RATIO

$ 0.00 USD

$ 0.00 USD

$ 0.00 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

0.00 0.00 RATIO

Ratio Finance-related information

Issue Time

2022-08-17

Platform pertained to

--

Current coin price

0.00

Market Cap

$0.00USD

Volume of Transaction

24h

$0.00USD

Circulating supply

0.00RATIO

Volume of Transaction

7d

$0.00USD

Change

24h

0.00%

Number of Markets

Crypto token price conversion

Current Rate0

0.00USD

WikiBit Risk Alerts

1WikiBit has marked the token as air coin project for we have received overwhelming complaints that this token is a Ponzi Scheme. Please be aware of the risk!

RATIO Price Chart

Ratio Finance introduction

Markets

Markets3H

0.00%

1D

0.00%

1W

0.00%

1M

0.00%

1Y

0.00%

All

0.00%

| Aspect | Information |

|---|---|

| Short Name | RATIO |

| Full Name | Ratio Finance |

| Founded Year | 2021 |

| Support Exchanges | Uniswap, SushiSwap, Balancer etc. |

| Storage Wallet | Any Wallet that Supports Ethereum based Tokens (Most likely options: MetaMask, Trust Wallet, Ledger) |

Overview of Ratio Finance(RATIO)

Ratio Finance (RATIO) is a blockchain-based cryptocurrency and decentralized finance (DeFi) platform. It is designed to operate as an automated market maker (AMM) focusing on offering options, futures, and swap trading in addition to yield farming opportunities in a single location. As a crypto token, RATIO facilitates transactions within its ecosystem and serves as a means for earning rewards and influencing governance decisions within the Ratio Finance network.

RATIO is built on the Ethereum blockchain, leveraging the security, immutability, and decentralization benefits of this network. It utilizes various Smart Contracts to automate operations, ranging from trading to liquidity provision. It's essential to note that, like any cryptocurrency, RATIO carries market risk and should be considered alongside other investment strategies. Wallet holders can store, receive, send or stake RATIO tokens guaranteeing it's being used as a store of value or investment tool.

RATIO finance has a native token denoted as RATIO. It is typically used for platform governance, staking, yield farming, and as a medium of exchange within the Ratio Finance environment.

Pros and Cons

| Pros | Cons |

|---|---|

| Automated market maker (AMM) features | Dependence on Ethereum blockchain's performance |

| Options, futures, and swap trading | Market risk inherent to all cryptocurrencies |

| Yield farming opportunities | Smart contract vulnerabilities |

| Native governance token | Possibility of low liquidity |

| Interoperable with Ethereum-based wallets | Network congestion and high gas fees |

Pros:

1. Automated Market Maker (AMM) Features: Ratio Finance platform is built around the concept of automated market makers. This allows it to provide seamless trading services and liquidity provisions, making it easily navigable for users.

2. Options, Futures, and Swap Trading: Ratio Finance platform isn't confined to only spot trading but also offers options, futures, and swap trading. This gives users a wide array of investment and financial operations' opportunities to utilize the platform according to their needs.

3. Yield Farming Opportunities: Ratio Finance stands out due to the yield farming opportunities it provides. Users can stake their RATIO tokens and earn rewards over time, thereby leveraging their holdings.

4. Native Governance Token: RATIO token has dual functionality - as a medium of exchange within its network and as a tool for influencing governance decisions. This allows users to contribute to the development of the ecosystem.

5. Interoperable with Ethereum-based Wallets: Since Ratio Finance is built on the Ethereum platform, its compatible with any Ethereum-supporting wallet. This gives users a wide variety of choices for storing their RATIO tokens.

Cons:

1. Dependence on Ethereum Blockchain's Performance: Ratio Finance's performance is tied to the Ethereum blockchain. With Ethereum congestion issues, transactions on Ratio Finance could be delayed and transaction fees could be higher.

2. Market Risk Inherent to all Cryptocurrencies: Like all cryptocurrencies, RATIO tokens are subject to market volatility and value fluctuation. This risk means that the value of investments can rapidly increase or decrease at any time.

