Mt.Gox

| Aspect | Information |

| Short Name | Mt.Gox |

| Full Name | Mt.Gox (Magic: The Gathering Online Exchange) |

| Founded Year | 2010 |

| Main Founders | Jed McCaleb (originally), Mark Karpelès (later became CEO) |

| Support Exchanges | Bitstamp, BTC Markets, Coincheck, Kraken, Poloniex |

| Storage Wallet | Hardware Wallets,Software Wallets, Web Wallets |

Overview of Mt.Gox

Mt.Gox was a Japan-based Bitcoin exchange platform that was launched in 2010. It was originally created by Jed McCaleb, an American entrepreneur known for his contributions to several digital platforms. Later, in 2011, McCaleb sold the exchange to a French software developer Mark Karpelès who became the CEO. At the height of its operation, Mt.Gox was handling over 70% of all worldwide Bitcoin transactions, thereby becoming the largest Bitcoin intermediary and the leading exchange platform. However, the exchange's course was marked by a series of security issues, financial mismanagements, and ultimately a massive Bitcoin theft that led to its bankruptcy declaration in 2014. The Mt.Gox case has marked an unforgettable phase in the history of cryptocurrency exchanges.

To obtain more information, you can visit their website:https://www.mtgox.com/ and try to log in or register to use more services.

Pros and Cons

| Pros | Cons |

| Handled over 70% of worldwide Bitcoin transactions at its peak | Faced serious security issues |

| Highest volume cryptocurrency exchange for a period | Subject to financial mismanagements |

| Played a significant role in bringing blockchain technology to the mainstream | Involved in massive Bitcoin theft leading to bankruptcy |

Pros of Mt.Gox:

1. Handled over 70% of worldwide Bitcoin transactions at its peak: Mt.Gox was the dominant force in the Bitcoin trading world. At the height of its operation, the exchange was responsible for over 70% of all Bitcoin transactions globally. This marked a significant moment when the platform and Bitcoin were intertwined, as significant shifts in either affected the overall landscape of the Bitcoin economy.

2. Highest volume cryptocurrency exchange for a period: The high transaction volumes on Mt.Gox provided a clear snapshot of Bitcoin's early adoption. The high volume reflected investor confidence and created a marketplace for Bitcoin trading, stimulating more interest and activities in the cryptocurrency world.

3. Played a significant role in bringing blockchain technology to the mainstream: Being the leading Bitcoin exchange, Mt.Gox helped facilitate the mainstream recognition of Bitcoin and blockchain technology. The platform served as an intermediary that provided a stage for Bitcoin to be exchanged on an international scale, making it more accessible to the public.

Cons of Mt.Gox:

1. Faced serious security issues: One of the main pitfalls of Mt.Gox was their inadequate security measures. The platform suffered from a series of hacks and cyber attacks, with the most significant one leading to the loss of 750,000 of its customers' Bitcoins and 100,000 of its own. This highlighted the critical issue of inadequate security measures and substandard infrastructure within the platform, which severely affected its functionality and operational reliability.

2. Subject to financial mismanagements: During its operation, Mt.Gox faced a series of financial management issues. The platform was charged with the misappropriation of funds as well as the alleged manipulation of Bitcoin price within the exchange.

3. Involved in massive Bitcoin theft leading to bankruptcy: The combination of security breaches and financial mismanagements culminated in a massive theft of Bitcoins. This catastrophic event led to the platform's cessation and its declaration of bankruptcy in 2014. This incident not only brought about the end of Mt.Gox but also raised significant questions about the safety, security, and credibility of cryptocurrency exchanges.

Security

Mt.Gox's security measures were significantly inadequate and ultimately led to its downfall. The most well-known and catastrophic security breach occurred in 2014, when approximately 850,000 Bitcoins, equivalent to about $450 million at the time, were stolen from the exchange. This represented about 7% of all Bitcoins in existence at the time and led to the exchange filing for bankruptcy.

