OCC

$ 0.2477 USD

$ 0.2477 USD

$ 87,370 0.00 USD

$ 87,370 USD

$ 0 USD

$ 0.00 USD

$ 77.59 USD

$ 77.59 USD

0.00 0.00 OCC

Occam.Fi-related information

Issue Time

2021-04-16

Platform pertained to

--

Current coin price

$0.2477USD

Market Cap

$87,370USD

Volume of Transaction

24h

$0.00USD

Circulating supply

0.00OCC

Volume of Transaction

7d

$77.59USD

Change

24h

+369.92%

Number of Markets

20

Crypto token price conversion

Current Rate0

0.00USD

WikiBit Risk Alerts

2WikiBit has marked the token as air coin project for we have received overwhelming complaints that this token is a Ponzi Scheme. Please be aware of the risk!

The number of the negative comments received by WikiBit have reached 7 for this token in the past 3 months, please be aware of the risk and the potential scam!

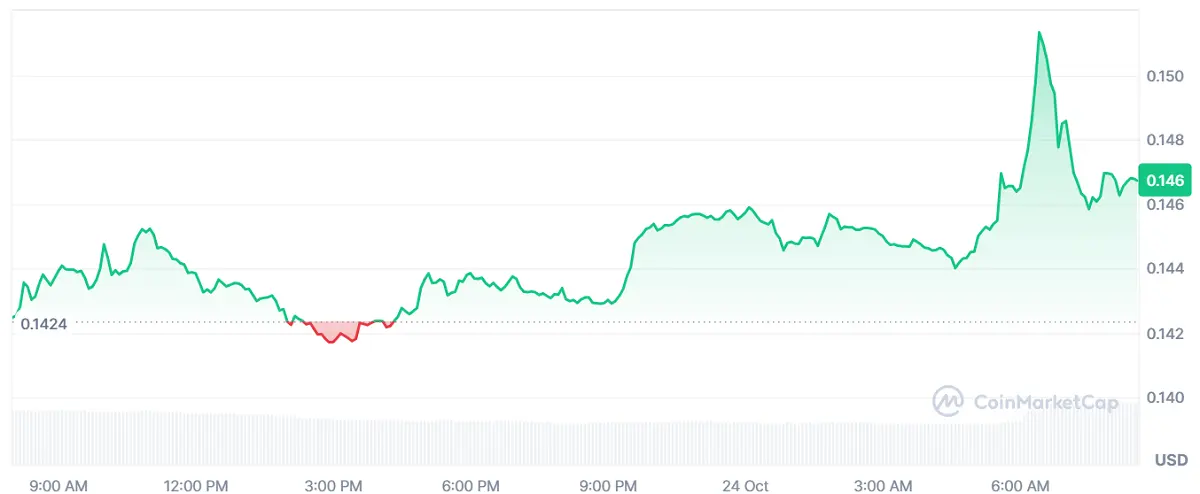

OCC Price Chart

Occam.Fi introduction

Markets

Markets3H

+385.87%

1D

+369.92%

1W

+367.09%

1M

+212.63%

1Y

+46.3%

All

-97.3%

| Aspect | Information |

|---|---|

| Short Name | OCC |

| Full Name | Occam.Fi |

| Founded Year | 2021 |

| Main Founders | Mark Berger |

| Support Exchanges | Gate.io, MEXC, Uniswap v2, LATOKEN, HitBTC, Bilaxy, OccamRazer, MuesliSwap, CardanoSwap, and SundaeSwap |

| Storage Wallet | Daedalus, Yoroi, ADALite, Nami |

| Customer Support | Medium: https://medium.com/occam-finance |

| Telegram: https://t.me/occamfi_com | |

| Reddit: https://www.reddit.com/user/OccamFi | |

| Discord: https://discord.com/invite/occamfi | |

| Twitter: https://twitter.com/OccamFi |

Overview of Occam.Fi (OCC)

Occam.Fi (OCC) is a decentralized finance (DeFi) platform and a suite of products, designed to work within the Cardano ecosystem. Named after philosopher William of Ockham, this crypto platform seeks to produce solutions that adhere to the principle of simplicity or “Occam's Razor”. It includes a launchpad (OccamRazer), a DEX (OccamX), and liquidity solutions (OccamDAO). It focuses on delivering a compliant, decentralized fundraising mechanism and seeks to provide services such as fair token sales and transparent listings. The OCC token is the native utility token of the Occam.Fi platform that users can stake, and use to participate in governance decisions.

