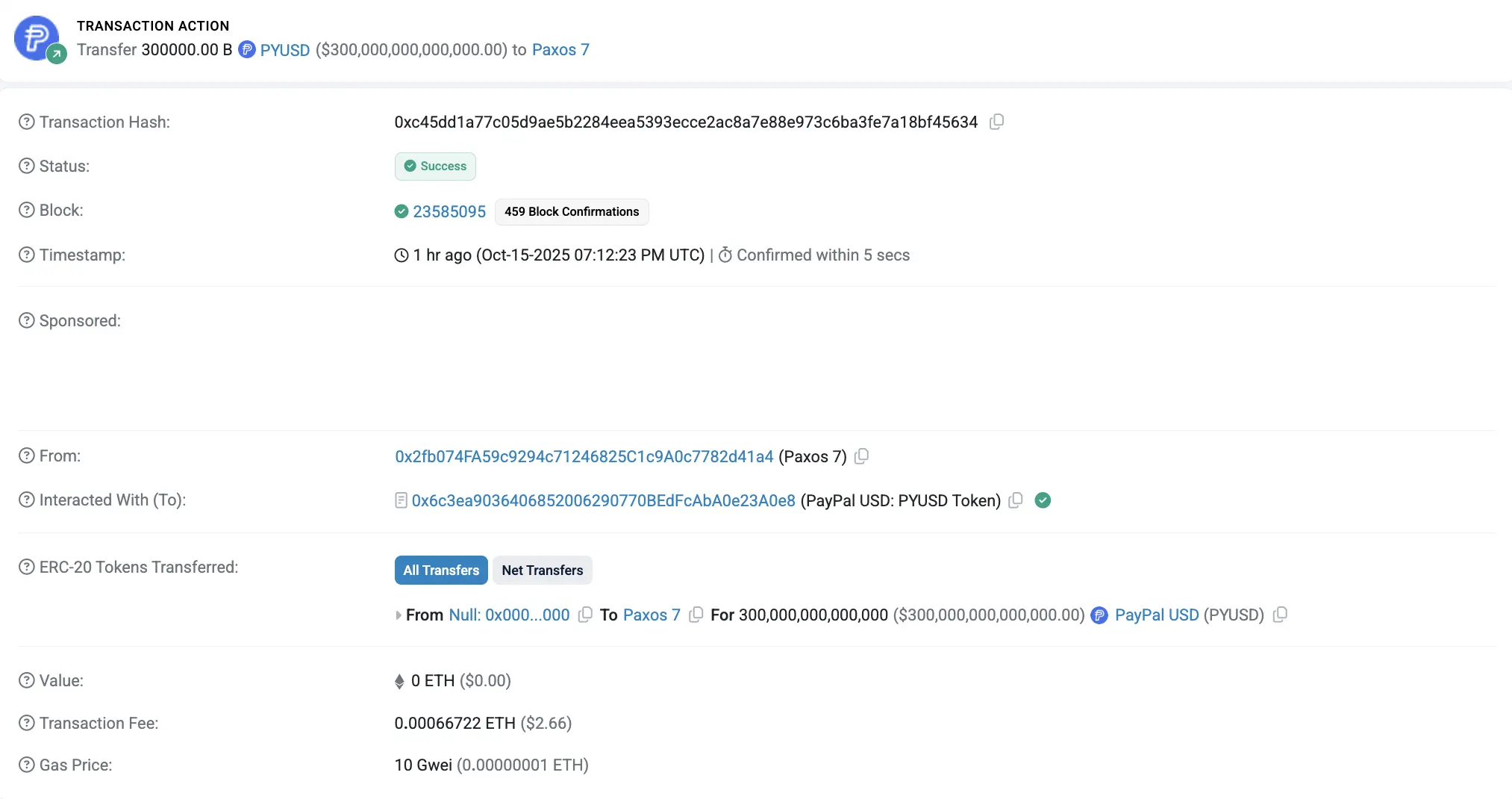

TokenAave freezes PYUSD markets after unprecedented 300T mint and burn

Blockchain data showed stablecoin issuer Paxos both minted and burned about $300 trillion worth of t