The loss was attributed to a lack of appropriate security measures, including the absence of cold storage or offline Bitcoin wallets, which would have kept a significant amount of Bitcoin out of reach of online hackers. The exchange's software was also reportedly flawed, allowing hackers to manipulate transaction IDs to make it appear as though transactions had not been processed when in fact they had.

The platform also had a history of smaller incidents, including the loss of 2609 BTC due to a YubiKey vulnerability in June 2011 and the unauthorized movement of coins between client accounts due to a wallet.dat leak in March 2011.

Mt.Gox's security measures were also criticized for failing to implement industry standard practices such as multi-signature security, which requires multiple cryptographic keys to authorize a Bitcoin transaction.

In summary, Mt.Gox's security infrastructure was significantly insufficient. It lacked basic measures such as cold storage, multi-signature security, and robust software protection against manipulation. The severe consequences of these shortcomings underline the importance of robust and appropriate security measures in cryptocurrency exchanges.

What Makes Mt.Gox Unique?

Despite its unfavorable end, Mt.Gox did introduce several features that were unique and innovative at its time:

1. First Significant Bitcoin Exchange: Mt.Gox was one of the earliest and most influential Bitcoin exchanges, handling over 70% of all Bitcoin transactions globally at its peak. It helped bring Bitcoin to the mainstream and paved the way for the growth of the cryptocurrency industry.

2. International Wire Transfers: Mt.Gox was one of the first exchanges to allow users to fund their accounts through international wire transfers. This enabled the transfer of substantial amounts of traditional currency into and out of the Bitcoin economy.

3. Trading Interface: Mt.Gox had a user-friendly interface that provided detailed charts and trading information, which helped users make informed trading decisions. It was one of the first platforms to offer such a comprehensive trading interface.

4. Magic The Gathering Connection: The exchange's unusual name stands for “Magic: The Gathering Online Exchange”. Originally, the website was intended to be an online marketplace for Magic: The Gathering cards, demonstrating a unique blend of nerdy internet subcultures.

However, it's important to note that despite these unique features, Mt.Gox was severely hampered by its poor security measures and mismanagement, which ultimately led to its downfall.How Does Mt.Gox Work?

Mt.Gox functioned as a cryptocurrency exchange where users could buy, sell, and trade Bitcoin. The platform served as an intermediary, matching orders from buyers and sellers. Users could deposit funds into their Mt.Gox accounts through international wire transfers and then purchase Bitcoins by placing a buy order on the platform.

When a user placed a buy order, the platform's system would match it with a sell order of the same price. If a sell order was found, the system would fulfill the transaction, transferring ownership of the Bitcoin to the buyer and the funds to the seller. Conversely, if a user wanted to sell Bitcoin, they could place a sell order, which would also be matched with a buy order of the same price by the system.

Moreover, users could check the price trends of Bitcoin on the exchange as Mt.Gox provided charts and other trading information, which helped users make informed trading decisions.

However, it's important to note that while the system was in theory sound, in practice, Mt.Gox faced serious issues due to poor management and weak security infrastructure, which ultimately led to its downfall.

Price

Mt.Gox was a Bitcoin exchange that was once one of the largest and most popular in the world. However, in 2014, the exchange was hacked and lost 850,000 bitcoins, which were worth about $450 million at the time. The hack led to the collapse of Mt.Gox and had a significant impact on the price of Bitcoin.

The price of Bitcoin is highly volatile and has fluctuated wildly since its inception. In 2017, the price of Bitcoin reached a high of nearly $20,000 before crashing back down to around $3,000 in 2018. The price has since recovered and is currently trading around $16,000.

Exchanges to Buy Mt.Gox

Several exchanges facilitate the purchase of Mt.Gox, and they offer a variety of currency and token pairs to cater to different trading preferences.