To obtain more information, you can visit their website: https://occam.fi/ and try to log in or register to use more services.

Pros and Cons

| Pros | Cons |

|---|---|

| Operates within the Cardano Ecosystem | Reliant on Cardano's performance and infrastructure |

| Offers a range of DeFi products and services | Limited transparency regarding operations |

| Native OCC token has multiple uses | Market volatility can impact OCC's value |

| Focus on compliance and decentralized fundraising | Dependent on regulatory landscape and potential legal changes |

Pros:

Operates within the Cardano Ecosystem: OCC operates within the Cardano ecosystem, one of the main competitors to the Ethereum blockchain. This enables OCC to leverage Cardano's technical strengths and participating in its robust community.

Offers a range of DeFi products and services: Occam.Fi is not a standalone token, it's an entire suite of products including a launchpad, DEX (decentralized exchange), and liquidity solutions. This means investors in OCC are not just investing in a single product but a whole ecosystem of tools and applications.

Native OCC token has multiple uses: Apart from being a tradable asset itself, OCC is also utilized within the Occam.Fi ecosystem for staking and governance decisions, adding utility and value to the token beyond its market price.

Focus on compliance and decentralized fundraising: Occam.Fi makes it a point to focus on compliance, aiming to introduce secure decentralized fundraising mechanisms. This can help build trust and legitimacy around their platform and its operations.

Cons:

Reliant on Cardano's performance and infrastructure: As OCC is built on the Cardano platform, it's inevitably linked to Cardano's success and functionality. Any technical issues or loss of community favour towards Cardano can have a negative impact on OCC.

Limited transparency regarding operations: Although Occam.Fi has made it a focus to introduce compliance and secure fundraising mechanisms, some critics point to a lack of transparency around the platform's operations and team, which is a concern for potential investors.

Market volatility can impact OCC's value: Like all cryptocurrencies, OCC's price is subject to market fluctuations and can be highly volatile. This will lead to significant financial losses if not managed correctly.

Dependent on regulatory landscape and potential legal changes: As with all DeFi platforms, Occam.Fi exists in a space that is subject to evolving regulations and legal requirements. Changes in these areas can impact the platform's operations or legitimateness, and by extension, the value of the OCC token.

What Makes Occam.Fi (OCC) Unique?

Occam.Fi, denoted by the token OCC, distinguishes itself within the saturated realm of cryptocurrencies with its primary positioning as a DeFi suite of products that operate on the Cardano blockchain. While there are several DeFi platforms available, many of them function on the Ethereum blockchain. Occam.Fi belongs to a newer wave of DeFi protocols specifically built within the Cardano ecosystem, leveraging its proof of stake consensus mechanism and commitment to scientific philosophy and peer-reviewed research.

Two additional key features that differentiate Occam.Fi from other cryptocurrencies are its dedicated launchpad, OccamRazer, and its' comprehensive governance system. OccamRazer is designed to be a secure and efficient launchpad, enabling new projects to raise capital in a decentralized and compliant manner. The aim, as suggested by Occam.Fi, is to create a procedure deemed fairer to investors and project creators alike.

Meanwhile, through its DAO (Decentralized Autonomous Organization) structure, OCC token holders are permitted to have a say in the governance of the platform. They can propose, discuss, and vote on changes. Whereas a good number of cryptocurrencies offer some form of governance to their token holders, Occam.Fis commitment to decentralized control and decision-making again ties back to Cardano's philosophy of creating a more balanced and sustainable blockchain ecosystem.

