Score

Money Partners

Japan

15-20 years

Digital Currency License

https://www.moneypartners.co.jp/

Website

Influence

B

Influence Index NO.1

Japan 7.87

Biz Area

Search Statistics

Advertising

Social Media Index

Exchange License

FSARegulated

Digital Currency License

Money Partners Exchange Info

Website

Relationship Mapping

Social Media

Trade Type

Keywords

Time Machine

White Paper

Related Software

Github

Related Docs

All Corps

New Arrival

Trading statistics

Influence

Yesterday Vol

7 Days

Money Partners User Reviews

Money Partners

| Aspect | Information |

|---|---|

| Company Name | Money Partners |

| Registered Country/Area | Japan |

| Founded year | 5-10 Years |

| Regulatory Authority | Financial Services Agency (FSA) |

| Cryptocurrencies offered/available | BTC/JPY, ETH/JPY, LTC/JPY, BCH/JPY. |

| Trading Platforms | MoneypartnersFX, MP Mobile, MP Bot |

| Deposit & Withdrawal | Bank transfer, Credit card, Quick deposit , ATM withdrawal |

| Educational Resources | Online courses, educational articles, webinars |

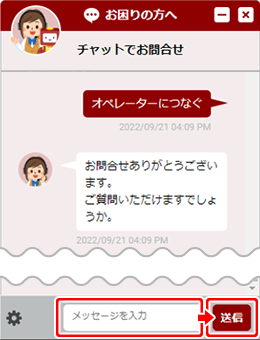

| Customer Support | Email, phone, live chat |

Overview of Money Partners

Money Partners, a virtual currency exchange based in Japan. The company is regulated by the Financial Services Agency (FSA). Money Partners offers 4 popular cryptocurrencies such as BTC/JPY, ETH/JPY, LTC/JPY, BCH/JPY.

Money Partners provides several trading platforms, including MoneypartnersFX, MP Mobile, and MP Bot, allowing users to trade conveniently on different devices. Customers can easily deposit and withdraw funds using Bank transfer, Credit card, Quick deposit , ATM withdrawal.

In addition to its trading features, Money Partners also offers educational resources to help users improve their trading skills. These resources include online courses, educational articles, and webinars.

To provide support to its customers, Money Partners offers various channels of communication, including email, phone, and live chat. This ensures that customers can easily reach out for assistance whenever they need it.

Overall, Money Partners has established itself as a reputable virtual currency exchange with a wide range of cryptocurrencies, trading platforms, and customer support options.

Pros and cons

Money Partners presents several advantages and drawbacks for traders. It holds regulation from Japan's FSA, bolstering its credibility. However, it offers a more restricted range of cryptocurrencies than some other exchanges. Trading against the Japanese Yen is available, though fees could be deemed relatively higher. The presence of multiple trading platforms enhances options, while withdrawal fees apply for Japanese Yen after a certain number of requests. The exchange is noted for swift coin listing and valuable educational resources. Nevertheless, it is limited to JPY trading and lacks the variety of trading with other fiat currencies. Moreover, while providing convenient payment methods, Money Partners might lack the same recognition as more established exchanges.

Pros and Cons of Money Partners

| Pros | Cons |

|---|---|

| Regulated by Japan's FSA, providing credibility | Limited selection of cryptocurrencies compared to some other exchanges |

| Offers trading against Japanese Yen (JPY) | Fees might be considered relatively higher |

| Multiple trading platforms available | Withdrawal fees for Japanese Yen after a certain number of requests |

| Known for fast coin listing and educational resources | Limited to JPY trading, lacks trading with other fiat currencies |

| Provides convenient payment options | May not have the same recognition as larger, more established exchanges |

Regulatory Authority

Money Partners is a regulated financial institution in Japan. It operates under an Exclusive license type with license number 関東財務局長 第00001号. The institution, 株式会社マネーパートナーズ (Money Partners), falls under the oversight of the Financial Services Agency (FSA) and has been regulated since September 29, 2017. It holds a Digital Currency License.