3. Smart Contract Vulnerabilities: The Ratio Finance platform relies on smart contracts for automation. Despite the convenience, smart contracts are prone to bugs and often targeted by hackers.

4. Possibility of Low Liquidity: Since Ratio Finance is an AMM, it's exposed to the risk of low liquidity if not enough users commit their funds. Low liquidity could lead to difficulties in trading and potential losses for liquidity providers.

5. Network Congestion and High Gas Fees: In times of high network usage, the Ethereum network can become congested resulting in slow transaction speeds and high gas prices. This directly affects Ratio Finance users who will have to pay these fees.

What Makes Ratio Finance(RATIO) Unique?

Ratio Finance stands out in a crowded field of cryptocurrencies due to its focus on integrating various DeFi features into a singular platform. The platform combines automated market making (AMM) with a range of trading options including futures, swaps, and options trading. This breadth of offerings is unusual; generally, different platforms specialize in one or two of these areas.

Moreover, Ratio Finance also allows for yield farming — the practice of earning returns by lending or providing liquidity to a DeFi platform. Providing multiple features, like yield farming and variety of trading on a single platform, distinguishes Ratio Finance from many other cryptocurrencies and DeFi platforms.

Another point of differentiation is the RATIO token's dual function as both a medium of exchange and as a governance token. This combination is not found in every cryptocurrency and allows for user participation in decision-making within the Ratio Finance ecosystem.

However, it is important to note that Ratio Finance is not unique in every aspect. Just like most DeFi platforms, Ratio Finance is tied to the Ethereum blockchain and assumes similar issues such as network congestion and high gas fees. Its reliance on programmable Smart Contracts also implies potential vulnerability to bugs and hacking, common risks in the domain of blockchain technologies.

Furthermore, while Ratio Finance offers an integrated DeFi platform, it faces stiff competition from other similar platforms simultaneously developing and refining similar features. It shares with these platforms risks like potentially low liquidity and the inherent volatility of the cryptocurrency markets.

Therefore, while Ratio Finance does possess several distinguishing features that set it apart, it also remains similarly susceptible to challenges and risks common to cryptocurrencies and the DeFi sector.

How Does Ratio Finance(RATIO) Work?

Ratio Finance operates as a decentralized finance (DeFi) platform with an automated market maker (AMM) system. This system essentially replaces traditional digital order books with smart contract-based liquidity pools. Traders interact with these liquidity pools to perform their trades. User deposits form these liquidity pools, and the users earn transaction fees in return, incentivizing more users to provide liquidity for the platform.

One of the integral components of Ratio Finance is the RATIO token. This token serves dual purposes - it functions as a means of transaction within the Ratio Finance ecosystem and as a governance token. As a governance token, RATIO holders may use their tokens to vote on decisions that impact the overall development and operation of the Ratio Finance ecosystem.

Moreover, Ratio Finance provides opportunities for yield farming. This involves staking or lending cryptocurrency tokens to earn rewards. Users can lend their RATIO tokens to the platform, allowing other users to borrow these tokens for a fee. The fee is then distributed back to the lenders as a form of return on their deposit.

On the technical side, Ratio Finance utilizes Ethereum's blockchain for the operation of its platform. The smart contracts that power the platform are based on Ethereum, allowing Ratio Finance to leverage the security, decentralization capabilities, and established infrastructure of the Ethereum network.

Circulation of Ratio Finance(RATIO)

Ratio Finance, traded under the ticker RATIO, is a cryptocurrency whose circulation refers to the total number of coins that are currently being used or traded in the market. This includes RATIO tokens that are held in personal crypto wallets and those that are on exchanges ready for trading. The circulating supply gives an indication of how much of the total supply of the RATIO tokens is available in the market, and therefore, potentially influences the price and volatility of the token.

However, at the moment, specific details or figures regarding the circulating supply of Ratio Finance‘s RATIO tokens is not disclosed on Internet. For accurate and current data, it would be best to check established cryptocurrency market tracking websites . Note that the circulating supply is only one aspect of understanding a cryptocurrency’s potential value and performance. Other considerations should include the total supply, demand, utility, adoption, market conditions, and regulations.