How Does Occam.Fi (OCC) Work?

Occam.Fi operates as a suite of DeFi solutions specifically tailored for the Cardano ecosystem. It comprises of a few key components:

OccamRazer: This is a decentralized launchpad for Cardano-based projects. New projects can conduct initial decentralized offerings (IDOs), enabling them to raise capital in a decentralized and transparent manner.

OccamX: This is a DEX that allows for the trading of Cardano-native tokens. It operates on an automated market maker principle, where trading pairs can be created and liquidity can be supplied by the community, meaning there is no need for order books.

OccamDAO: It is a decentralized autonomous organization where token holders can propose, discuss and vote on changes to the Occam.Fi platform.

The overall principle guiding these components is Occam's Razor, a philosophy asserting that the simplest solutions are often the correct ones. This principle is implemented by Occam.Fi through its focus on delivering a compliant, transparent and user-friendly DeFi ecosystem.

The OCC token plays a key role in this ecosystem. It's used as a utility token to facilitate transactions across the platform, rewarding users for their participation. The token is also used for governance, permitting holders to vote on proposed changes to the platform. Additionally, the token can be staked, offering holders potential yield and additional voting power based on the size of their stake.

Like all DeFi platforms, Occam.Fi relies on the principles of cryptography, decentralization, transparency, and immutability of transactions to operate securely and efficiently.

Market & Price

The OCC token has experienced significant price fluctuations in recent months. Here's a closer look.

Current Price:

As of February 24, 2024, the price of OCC is $0.198667 USD.

Recent Trends:

Short-term: Over the past 24 hours, OCC has seen an increase of 8.78%. Over the past week, the price has remained relatively stable, with a slight increase of 3.51%.

Mid-term: Looking at the past month, OCC has risen by 19.23%. Over the past 3 months, OCC has been volatile, dropping 7.76% in the past 60 days while gaining 11.74% in the past 90 days.

Long-term: Compared to its all-time low of $0.1148 in June 2023, OCC has increased by 77.44%.

Exchanges to Buy Occam.Fi (OCC)

MEXC: MEXC is the current leading exchange for OCC trading volume, with a 24-hour trading volume exceeding $439.96. It offers OCC/USDT, OCC/BTC, and OCC/ETH trading pairs. See this link for details on how to buy OCC: https://www.mexc.com/how-to-buy/OCC.

Create a free account on MEXC Crypto Exchange via website or the app to buy Occam.Fi Coin.

Your MEXC account is the easiest gateway into buying crypto. But before you can buy Occam.Fi (OCC) , youll need to open an account and pass KYC (Verify Identification).

Choose how you want to buy the Occam.Fi (OCC) crypto tokens.

Click on the “Buy Crypto” link on the top left of the MEXC website navigation, which will show the available methods in your region.

Store or use your Occam.Fi (OCC) on MEXC.

Now that you bought your crypto, you can hold it in your MEXC Account Wallet or send it somewhere else via blockchain transfer. You can also trade for other crypto or stake it on MEXC Earning Products for passive income (Savings, Kickstarter).

Trade Occam.Fi (OCC) on MEXC.

Trading crypto such as Occam.Fi on MEXC is easy and intuitive. You only need to complete a few steps to execute a crypto trade.

Gate.io: Established and well-regarded, Gate.io boasts high liquidity for OCC, making it a popular choice for many investors. It offers three trading pairs: OCC/USDT, OCC/BTC, and OCC/ETH. See this link for details on how to buy OCC: https://www.gate.io/how-to-buy/occamfi-occ.

Step 1 - Create an Account on Gate.io

Create an account with Gate.io, or login to your existing Gate.io account.

Step 2 - Complete KYC & Security Verification

Ensure that you have completed KYC and security verification.

