BEAR

$ 0.00 USD

$ 0.00 USD

$ 0.00 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

0.00 0.00 BEAR

3X Short Bitcoin Token-related information

Issue Time

2000-01-01

Platform pertained to

--

Current coin price

0.00

Market Cap

$0.00USD

Volume of Transaction

24h

$0.00USD

Circulating supply

0.00BEAR

Volume of Transaction

7d

$0.00USD

Change

24h

0.00%

Number of Markets

Crypto token price conversion

Current Rate0

0.00USD

WikiBit Risk Alerts

1WikiBit has marked the token as air coin project for we have received overwhelming complaints that this token is a Ponzi Scheme. Please be aware of the risk!

BEAR Price Chart

3X Short Bitcoin Token introduction

Markets

Markets3H

0.00%

1D

0.00%

1W

0.00%

1M

0.00%

1Y

0.00%

All

0.00%

| Aspect | Information |

| Short Name | BEAR |

| Full Name | 3X Short Bitcoin Token |

| Founded Year | 2019 |

| Main Founders | Amun AG |

| Support Exchanges | FTX, Binance |

| Storage Wallet | Metamask, TrustWallet |

Overview of BEAR

BEAR, also known as the 3X Short Bitcoin Token, is a type of cryptocurrency that was founded in 2019 by Amun AG. It is a unique kind of crypto token that was designed to inversely track Bitcoin's price movements on a daily basis, aiming for triple inverse performance. This means that if Bitcoin's value decreases by 1%, the value of BEAR should approximately increase by 3%, making it an attractive option for traders who anticipate a drop in Bitcoin's price. It's important to note, however, that this type of leveraged performance is recalculated daily, which can lead to compounding effects where the performance of BEAR over periods longer than one day can diverge significantly from a -3x multiple of Bitcoin's performance. BEAR can be traded on significant exchanges such as FTX and Binance, and it can be stored in wallets like Metamask and TrustWallet.

Pros and Cons

| Pros | Cons |

| Potential for profit during Bitcoin downturns | Daily leverage can lead to compounding effects |

| Can be traded on major exchanges | High-risk involvement due to leverage |

| Reputable founding team - Amun AG | Not suitable for inexperienced traders |

| Storage in popular wallets (Metamask, TrustWallet) | Performance can significantly diverge from -3x multiple of Bitcoin's performance over more than a day |

Pros:

Potential for profit during Bitcoin downturns: Since BEAR is designed to inversely track Bitcoin's price movements on a daily basis, aiming for triple inverse performance, it presents a unique opportunity to generate profits when Bitcoin's price goes down.

Can be traded on major exchanges: Availability on significant exchanges such as FTX and Binance increases its accessibility for traders and investors, providing more opportunities for buying, selling, and trading the token.

Reputable founding team - Amun AG: Founded by a credible and experienced organisation, Amun AG which has a wide range of other successful cryptocurrency ventures, increasing the trustworthiness of the BEAR token.

Storage in popular wallets (Metamask, TrustWallet): The possibility to store BEAR token in widely-used and trusted digital wallets like Metamask and TrustWallet gives users a practical and safe way to manage their tokens.

Cons:

Daily leverage can lead to compounding effects: While the prospect of daily leverage can be enticing, it can also amplify losses due to market volatility and price fluctuations.

High-risk involvement due to leverage: With the potential for high returns comes high risk, particularly because of the leverage involved in the pricing mechanism of BEAR. This high level of risk may not be suitable for all investors.

Not suitable for inexperienced traders: Trading in BEAR requires a deep understanding of the cryptocurrency market and trading principles. Therefore, it might not be the best choice for novice traders or those who do not fully understand the implications of inverse tracking and leverage.

Performance can significantly diverge from -3x multiple of Bitcoin's performance over more than a day: While it aims to give triple inverse performance of Bitcoin's price movements on a daily basis, its performance can significantly deviate from the -3x of Bitcoin's performance over periods longer than one day. This could lead to unexpected results for holders of the BEAR token.

What Makes BEAR Unique?

One distinct factor that sets BEAR apart from many other cryptocurrencies is its structure as an inverse and leveraged token. Unlike typical cryptocurrencies that rise in value as their underlying asset or market increases, BEAR is designed to increase in value when Bitcoin's price falls, thereby giving investors an opportunity to profit from Bitcoin's price downturns.