The FSA is responsible for overseeing all financial services providers in Japan, including Forex brokers, with the goal of maintaining the stability of the country's financial system and protecting investors, policyholders, and depositors. It plays a crucial role in policy making, supervision of financial services, securities transactions, and inspection of private sector financial institutions. The FSA's accountability extends to the Japanese Minister of Finance, and it has a broad range of responsibilities in ensuring the soundness of Japan's financial industry.

Security

Money Partners prioritizes user security through robust measures. The majority of user funds are stored in offline cold storage, safeguarded from online threats. Multi-factor authentication (MFA) is mandatory, requiring a phone-generated code along with passwords. SSL encryption shields data transmission, preventing interception of sensitive info. Regular independent audits verify the efficacy of Money Partners' security protocols.

Cryptocurrencies available

Money Partners provides trading opportunities for four cryptocurrency pairs:

BTC/JPY,

ETH/JPY,

LTC/JPY,

BCH/JPY.

Money Partners provides trading spreads for cryptocurrency pairs against the Japanese Yen (JPY), including BTC/JPY (spread: 11,700), ETH/JPY (spread: 1,030), LTC/JPY (spread: 174), and BCH/JPY (spread: 560).

Money Partners is known for its fast coin listing speed. They typically list new coins within a few days of their release, which is much faster than many other exchanges. This makes it a great place to go if you want to get in on the ground floor of new cryptocurrencies.

In addition to cryptocurrency trading, Money Partners also provides other products and services. Users can access different trading platforms such as MoneypartnersFX, MP Mobile, and MP Bot, which allow for convenient trading on various devices. The exchange also offers educational resources such as online courses, educational articles, and webinars to help users improve their trading skills and knowledge.

It's worth noting that while Money Partners primarily focuses on cryptocurrency trading, users should carefully consider their investment goals, risk tolerance, and conduct thorough research before engaging in any trading activities.

How to open an account?

To register with Money Partners, users need to visit the exchange's website and click on the “Sign Up” or “Register” button.

Money Partners employs a tiered fee structure tied to trading volume in USD: Taker fees span from

50 cents to 2.30%, while Maker fees extend from

0% to 0.30%,with distinct rates corresponding to varying volume levels.

2. Users will be prompted to enter their personal information, such as their full name, email address, and phone number.

3. Once the personal information is provided, users will need to create a username and password for their account.

4. After creating their login credentials, users will be required to verify their email address through a confirmation link sent to their registered email.

5. Users will then need to complete the Know Your Customer (KYC) process, which involves providing additional personal information and submitting identification documents such as a passport or driver's license.

6. Finally, users will need to agree to the exchange's terms and conditions and complete any additional steps or requirements outlined by Money Partners, such as setting up two-factor authentication for added security.

Fees

| Volume (USD) | Taker Fee | Maker Fee |

|---|---|---|

| Up to 25 | 50 cents | 0% |

| 25-100 | 2.30% | 0.10% |

| 100-200 | 2% | 0.20% |

| Above 200 | 1.50% | 0.30% |

Deposit & Withdrawal

Money Partners provides convenient payment options such as bank transfers and ATM transfers with no transaction fees. When conducting delivery transactions, there's a 0.10 yen fee per currency unit. Japanese Yen withdrawals are subject to fees: the first five requests are free, while the sixth request onwards costs 440 yen. Withdrawals of 20,000 currency units or more have no fees.

| Payment Method | Buy | Sell | Add Cash | Cash Out |

|---|---|---|---|---|

| Bank transfer | Yes | Yes | Yes | Yes |

| Credit card | Yes | Yes | Yes | Yes |

| Quick deposit | Yes | Yes | No | No |

| ATM withdrawal | No | No | Yes | Yes |

Educational Resources

Money Partners provides users with various educational resources and tools to help enhance their trading knowledge and skills. The exchange offers trading guides, video tutorials, and webinars that cover topics such as technical analysis, understanding market trends, and risk management strategies. These resources aim to assist users in making informed trading decisions.