Bitstamp

Bitstamp is a well-established and reputable cryptocurrency exchange that has been operating since 2011. It is one of the few exchanges that supports the rehabilitation process of Mt. Gox creditors, led by the creditors' bankruptcy trustee. To buy Mt. Gox on Bitstamp, creditors can open an account with Bitstamp and register on the trustee's platform by following the instructions available on https://www.mtgox.com/.

BTC Markets

BTC Markets is an Australian cryptocurrency exchange that has been operating since 2013. It is one of the largest and most popular exchanges in Australia, and it offers a wide range of cryptocurrencies, including Mt. Gox. To buy Mt. Gox on BTC Markets, you can create an account and deposit Australian dollars (AUD) into your account. You can then use your AUD to buy Mt. Gox.

Coincheck

Coincheck is a Japanese cryptocurrency exchange that has been operating since 2014. It is one of the largest and most popular exchanges in Japan, and it offers a wide range of cryptocurrencies, including Mt. Gox. To buy Mt. Gox on Coincheck, you can create an account and deposit Japanese yen (JPY) into your account. You can then use your JPY to buy Mt. Gox.

Kraken

Kraken is a global cryptocurrency exchange that has been operating since 2011. It is one of the most popular exchanges in the world, and it offers a wide range of cryptocurrencies, including Mt. Gox. To buy Mt. Gox on Kraken, you can create an account and deposit fiat currency (EUR, USD, CAD, JPY, GBP) or cryptocurrency into your account. You can then use your fiat currency or cryptocurrency to buy Mt. Gox.

Poloniex

Poloniex is a global cryptocurrency exchange that has been operating since 2014. It is one of the most popular exchanges for experienced cryptocurrency traders, and it offers a wide range of cryptocurrencies, including Mt. Gox. To buy Mt. Gox on Poloniex, you can create an account and deposit fiat currency (USD, EUR, CAD, GBP, JPY) or cryptocurrency into your account. You can then use your fiat currency or cryptocurrency to buy Mt. Gox.

How to Store Mt.Gox?

Mt.Gox, once a major cryptocurrency exchange, is no longer operational. However, if you're looking to store cryptocurrencies securely, there are several methods available:

Software Wallets: These are applications or software programs installed on your computer or mobile device. Examples include Electrum (for Bitcoin) or **Exodus**, which allow you to store cryptocurrencies securely on your device. They offer control over your private keys.

2. Desktop Wallets: Similar to software wallets but specifically designed for desktop computers. Desktop wallets like Atomic Wallet provide security features and enable users to manage their crypto assets offline.

3. Mobile Wallets: Applications designed for smartphones, ensuring convenience for users who prefer accessing their crypto on the go. Wallets like Trust Wallet or Coinomi offer mobile-based storage and often have enhanced security features.

4. Hardware Wallets: Considered one of the most secure options, hardware wallets are physical devices that store your cryptocurrency offline. Products like **Ledger Nano S/X**, **Trezor**, or KeepKey provide excellent security by keeping your private keys offline.

5. Web Wallets: These wallets operate on the cloud and can be accessed from any device with an internet connection. While convenient, they are more susceptible to hacking. Examples include MetaMask for Ethereum-based tokens.

How to sign up?

As of currently, signing up for a new account on Mt.Gox is impossible. The Japan-based Bitcoin exchange was declared bankrupt in 2014 following a major hacking incident, during which a significant amount of Bitcoin was stolen. The site ceased its operations and closed down subsequently. Since then, Mt.Gox remains non-functional and inaccessible, with an ongoing rehabilitation process in place to ensure the return of lost assets to its former users, which means you cannot create a new account or use any of its services.

Can You Make Money?

While Mt.Gox is no longer operational for one to make money through its platform, historically, like other cryptocurrency exchanges, it did offer opportunities for users to potentially profit from trading Bitcoin. Similar opportunities can be sought in active, secure and reputable cryptocurrency exchanges. Here are some general tips:

1. Education: The cryptocurrency market is volatile and complex. Taking time to educate oneself through reliable resources can provide a solid understanding of market trends and how different factors influence price fluctuations.