Moreover, it aims to deliver triple the opposite return of Bitcoin's daily performance. This means that instead of merely moving in the opposite direction of Bitcoin, it moves in a magnified manner, a concept quite unique to BEAR and a few other tokens.

However, it's worth noting that this innovative character of providing leveraged inverse returns also comes with compounded risks. The daily resetting of leverage can lead to significant deviations from the expected return over longer periods, especially in volatile markets. This unpredictability, high risk and potential for high rewards differentiate the BEAR token from the stable-value model adopted by traditional cryptocurrencies.

Furthermore, the creation of BEAR involves contractually selling Bitcoin short, which is an advanced financial concept seldom seen in many conventional digital currencies. Although this does invoke a higher-risk profile, it provides a different method for traders to speculate on the price movements of Bitcoin, illustrating the versatility and diversity of strategies in the cryptocurrency space.

How Does BEAR Work?

BEAR functions as a leveraged and inverse token, which means it's designed to provide the opposite return of Bitcoin's daily performance at a multiplied rate. The primary objective of BEAR is to deliver three times the inverse (i.e., -3x) daily return of Bitcoin. In simple terms, if Bitcoin's value goes down by 1% in a day, ideally, the value of BEAR should go up by approximately 3% that day.

To achieve these inverse returns, BEAR employs a practice known as short selling. Essentially, the BEAR token is contractually selling Bitcoin short, betting that the price of Bitcoin will fall. If the price of Bitcoin does indeed decrease, BEAR's value should increase by three times the percentage decrease, offering traders an opportunity to profit from falling Bitcoin prices.

However, it should be noted that this leverage is recalculated on a daily basis due to its nature as a daily traded product. This implies that the underlying exposure and performance of BEAR token can vary greatly when held for periods longer than one day because of the 'compounding' effect, causing potential divergence from the expected -3x multiple of Bitcoin's performance.

Lastly, like most digital tokens, BEAR operates on blockchain technology which underlies all cryptocurrencies. This technology allows for secure, transparent transactions and helps avoid issues such as double-spending or fraud.

Circulation of BEAR

Price fluctuation

3X Short Bitcoin Token (BEAR) is a leveraged cryptocurrency, which means that it is designed to amplify the price movements of Bitcoin. This means that BEAR is more volatile than Bitcoin and its price can fluctuate wildly, both up and down.

For example, if the price of Bitcoin increases by 10%, then the price of BEAR is expected to increase by 30%. However, if the price of Bitcoin decreases by 10%, then the price of BEAR is expected to decrease by 30%.

This volatility can make it difficult for investors to predict the value of BEAR and can lead to significant losses.

Mining cap

BEAR is a token on the Ethereum blockchain and does not have a mining cap. This means that there is no limit to the number of BEAR tokens that can be created.

This lack of a mining cap can lead to inflation, which can erode the value of BEAR over time.

Exchanges to Buy BEAR

BEAR is supported by a variety of cryptocurrency exchanges. Here are 10 exchanges where BEAR is listed, along with the token/currency pairs they offer:

FTX: This exchange is well-known for offering a wide range of leveraged tokens including BEAR. The token pairs supported include BEAR/USD.

Binance: One of the biggest and most popular exchanges globally that lists BEAR. The token pairs available include BEAR/BTC, BEAR/BNB, and BEAR/USDT.

Kraken: This U.S. based exchange supports BEAR with several pairs such as BEAR/USD, BEAR/EUR, and BEAR/BTC.

Bitfinex: Known for a wide range of cryptocurrencies, BEAR can be traded in Bitfinex with the token pairs such as BEAR/USD and BEAR/USDT.

CoinEx: BEAR token can be traded in CoinEx exchange with BEAR/BTC and BEAR/ETH pairs.

OKEx: This exchange supports BEAR and offers pairs like BEAR/USD, BEAR/USDT, and BEAR/BTC.

Poloniex: This exchange lists BEAR and offers pairs like BEAR/USDC and BEAR/BTC.

HitBTC: On HitBTC, the BEAR token can be traded with the BEAR/BTC, BEAR/ETH, and BEAR/USDT pairs.

