BANK

$ 0.00 USD

$ 0.00 USD

$ 0.00 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

0.00 0.00 BANK

Bank Coin-related information

Issue Time

2018-05-15

Platform pertained to

--

Current coin price

0.00

Market Cap

$0.00USD

Volume of Transaction

24h

$0.00USD

Circulating supply

0.00BANK

Volume of Transaction

7d

$0.00USD

Change

24h

0.00%

Number of Markets

Crypto token price conversion

Current Rate0

0.00USD

WikiBit Risk Alerts

1WikiBit has marked the token as air coin project for we have received overwhelming complaints that this token is a Ponzi Scheme. Please be aware of the risk!

BANK Price Chart

Bank Coin introduction

Markets

Markets3H

0.00%

1D

0.00%

1W

0.00%

1M

0.00%

1Y

0.00%

All

0.00%

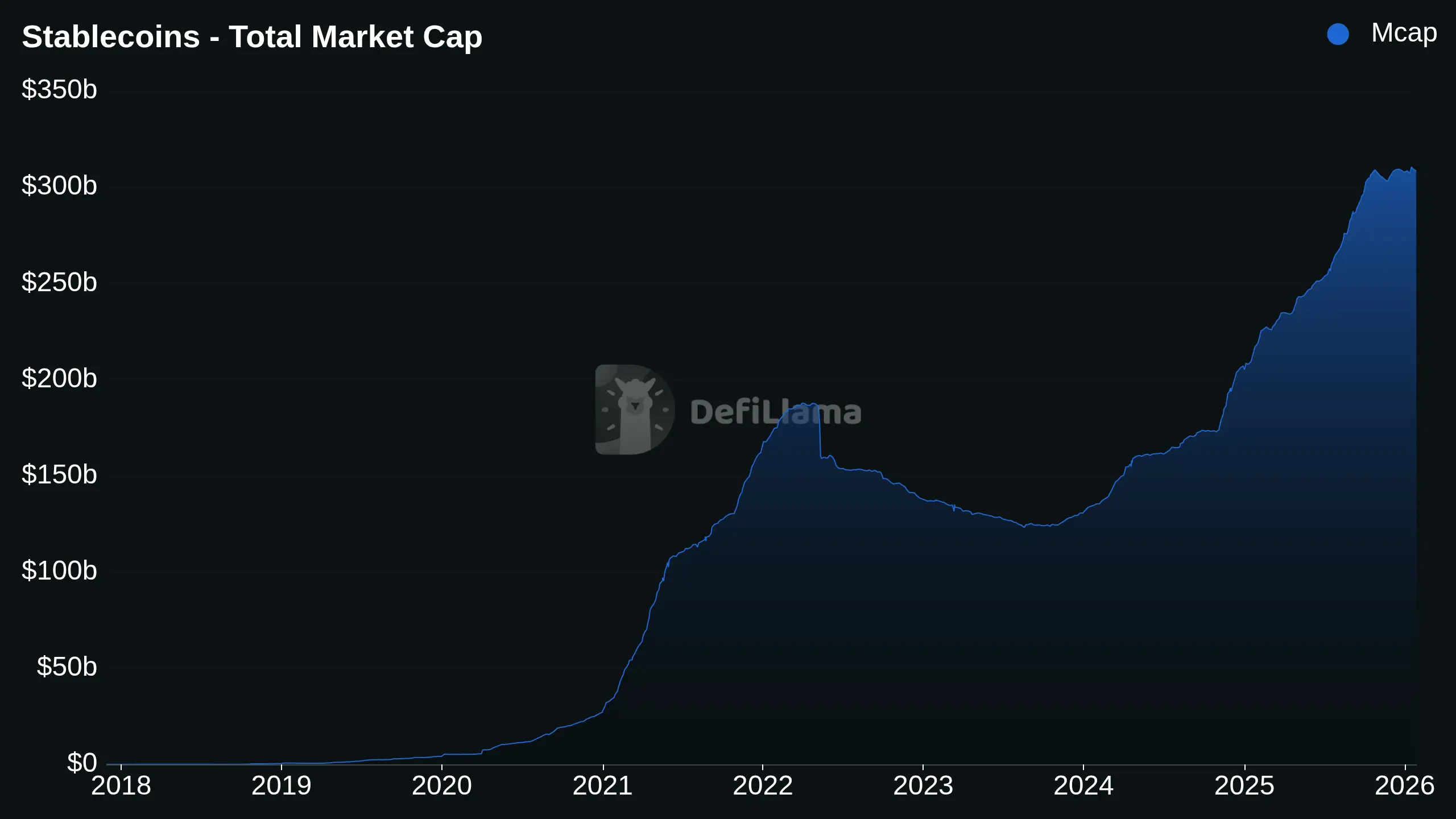

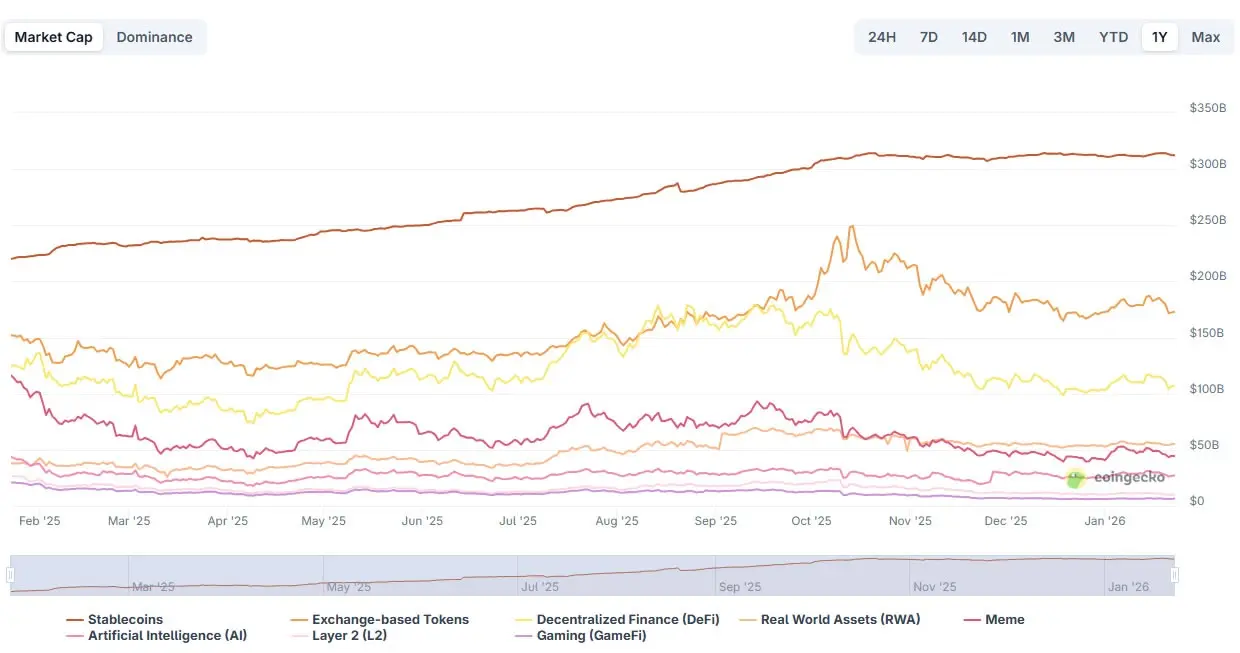

Bank Coin, as a term, is not directly associated with a specific cryptocurrency but rather can refer to a concept or category of digital assets within the financial sector. In the context of digital currencies, a “Bank Coin” could be considered a type of stablecoin, which is designed to maintain a stable value relative to an official currency or other assets, including crypto-assets .