Step 3 - Choose your preferred method to buy OccamFi (OCC)

You can choose from Spot Trading, Onchain Deposit, and GateCode Deposit.

Step 4 - Purchase successful

Your OccamFi (OCC) is in your wallet now. If you havent received your crypto, you may visit the Help Centre or ask reach out to the customer service team by live chat.

LATOKEN: Known for its user-friendly interface and diverse coin selection, LATOKEN presents a convenient option for buying OCC. It offers OCC/USDT trading.

HitBTC: It offers OCC/BTC, OCC/USDT, and OCC/ETH trading pairs.

Bilaxy: Appealing to those who value a vast selection of altcoins, Bilaxy allows you to trade OCC/ETH.

Uniswap v2: Offering greater control over your funds and eliminating the need for KYC, Uniswap v2 provides an alternative approach to acquiring OCC. It features the OCC/WETH (Wrapped Ethereum) trading pair.

OccamRazer: It is Occam.Fi's home platform, allowing direct swaps between OCC, ADA, and other Cardano-based tokens with low fees.

CardanoSwap: It leverages automated market makers to facilitate swaps between OCC and other tokens.

SundaeSwap: A decentralized exchange built on the Cardano blockchain, offering OCC/ADA and OCC/wADA trading pairs.

MuesliSwap: Another DEX on Cardano, offering OCC/ADA and OCC/wADA trading pairs.

How to Store Occam.Fi (OCC)?

As an ADA and Cardano-based token, OCC can be stored in any wallet that supports the Cardano blockchain. The most popular options are Daedalus and Yoroi, which are official Cardano wallets designed specifically for storing ADA and other native assets like OCC.

Daedalus is a full node desktop wallet that gives users maximum security and control over their funds. Yoroi is a lightweight browser extension and mobile wallet focused on simplicity and ease of use. Both integrate seamlessly with tools like the OccamRazer DEX for trading OCC.

Third party wallets like ADALite and Nami can also store OCC, providing alternative interfaces and features. But Daedalus and Yoroi are likely the best choices for those primarily using OCC on Occam.Fi and Cardano.

Is It Safe?

The safety of any investment, including cryptocurrency, involves a complex interplay of various factors, and it's impossible to guarantee absolute security. There are some potential risks associated with OCC.

Volatility: The cryptocurrency market is inherently volatile, and the price of OCC can fluctuate significantly. This means there's a risk of losing money if you invest in OCC.

Exchange Security Risks: If you choose to buy OCC on a centralized exchange, there's a risk of the exchange being hacked or experiencing other security issues that lead to the loss of your tokens.

Project Risks: The success of OCC ultimately depends on the success of the Occam.Fi project. If the project fails to gain traction or encounters unforeseen challenges, the value of OCC will plummet.

Regulatory Risks: The regulatory landscape surrounding cryptocurrency is constantly evolving, and changes in regulations will negatively impact the OCC token.

How to Earn Occam.Fi (OCC)?

Staking:

Occam Staking: You can stake your OCC tokens on the Occam.Fi platform to earn rewards in the form of additional OCC tokens. The current APY (Annual Percentage Yield) for staking OCC varies depending on the lockup period you choose.

Third-party Platforms: Some cryptocurrency exchanges and DeFi platforms offer OCC staking with varying APYs.

Participating in Initial Decentralized Offerings (IDOs):

As the native token of the OccamRazer launchpad, OCC is required to participate in IDOs for new Cardano projects. By participating in these IDOs, you can acquire tokens from promising startups at an early stage.

Community Activities:

Occam.Fi occasionally runs community contests or giveaways where you can win OCC tokens. Keep an eye on their social media channels for announcements.

Providing Liquidity:

Some DeFi platforms allow you to earn rewards by providing liquidity for OCC trading pairs.

Conclusion

Occam.Fi (OCC) is a decentralized finance platform leveraging the capabilities of the Cardano ecosystem, offering a suite of products including a launchpad, decentralized exchange and a decentralized autonomous organization for governance. Its initiative to simplify and enhance DeFi on the Cardano blockchain underlies this cryptocurrency's unique positioning.