KuCoin: KuCoin also supports the BEAR token. The available currency pairs include BEAR/BTC and BEAR/USDT.

Bibox: Bibox includes the BEAR token in its listings. The available token pairs include BEAR/BTC, BEAR/ETH, and BEAR/USDT.

Please note that the availability of certain pairs can depend on the user's location and the exchange's specific rules. Always check with the exchange for the most accurate and up-to-date information.

How to Store BEAR?

As a type of cryptocurrency, the BEAR token is digital and doesn't require a physical medium for storage. Instead, it can be stored in various types of digital wallets.

Here are the different types of wallets where you can store the BEAR token:

Software Wallets (Desktop/Mobile):

1. Metamask: A well-regarded Ethereum-based wallet that has both browser plug-in and mobile versions. It offers a simple and practical way of managing the BEAR tokens and interacting with Ethereum-based DApps.

2. MyEtherWallet: A free, open-source, client-side Ethereum and ERC20 tokens interface which is widely used in the crypto community.

3. TrustWallet: An easy-to-use, secure multi-coin wallet which supports all Ethereum ERC20 and ERC721 tokens. It also has a mobile version for both Android and iOS.

4. Atomic Wallet: A desktop wallet that supports multiple cryptocurrencies including the BEAR token.

Hardware Wallets:

1. Trezor: It's a hardware wallet, providing high-level security without sacrificing convenience. The main advantage of Trezor over software wallets is that it stores the private keys offline, hence not susceptible to hacking or malware.

2. Ledger: A popular multi-currency hardware wallet supporting a wide range of cryptocurrencies, ensuring cold storage of private keys.

Web-based Wallets:

1. MetaMask (As a browser extension): Just as mentioned above, this wallet has a browser plug-in version that lets users manage the BEAR tokens and interact with Ethereum-based DApps directly from the browser.

While these wallets allow you to store the BEAR token, it's always recommended to do thorough research before storing any large amount of cryptocurrency. Ensure the necessary security measures are in place like two-factor authentication, strong passwords, and keeping your private keys secure.

Should You Buy BEAR?

Buying BEAR tokens may be suitable for a specific group of cryptocurrency traders with an understanding of leveraged products and a risk tolerance that aligns with the high level of financial risk associated with them. These individuals should preferably have experience in dealing with advanced financial instruments, have a comprehensive understanding of the cryptocurrency market, and are able to endure the risk of potential substantial losses.

Those considering buying BEAR should keep in mind the following:

1. Understanding of Market Anticipation: As BEAR's performance is inherently tied to the value of Bitcoin, albeit inversely, potential investors should possess an understanding of Bitcoin's market behavior and be able to predict or anticipate price fluctuations.

2. Risk Tolerance: Due to its leveraged nature, the BEAR token can present substantial risk. While these tokens can provide significant returns when the market is in your favor, they can also lead to considerable losses if the market moves against your position. Therefore, potential investors should assess their risk tolerance levels.

3. Expertise with Leveraged Tokens: Leveraged tokens are complex financial instruments and may not be suitable for beginners or those who do not fully understand their principles.

4. Hold Term: Given that BEAR tokens' leverage is rebalanced daily, these are generally not recommended for long-term holding. If the leverage were to reset at a time when the price of Bitcoin is increasing, it may lead to considerable losses.

5. Regular Monitoring: Due to the high risk associated with BEAR, those who invest in it should monitor their investment regularly. Markets can shift quickly, and what was a profitable investment one day can rapidly become a significant loss.

6. Reliable Information Sources: Potential buyers should regularly follow reliable sources of information and news regarding Bitcoin's trend as it directly affects BEAR's performance.

Before making any investments, it is always recommended to thoroughly research, possibly seek advice from financial advisors, and never invest money that you cannot afford to lose.

Conclusion

BEAR, short for 3X Short Bitcoin Token, is a unique kind of cryptocurrency developed by Amun AG in 2019. It stands out from traditional cryptocurrencies in its structure as an inverse and leveraged token, designed to inversely track Bitcoin's daily price movements at a triple rate. Essentially, it aims to increase in value when Bitcoin's price falls, providing a distinct opportunity for traders to profit during Bitcoin downturns.