Exchanges to Buy Ratio Finance(RATIO)

RATIO is an Ethereum-based token, it is accessible for trading on decentralized exchanges (DEXs) that connect with the Ethereum blockchain.

In general, some of the potential decentralized exchanges that frequently list Ethereum-based tokens include:

1. Uniswap: It's one of the largest and most well-known decentralized exchanges that operates on the Ethereum blockchain. You can exchange RATIO with ETH or any other ERC-20 tokens if it's listed here.

2. SushiSwap: It's another popular DEX on Ethereum. Similar to Uniswap, if RATIO is listed here, it will likely be paired with ETH and other Ethereum-based tokens.

3. Balancer: Balancer allows for automatic portfolio management and provides liquidity. If RATIO is listed here, token pairs could include ETH and various ERC-20 tokens.

4. Curve Finance: Known for stablecoin swaps, Curve might list RATIO and allow for swapping it for ETH or other stablecoins.

5. Kyber Network: Kyber is a liquidity protocol that allows decentralized token swaps to be integrated into any application. If RATIO is on Kyber, it could likely be traded for ETH and other ERC20 tokens.

Please note, the details for specific token pairs for RATIO will only become clear when the token is listed on these or other exchanges. It is advised to check the official project website or announcements for the most accurate, up-to-date information.

How to Store Ratio Finance(RATIO)?

Ratio Finance (RATIO) is an Ethereum-based token, meaning it can be stored in any wallet that supports Ethereum and its associated token standards, primarily ERC-20. There are numerous types of wallets available, and the choice often depends on the level of security and convenience a user is seeking.

Here are some wallet types for storing RATIO tokens:

1. Web Wallets: These are accessed via web browsers, and they're often the simplest to use. A widely-used web wallet is MetaMask, which is a browser extension available for Chrome, FireFox, and Brave.

2. Mobile Wallets: These wallet applications for smartphones provide convenience for on-the-go users who want to access their cryptocurrency at any time. Trust Wallet and Coinbase Wallet are examples of mobile wallets supporting Ethereum and its tokens.

3. Desktop Wallets: Downloadable on computers, these wallets offer robust security features while providing an easy-to-use interface. Examples include wallets like MyEtherWallet and Exodus, which can hold Ethereum and its tokens.

4. Hardware Wallets: For those prioritizing security, hardware wallets could be the most suitable option. These wallets store your digital assets on a physical device, offline, making them immune to online hacking attempts. Notable brands include Ledger and Trezor.

5. Paper Wallets: These wallets involve physically printing out the public and private keys in a QR code form, which can be scanned to execute transactions. It's a quite secure but less practical method due to the inconvenience of handling paper wallets.

Before deciding on a wallet, it is advisable to consider factors such as the wallet's security features, the reputation of the provider, ease of use, and the specific requirements of the user. Lastly, regardless of the chosen wallet, it is extremely important always to keep your private key secure and private.

Should You Buy Ratio Finance(RATIO)?

Ratio Finance (RATIO) is well-suited for individuals who are interested in decentralized finance (DeFi) and those who would like to gain exposure to a variety of DeFi features such as automated market making, future and options trading, and yield farming, all while being directly involved in platform governance through the RATIO token.

The following groups of people might find Ratio Finance of interest:

1. Crypto Traders and Investors: Those interested in trading and investing in cryptocurrencies could consider adding RATIO to their portfolio if they find its utility and potential growth prospects appealing. It should be considered a supplementary part of a diversified portfolio.

2. DeFi Enthusiasts: Individuals who are looking to engage with advanced DeFi features such as yield farming, futures trading, and options trading may find Ratio Finance appealing.

3. Crypto Stakers: The RATIO token can be staked on the platform, allowing users to earn rewards. This could interest individuals keen on passive income opportunities.

4.Decentralization Advocates: For people interested in blockchain's democratic potential, RATIO allows them to participate in the governance of the network.

However, it is important to note the following for potential RATIO buyers:

1. Research: Extensive research should be carried out before investing in RATIO or any cryptocurrency. This includes understanding the platform's purpose, how it works, and its long-term vision.