Stablecoins, which could be referred to as Bank Coins in some contexts, play a significant role in the crypto-asset ecosystem due to their potential to provide liquidity and reduce the high price volatility often associated with unbacked crypto-assets such as Bitcoin and Ethereum . They are engineered to mitigate price volatility by pegging their value to a stable asset or a reserve of assets, which could include fiat currencies, commodities, or a combination of these .

However, the stability of these coins is not guaranteed, as demonstrated by events such as the crash of TerraUSD and the temporary de-pegging of Tether. These incidents highlight the importance of robust reserve asset management to instill confidence and ensure the stability of the peg, avoiding potential contagion effects on the financial system .

The growth and innovation of stablecoins, including any Bank Coin, have implications for financial stability. They are increasingly being used in payments and settlements, and their interlinkages with the traditional financial system are a concern for policymakers. As such, there is a call for the urgent implementation of effective regulatory, supervisory, and oversight frameworks to manage the potential risks .

Bank Coin User Reviews

Bank Coin News

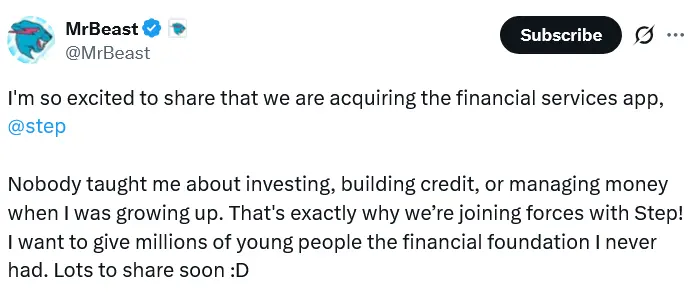

TokenMrBeast buys Gen Z bank just weeks after BitMine's $200M bet

Beast Industries, the entertainment company founded by YouTuber Jimmy “MrBeast” Donaldson, is acquir

2026-02-10 09:02

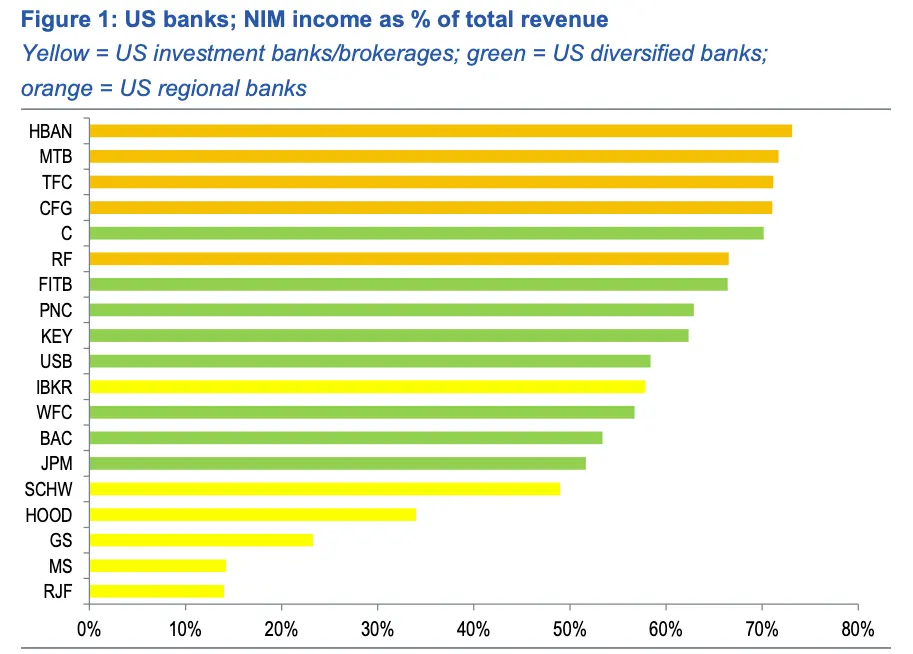

TokenBanks fear stablecoin ‘bank run,’ regulators see limited impact

Banks warn stablecoins — especially those paying yield — could pull deposits out of the banking syst