Regarding the development prospects of BEAR, there are a few factors to consider. As a leveraged and inverse token, its future is intrinsically tied to Bitcoin's price trends. Rising interest in these alternative forms of investment vehicles might benefit BEAR's future growth and adoption. However, the inherent volatility of cryptocurrencies coupled with BEAR's leverage makes it highly unpredictable, adding substantial risk in addition to its potential rewards.

It's plausible that individuals can make money or see appreciation in their BEAR investment, particularly if they successfully anticipate downturns in the Bitcoin market. However, this isn't guaranteed. The leveraged nature and daily rebalancing of BEAR imply that profit-making is largely dependent on short-term moves in Bitcoin's price.

All in all, while the innovative concept of BEAR presents a unique investment opportunity in the cryptocurrency landscape, it comes with heavy risk and requires a deep understanding of the market. Therefore, potential investors should thoroughly research, evaluate their risk tolerance level, and possibly consult with a financial advisor before investing in it.

FAQs

Q: What type of cryptocurrency is BEAR?

A: BEAR is a type of leveraged and inverse token that's designed to track Bitcoin's daily price movements in reverse at a tripled rate.

Q: How does BEAR's value change in relation to Bitcoin's price?

A: BEAR is engineered to increase in value by about 3% for every 1% drop in the price of Bitcoin, and vice versa.

Q: Where can I buy and trade BEAR tokens?

A: BEAR tokens can be purchased and traded on several well-known exchanges, including FTX, Binance, and Kraken, among others.

Q: Is it possible to store BEAR tokens in a digital wallet?

A: Yes, BEAR tokens can be stored in a variety of digital wallets, including Metamask, TrustWallet, and hardware wallets like Trezor and Ledger.

Q: What level of risk is associated with investing in BEAR tokens?

A: Investing in BEAR tokens, given their leveraged nature and potential for high returns, is associated with a high level of risk.

Q: Is BEAR a good investment for inexperienced cryptocurrency traders?

A: BEAR might not be an ideal choice for novice traders due to the complexity of understanding inverse tracking and the use of leverage involved in the BEAR token.

Q: How does the performance of BEAR deviate when held for longer periods?

A: The performance of BEAR can strongly vary from a -3x multiple of Bitcoin's performance over periods longer than a day due to the daily recalculation of leverage.

Q: What makes BEAR unique from traditional cryptocurrencies?

A: BEAR is unique in that it is structured as a leveraged and inverse token, offering an opportunity for traders to profit during Bitcoin downturns instead of rising in value as their underlying asset or market increases.

Q: What factors should be considered when investing in BEAR?

A: When investing in BEAR, factors to consider include understanding of market dynamics, risk tolerance, expertise in leveraged products, investment terms, need for regular monitoring, and access to reliable information sources.

Q: What is the potential for making profits with BEAR tokens?

A: The potential for profit with BEAR tokens exists mainly during Bitcoin downturns, but such profitability is not guaranteed due to the high volatility and risk involved.

Risk Warning

Investing in cryptocurrencies requires an understanding of potential risks, including unstable prices, security threats, and regulatory shifts. Thorough research and professional guidance are advised for any such investment activities, recognizing these mentioned risks are just part of a wider risk environment.

3X Short Bitcoin Token User Reviews

3X Short Bitcoin Token News

TokenHow Severe Is This Bitcoin Bear Market and Where Is Price Headed Next?

Bitcoin recently experienced a sharp sell-off that nearly dragged the price down to the $60,000 leve

2026-02-08 12:02

ExchangeXRP and Shiba Inu (SHIB) in Focus: Is Latest $1,000,000,000 USDT Mint a Bear Market Turning Point?