2. Financial Risk: All cryptocurrencies, including RATIO, have inherent financial risks due to volatility. Never invest more than you can afford to lose.

3. Security Measures: Safeguard your investments by using secure wallets for storing RATIO tokens and ensure that your private keys are carefully protected.

4. Regulatory Compliance: Ensure that your interactions with cryptocurrencies are lawful in your jurisdiction. Different countries have different regulations regarding the buy, sell, or use of cryptocurrencies.

Conclusion

Ratio Finance (RATIO) is a decentralized finance (DeFi) platform that combines a suite of financial services within its ecosystem, including an automated market maker, futures, options and swap trading, yield farming, and on-platform governance through its RATIO token. Built on the Ethereum blockchain, Ratio Finance benefits from Ethereum's security and decentralization, though it also depends on the blockchain's performance.

As for making money or potential appreciation, the RATIO token could potentially generate returns through a few methods: trading gains, staking rewards (yield farming), and future appreciation due to increased demand or utility on the platform. However, it's crucial to remember the inherent risks associated with crypto assets. They are highly volatile, with prices that can fluctuate widely in very short periods, and should, therefore, form only a part of a diversified investment portfolio. It's also important to note that while RATIO's features and prospects might suggest potential for returns, this doesn't guarantee future performance.

It's essential for potential buyers or investors to carry out extensive research and preferably seek advice from a financial advisor before investing in Ratio Finance or any other cryptocurrencies.

FAQs

Q: What kind of cryptocurrency is Ratio Finance (RATIO)?

A: Ratio Finance (RATIO) is a decentralized finance (DeFi) platform and crypto token built on the Ethereum blockchain that offers options, futures, and swap trading along with yield farming.

Q: What is the primary purpose of the RATIO token?

A: The RATIO token serves as a means of exchange within its platform and as a mechanism for users to participate in decision-making processes for the Ratio Finance ecosystem.

Q: What type of trade features does Ratio Finance offer?

A: Ratio Finance offers a range of trade options including futures, options, and swap trading, in addition to automated market making.

Q: How does Ratio Finance enable yield farming?

A: By staking RATIO tokens on the Ratio Finance platform, users have the opportunity to earn returns through what is typically referred to as yield farming.

Q: On what type of blockchain is Ratio Finance built?

A: Ratio Finance is built on the Ethereum blockchain, utilizing its smart contracts and benefitting from its security, decentralization capacity, and established infrastructure.

Q: What types of wallet can store RATIO tokens?

A: As an Ethereum-based token, RATIO can be stored in any wallet supporting Ethereum and its associated token standards such as web wallets (e.g., MetaMask), mobile wallets (e.g., Trust Wallet), desktop wallets (e.g., MyEtherWallet), hardware wallets (e.g., Ledger), and paper wallets.

Risk Warning

Investing in cryptocurrencies requires an understanding of potential risks, including unstable prices, security threats, and regulatory shifts. Thorough research and professional guidance are advised for any such investment activities, recognizing these mentioned risks are just part of a wider risk environment.