The development prospects of OCC hinge heavily on various factors such as the success of the Cardano ecosystem, its adoption rate, regulatory landscape, market conditions, and the growth and acceptance of decentralized finance as a whole. Under favorable conditions and successful project development, OCC can provide financial returns to its holders through appreciation in value, and through participation avenues like staking or governance-based incentives.

FAQs

Q: What is the core utility of the OCC token?

A: The OCC token is a utility token used within the Occam.Fi platform for transactions, staking, and participating in governance decisions.

Q: How does Occam.Fi integrate into the Cardano network?

A: Occam.Fi is constructed to work within the Cardano network, facilitating DeFi services and products for Cardano-based projects.

Q: What are some possible risks of investing in OCC?

A: Risks associated with investing in OCC include market volatility, dependence on the Cardano ecosystem's success, the regulatory environment, and potential transparency issues.

Q: Can I participate in the governance of the Occam.Fi platform?

A: Yes, OCC holders can participate in the governance of the Occam.Fi platform by casting votes on proposed changes.

Q: Who is Occam.Fi designed for?

A: Occam.Fi suits investors who understand the volatility and risks associated with cryptocurrency investments, have an interest in the Cardano ecosystem and the DeFi sector, and are willing to participate in platform governance.

Q: Is the value and success of OCC dependent on Cardano?

A: Yes, as OCC is a part of the Cardano ecosystem, its value and success are influenced by the performance, adoption, and infrastructure of the Cardano network.

Risk Warning

Investing in cryptocurrencies requires an understanding of potential risks, including unstable prices, security threats, and regulatory shifts. Thorough research and professional guidance are advised for any such investment activities, recognizing these mentioned risks are just part of a wider risk environment.

OCC Good investment market

- 1

Occam.Fi User Reviews

Occam.Fi News

TokenTrump-picked OCC head proceeds with consideration of WLF's bank charter

The Office of the Comptroller of the Currency has knocked back US Senator Elizabeth Warren‘s bid to

2026-01-24 11:03

ExchangeCrypto.com Files National Trust Bank Charter Application with US OCC

Key NotesThe Singapore-based platform seeks federal oversight to avoid fragmented state-level bankin

2025-10-25 01:01

TokenErebor Bank Wins OCC Approval: Tech Billionaires Launch Crypto-Friendly Bank

The Office of the Comptroller of the Currency (OCC) approved the national charter for the Columbus,

2025-10-16 16:02

TokenOCC, Fed, FDIC publish joint guidance for banks offering crypto custody

The Office of the Comptroller of the Currency (OCC), the Federal Reserve Board (Fed), and the Federa

2025-07-15 11:01

ProjectOCC Confirms US Banks Can Offer Crypto Custody Services to Customers

The US Office of the Comptroller of the Currency (OCC) has confirmed that banks can provide crypto c

2025-05-08 08:07

Industry Acting CoC Hsu: More crypto regulation is needed

Acting Comptroller of the Currency Michael Hsu ponders Glass-Steagall in the context of crypto.

2021-11-05 21:15

NewsUS Regulators Looking at How Banks Could Hold Crypto Assets: Report

Jelena McWilliams, Chair of the Federal Deposit Insurance Corporation (FDIC), said banks should be allowed into the space while appropriately mitigating risk.

2021-10-27 12:14

NewsUS Crypto Regulation: Report Says Biden Likely To Deploy Executive Orders Soon

The US Cryptocurrency industry is about to become the target of Biden’s 65th executive order since becoming president in January, a recently released report by Bloomberg suggests.

2021-10-13 12:15

NewsTexas Senator Ted Cruz Opposes Biden's Anti-Crypto OCC Pick

Saule Omarova will be there to make life harder for the cryptocurrency industry and big banks

2021-09-29 10:49

8 ratings