2025-10-16 05:01

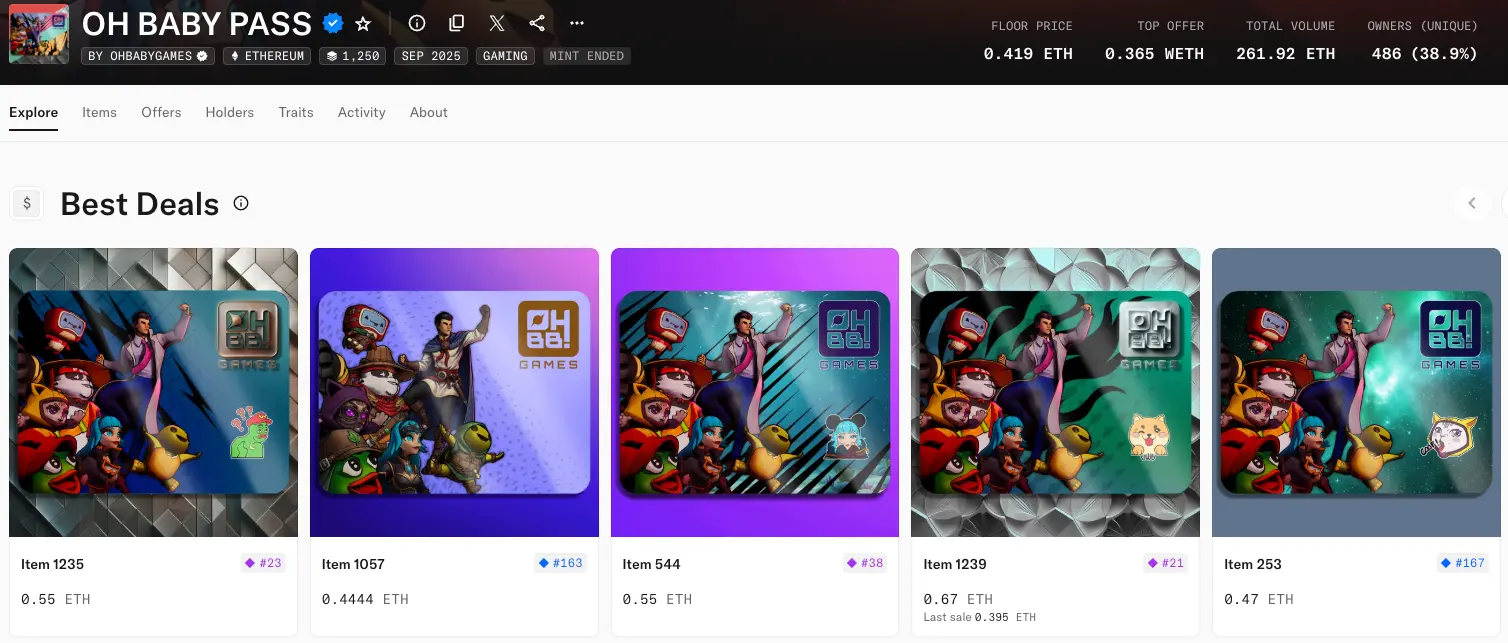

TokenOhBaby Games NFT Mint Offers GameFi Bulls a Glimmer of Hope

The past few years have not been kind to crypto gaming and GameFi investors, with most tokens and NF

2025-10-15 06:02

TokenUpbit Flags UXLINK Trading Warning Token As Hacker Gains Mint Role

Upbit, the largest Korean exchange, has listed UXLINK only hours after the web3 social media app rep