Ratio Finance User Reviews

Ratio Finance News

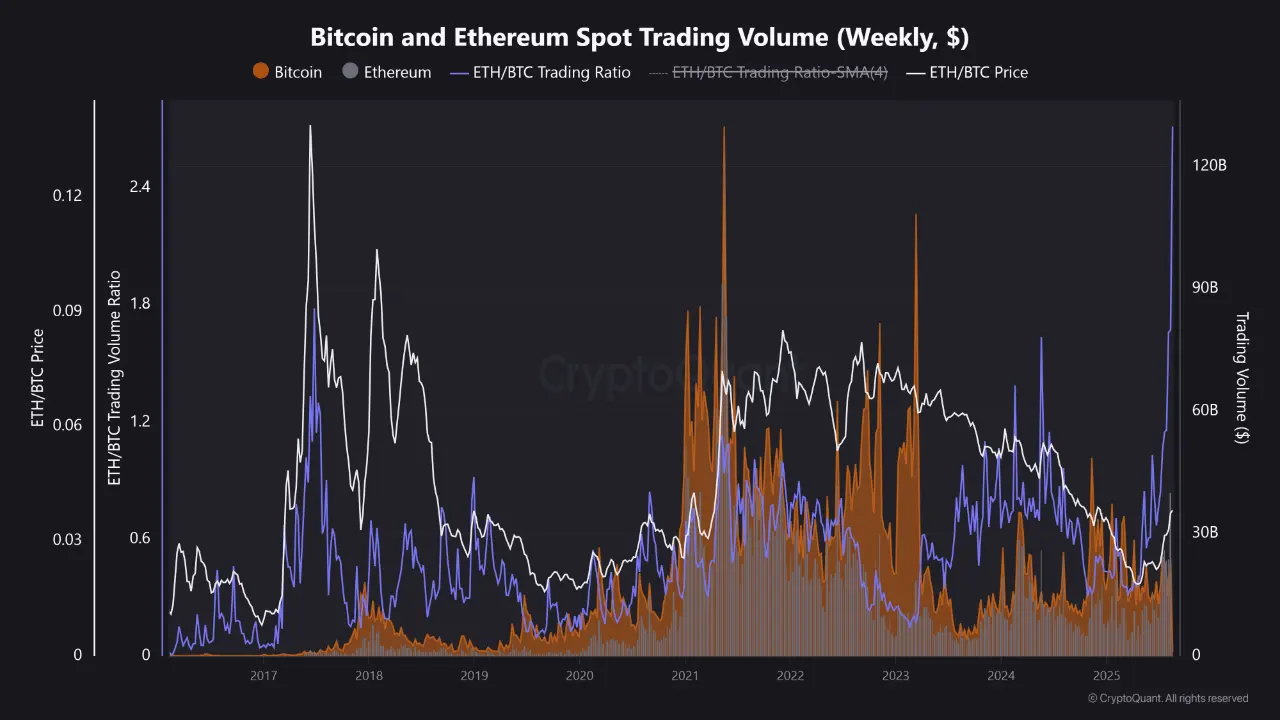

TokenETH-BTC ratio bottomed in April, mirrors 2019 cycle: Analyst

The price of Ether (ETH), the native cryptocurrency of the Ethereum layer-1 blockchain network, bott

2026-01-12 06:02

TokenEthereum to Outperform Bitcoin? ETH/BTC Ratio Shows Most Bullish Pattern Ever

The cryptocurrency sector may soon experience a stronger altcoin phase, as indications suggest a pos

2025-11-19 21:09

TokenCrypto Market Prediction: XRP Death Cross Welcomed Back, Ethereum to BTC Ratio to Skyrocket, Shiba Inu (SHIB): No Hope Left?

The market is experiencing a severe lack of liquidity and volatility. Extremely low volumes on XRP,

2025-11-03 09:02

TokenETH/BTC ratio remains below 0.05 despite institutional adoption and ATH

The ratio comparing Ether's (ETH) price to Bitcoin's (BTC) price remains under 0.05, a level ETH has failed to reclaim since July 2024.

2025-09-15 02:43

TokenEthereum vs. Bitcoin: ETH/BTC Ratio Climbs to Yearly Peak Amid Market Shift

Ethereum (ETH) has maintained upward momentum in recent weeks, with the asset briefly touching $4,77

2025-08-20 13:02

TokenEthereum (ETH) Price Eyes All-Time High as A Key Ratio Indicates 40% Rally

Ethereum is showing signs of strength across on-chain and technical indicators, with conditions now

2025-07-21 13:01

TokenSPY/TLT Ratio Nears Peak; Equities Surge While Crypto Faces Liquidations

US equities have hit their strongest position relative to bonds since the inauguration of the US pre

2025-06-19 06:05

TokenTron (TRX) Looks to Reclaim ATH as Sharpe Ratio and Risk Metrics Signal Strength

Fueled by the wider crypto market uptrend, Tron (TRX) has climbed close to 12% in the last month. Af

2025-05-22 12:04

TokenBitcoin and S&P500 Ratio Reaches an All-Time High | US Crypto News

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developm

2025-05-10 03:07

6 ratings