2. Diversification: Similar to traditional investments, don't put all your eggs in one basket. Diversifying your portfolio can help mitigate risks.

3. Regular Updates: Keep updated with news that could potentially impact the cryptocurrency market and stay apprised about announcements from prominent exchanges.

4. Develop a Robust Strategy: Whether you're interested in day trading or a long-term investment strategy, it's important to have a plan in place. Consider setting rules for entering and exiting trades, and always use stop-loss orders to manage potential losses.

5. Risk Management: Only invest what you can afford to lose. The cryptocurrency market is highly speculative and known to be extremely volatile.

Remember, while the potential for high returns exists, there is also substantial risk involved. Moreover, it's essential to use reliable and secure platforms for trading to avoid losses due to hacks or platform insolvency. Due diligence is key before getting involved in any trading activities.

Conclusion

Despite its initial success, Mt.Gox ultimately serves as a stark reminder of the risks associated with the lack of regulatory oversight and poor security measures in the world of cryptocurrency exchanges. As one of the earliest and most significant platforms for Bitcoin trading, handling over 70% of all Bitcoin transactions at its peak, it played a pivotal role in paving the way for the growing cryptocurrency industry. However, the platform's downfall due to chronic security issues, financial mismanagement, culminating in a massive theft of Bitcoins leading to its bankruptcy, emphasizes the need for stronger security infrastructure and proper financial oversight in cryptocurrency exchanges. Therefore, while Mt.Gox is a notable part of Bitcoin's history, it also represents a significant cautionary tale in the cryptocurrency sphere.

FAQs

Q: What is the history of Mt.Gox?

A: Launched in 2010 and once handling 70% of all Bitcoin transactions globally, Mt.Gox, endured a series of security breaches and financial mismanagement issues leading to a large-scale Bitcoin theft and its eventual bankruptcy in 2014.

Q: What were the strengths and weaknesses of Mt.Gox?

A: Mt.Gox boasted high transaction volumes and played a key role in popularizing Bitcoin; however, its significant weaknesses included pervasive security challenges, financial mismanagement, and a large-scale Bitcoin theft.

Q: What were Mt.Gox's security protocols?

A: Mt.Gox was criticized for its insufficient security protocols, suffering from multiple security breaches, and lacked practices such as offline Bitcoin wallets and multi-signature security.

Q: How did Mt.Gox operate?

A: Mt.Gox acted as a medium for Bitcoin trading, where users would deposit funds, place buy or sell orders, and the system would match these orders accordingly.

Q: What unique attributes did Mt.Gox exhibit?

A: Mt.Gox's uniqueness stemmed from its dominant position in early Bitcoin transactions, its pioneering role in providing international wire transactions, and a superior trading interface.

Q: As of now, can one sign up on Mt.Gox?

A: Currently, sign-up and services on Mt.Gox are not available as the platform declared bankruptcy in 2014 and ceased operations.

Q: Could users profit from participation in Mt.Gox's services?

A: While Mt.Gox had potential for financial gains through Bitcoin trading, the exchange is currently inactive; however, the potential for gain through trading can still be found in reputable, secure cryptocurrency exchanges.

Q: How can you summarize the overall evaluation of Mt.Gox?

A: Despite its initial dominance, Mt.Gox stands as a potential warning of the risks from poor security and lack of regulation in cryptocurrency exchanges, underlining the crucial need for robust security and stringent financial oversight within such platforms.

Risk Warning

Investing in blockchain projects carries inherent risks, stemming from the intricate and groundbreaking technology, regulatory ambiguities, and market unpredictability. Consequently, it is highly advisable to conduct comprehensive research, seek professional guidance, and engage in financial consultations before venturing into such investments. It's important to be aware that the value of cryptocurrency assets can experience significant fluctuations and may not be suitable for all investors.