2025-09-23 15:03

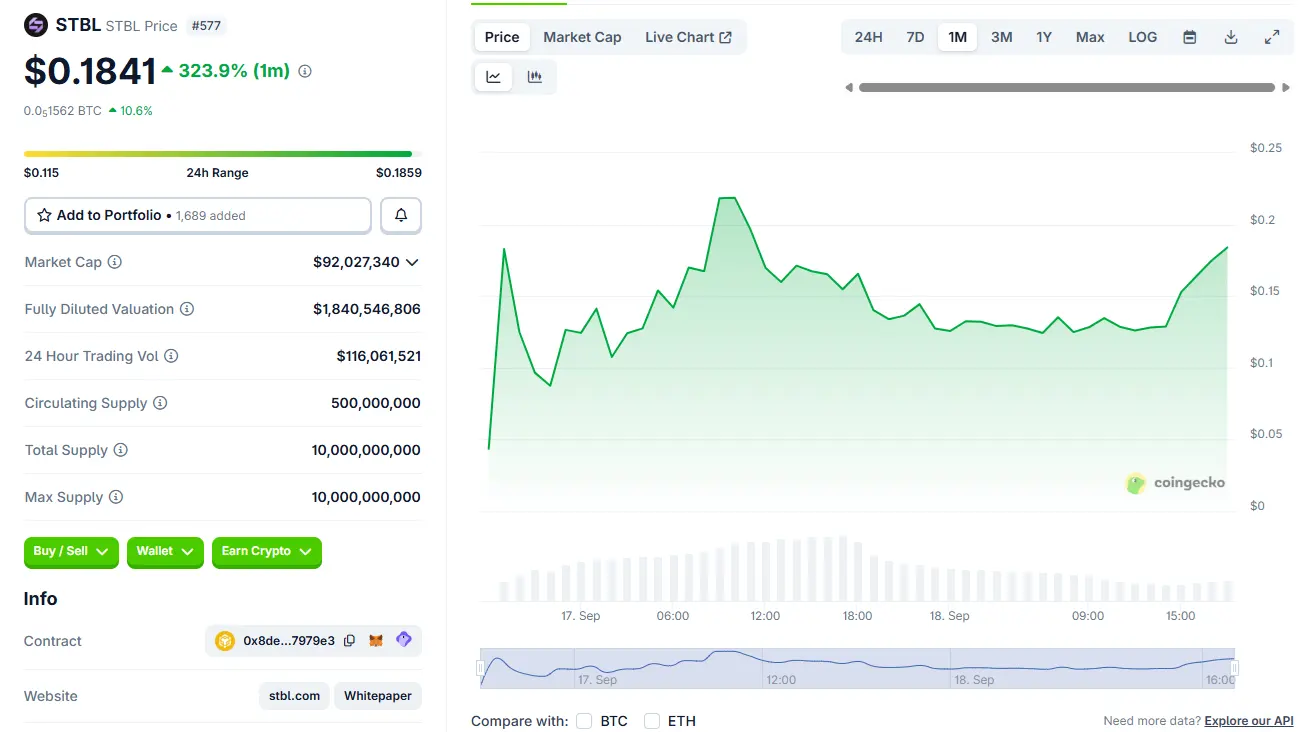

TokenFranklin Templeton joins STBL with $100M USST mint

Franklin Templeton is among the first to mint the new stablecoin USST issued by the STBL project. Th

2025-09-19 00:02

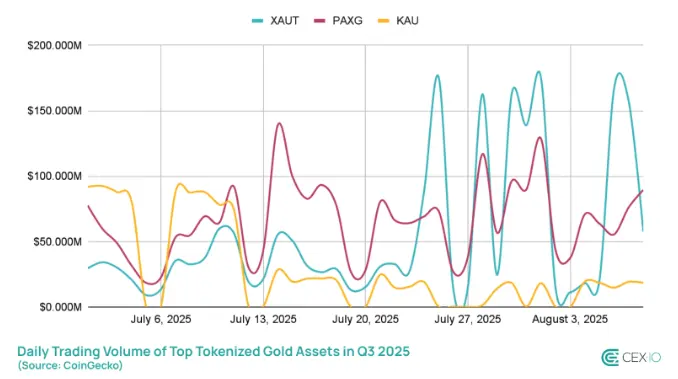

TokenTethers XAUT mint pushes tokenized gold supply up 20% in a day

Tethers XAUT overtook PAXG in market cap, becoming the biggest tokenized gold asset. SummaryTether m

2025-08-12 04:02

TokenMatt Furie NFTs Crater 97% After Mint Exploit

Artist Matt Furie, the creator of the Pepe the Frog meme, launched another NFT collection on June 17

2025-06-22 01:05

TokenFrom Free NFT Mint to Drinks at 7-Eleven: Rekt Is Reaching the Masses

Rektguy didnt mint out its free NFTs on the Ethereum blockchain in 2022—but three years later, the b

2025-06-21 23:21

Token$250M USDC Mint on Solana: MASSIVE Bull Run Incoming?

The $250M USDC Mint: A Major Blockchain EventOn June 6, 2025, Whale Alert reported the minting of $2

2025-06-07 21:04

10 ratings