2026-01-28 23:02

ExchangeStablecoins are a real threat to bank deposits, says Standard Chartered

Stablecoins pose a real risk to bank deposits both globally and in the United States, according to a

2026-01-27 20:00

TokenRipple Secures Riyad Bank Deal to Boost Middle East Expansión

TL;DRRipple has signed a partnership with Jeel, a subsidiary of Riyad Bank, to explore blockchain ap

2026-01-27 00:02

TokenTrump-picked OCC head proceeds with consideration of WLF's bank charter

The Office of the Comptroller of the Currency has knocked back US Senator Elizabeth Warren‘s bid to

2026-01-24 11:03

TokenUS bank lobby sets stopping stablecoin yields as top 2026 priority

The American Bankers Association (ABA) has made cracking down on stablecoin yield a top priority for

2026-01-23 16:02

TokenCapital One bank buys stablecoin fintech Brex for $5.15B

Major US bank Capital One has struck a $5.15 billion deal to buy the fintech Brex and is set to acqu

2026-01-23 13:02

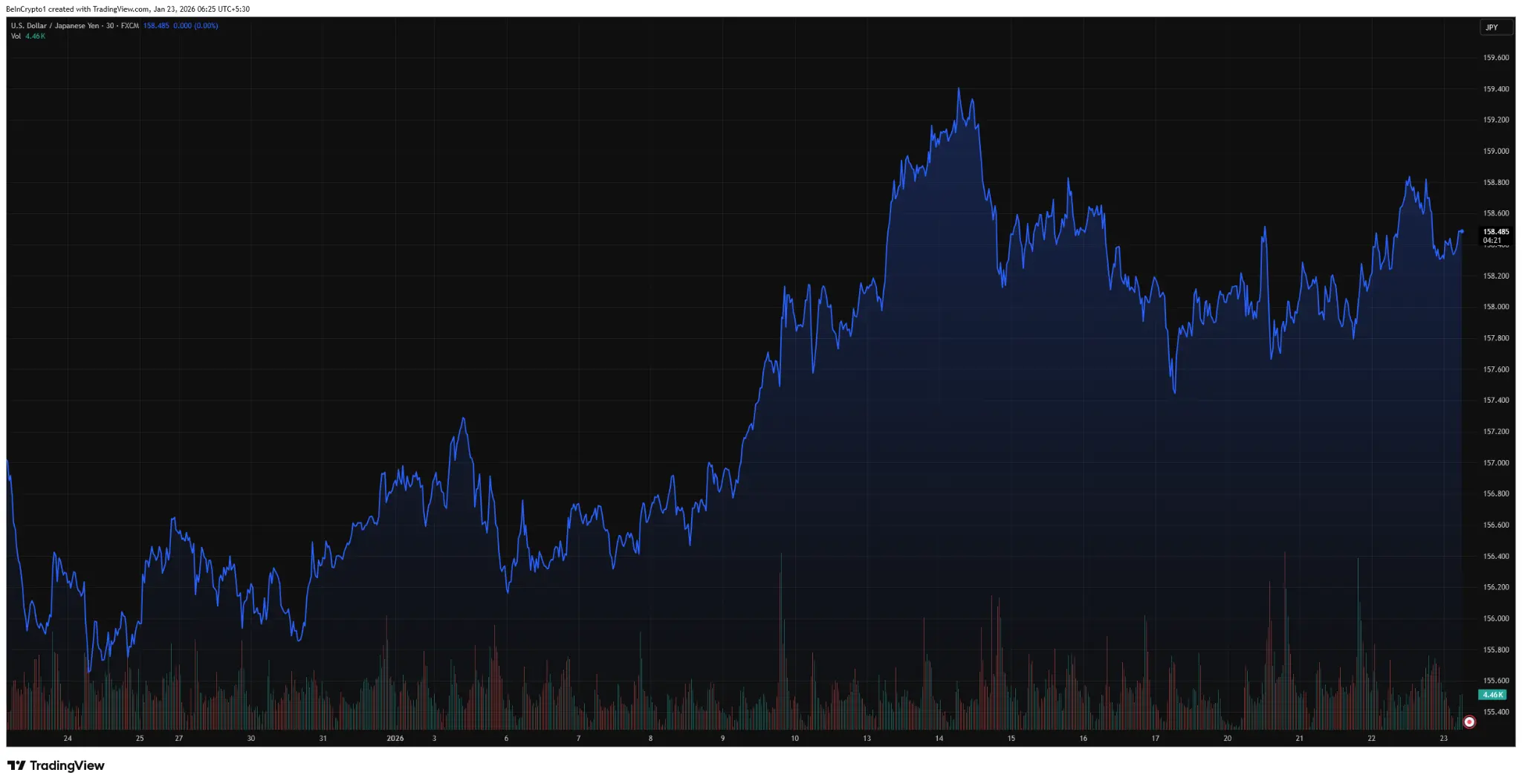

TokenBank of Japan Expected To Hold Rates, But Markets Seek Clues

The Bank of Japan (BoJ) is expected to leave its benchmark interest rate unchanged at 0.75% after co

2026-01-23 11:02

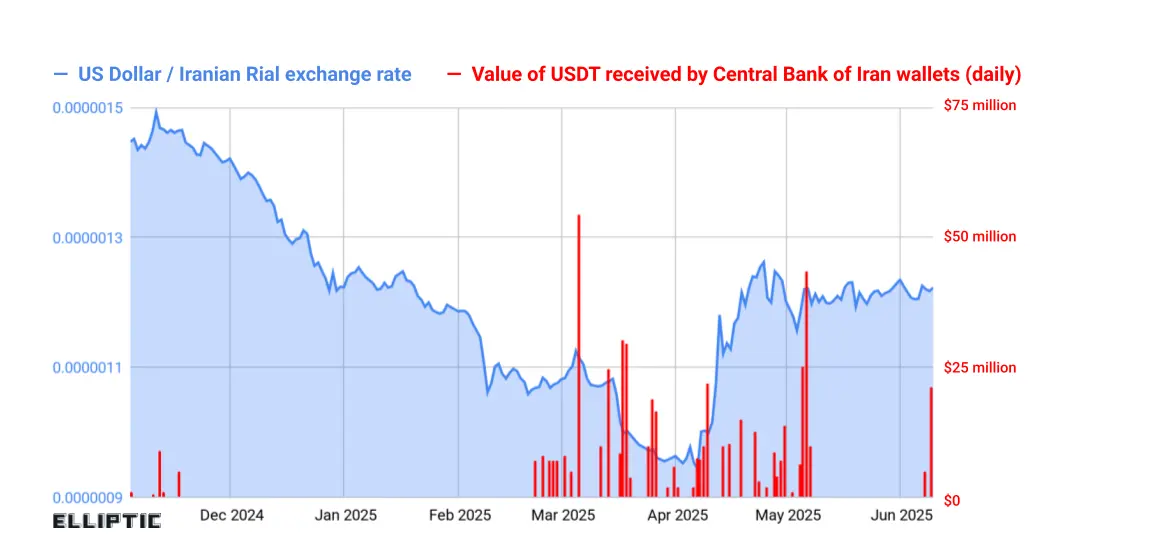

TokenIrans Central Bank Bought $500 Million in USDT Stablecoin to Prop Up Rial

Iran‘s Central Bank secretly purchased more than $500 million worth of Tether’s USDT stablecoin as t

2026-01-22 08:02

0 ratings