Website

Most visited countries/areas

Greece

mtgox.com

Server Location

Japan

Most visited countries/areas

Greece

Domain

mtgox.com

ICP registration

--

Website

WHOIS.TUCOWS.COM

Company

TUCOWS DOMAINS INC.

Domain Effective Date

2007-01-03

Server IP

35.78.21.145

Content you want to comment

Please enter...

Comment 4

News

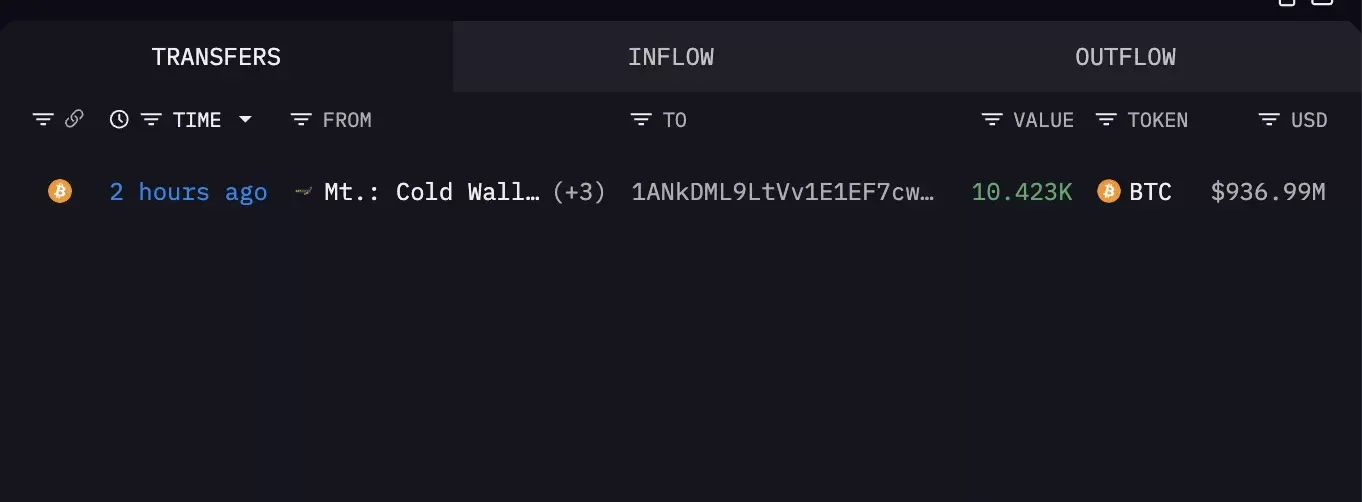

As Bitcoin (BTC) Falls, Mt.Gox Wallets See Major Fluctuation After Eight Months! What Will They Do?

While investors were expecting a recovery in November after the massive crash on October 11, Bitcoin

2025-11-18 17:27

BTC Drops Under $68K as Mt.Gox Sends $2.2B Bitcoin to Two Wallets

Mt. Gox moved of over 32,000 BTC ($2.2 billion) to new wallet addresses in preparation for future sa

2024-11-05 12:03

Mt.Gox Case and Goverments Tanked the Crypto Market

The cryptocurrency market experienced a dramatic downturn recently,, with over $170 billion in marke

2024-07-09 19:21

Mt.Gox将70亿美元的比特币转移作为偿还计划的一部分,引发了比特币价格的暴跌。

2024-05-28 00:00

比特币面临着Mt. Gox的“黑天鹅”事件,因为受托人准备解锁15万个BTC。

2022-07-07 00:00

Analysts expect parabolic Bitcoin price move after the ‘last’ resistance at $67K falls

Analysts say BTC price is set for a near parabolic price move once the “last” resistance at $67,000 is cleared.

2021-11-08 21:51