According to Whale Alert, a fresh $1,000,000,000 $USDT mint has entered the crypto market today, lan

2026-02-07 02:00

TokenDogecoin (DOGE) Sinks To $0.08 Amid Relentless Bear Pressure

Dogecoin started a fresh decline below the $0.10 zone against the US Dollar. $DOGE is now consolidat

2026-02-06 13:02

ExchangeBitcoin slides toward $70,000 as on-chain data flags bear market and traders bet Fed holds in April: Asia Morning Briefing

Good Morning, Asia. Here's what's making news in the markets:Welcome to Asia Morning Briefing, a dai

2026-02-05 11:54

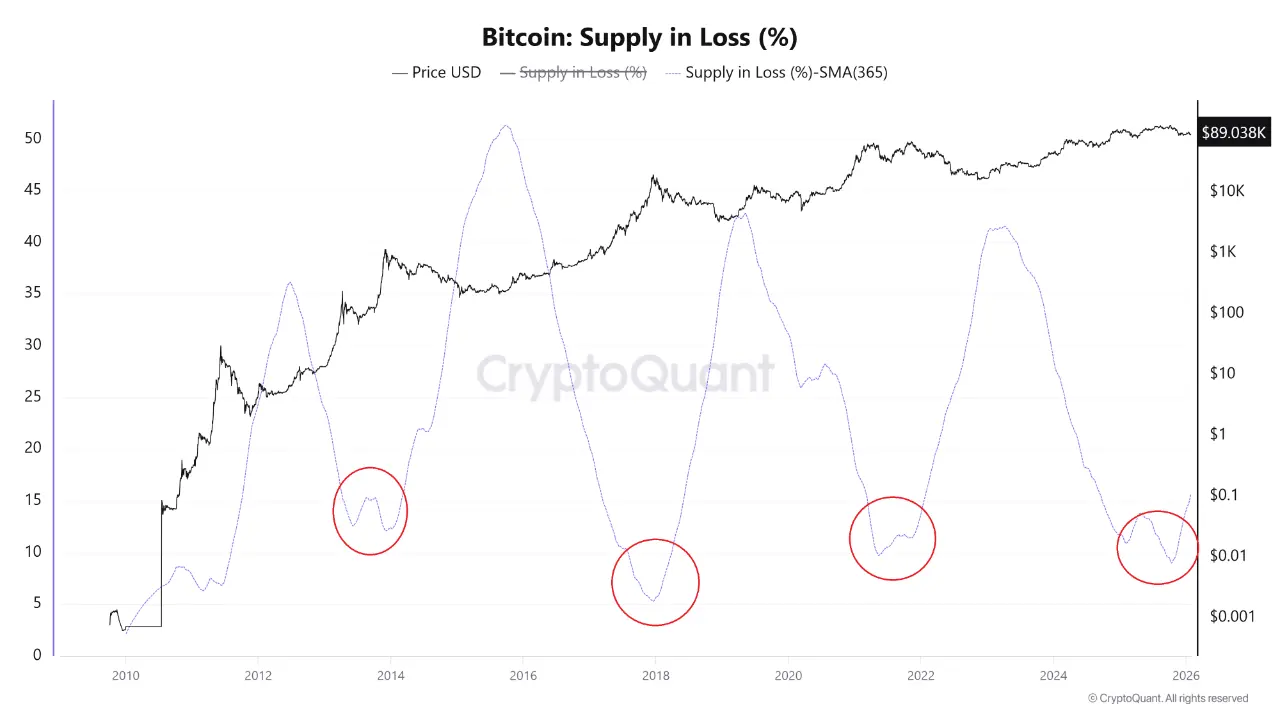

TokenBitcoin Bear Market Signal Emerges: Supply in Loss Rises Above 40%

Bitcoin slipped below the $80,000 level over the weekend as selling pressure intensified across glob

2026-02-03 13:02

TokenHyperliquid Price Surges: Why HYPE is Defying the 2026 Crypto Bear Market

The cryptocurrency market in early 2026 has been characterized by significant volatility, with $Bitc

2026-02-03 05:01

ExchangeInstitutions call it a bear market but still say Bitcoin is undervalued

In a global investor survey from Coinbase Institutional and Glassnode, 1 in 4 institutions agreed th

2026-02-02 03:01

TokenBitcoin Supply In Loss Turns Upward—Early Bear Market Signal?

On-chain data shows the Bitcoin Supply in Loss indicator has witnessed a shift in direction that has

2026-01-29 07:03

TokenZcash Bear Trap Active After 15% Rebound: Whats Next for ZEC Price?

The Zcash price has done something important after weeks of weakness. Since January 19, the ZEC pric

2026-01-25 06:02

2 ratings