Furthermore, Money Partners may have community support and communication platforms, such as forums or social media groups, where users can engage with fellow traders and share insights and experiences. These platforms can provide a sense of community and allow users to learn from others in the trading community.

It is important to note that the availability and specific details of these educational resources and support platforms may vary. Users are advised to visit the Money Partners website or contact their customer support for more information on the educational resources and tools offered by the exchange.

Customer Support

Customer support at Money Partners is readily accessible through chat, email inquiries, and phone assistance. The chat service operates from Monday to Friday, 9:00 to 18:00, providing swift responses. While inquiries via email form may take a few days for resolution, the chat service is the preferred option for urgent matters. Phone inquiries are also available at 0120-860-894 on weekdays from 9:00 to 18:30, with adjusted hours due to COVID-19 precautions.

Compare to Similar Brokers

Money Partners facilitates trading in four cryptocurrencies, featuring fees spanning from Taker: 50 cents - 2.3%, Maker: 0% - 0.3%, and a minimum account requirement of $50. In contrast, Binance provides access to an extensive array of 500+ cryptocurrencies with fees ranging from Taker: 0.1% - 0.5%, Maker: -0.04% - 0.02%, and no minimum account stipulation. Similarly, Coinbase supports trading for over 100 cryptocurrencies, charging Taker: 0.5% and Maker: 0.4% fees, necessitating a minimum deposit of $250. While Binance and Coinbase offer promotions of up to $500 and $100 in free Bitcoin respectively, Money Partners does not provide promotional offers.

| Feature | Money Partners | Binance | Coinbase |

|---|---|---|---|

| Cryptocurrencies Amounts | 4 | 500+ | 100+ |

| Fees | Taker: 50 cents - 2.3%, Maker: 0% - 0.3% | Taker: 0.1% - 0.5%, Maker: -0.04% - 0.02% | Taker: 0.5%, Maker: 0.4% |

| Account minimum | $50 | $0 | $250 |

| Promotions | None | Up to $500 in free Bitcoin | Up to $100 in free Bitcoin |

Is Money Partners a Good Exchange for You?

Money Partners could be suitable for various trading groups based on their offerings and features. Here are some target groups and recommendations:

1. Beginner Traders: Money Partners offers educational resources such as trading guides, video tutorials, and webinars, making it suitable for beginners who want to learn about cryptocurrency trading. The availability of a user-friendly interface and multiple trading platforms can also assist beginners in navigating the trading process more easily.

2. Experienced Traders: Money Partners provides a wide range of cryptocurrencies and multiple trading platforms. This can cater to experienced traders who are looking to diversify their portfolios and actively engage in cryptocurrency trading. The availability of advanced trading features and tools may also appeal to experienced traders.

3. Investors Seeking a Regulated Environment: Money Partners is regulated by the Financial Services Agency (FSA) in Japan. This regulatory oversight may provide reassurance to investors who prioritize trading on a regulated platform under the guidelines set by the FSA.

4. Traders Seeking Community Interaction: Money Partners may have community support and communication platforms such as forums or social media groups. These platforms can provide opportunities for traders to interact, share insights, and learn from each other. Traders seeking a sense of community and engagement may find value in these platforms.

5. Users in Japan: Money Partners operates in Japan and may offer customer support in Japanese. This makes it convenient for users who prefer to communicate in their local language and seek support in their time zone.

It's important to note that while these recommendations are made based on the available information, users should conduct their own research, consider their individual trading goals and preferences, and evaluate the suitability of Money Partners or any other cryptocurrency exchange accordingly.

User satisfaction

User 1:

“User 1: Hey folks, just my take on Money Partners. The security measures here are pretty solid, love that. Plus, they're regulated, so that's a big plus for trust. The interface is smooth, easy to navigate. But gotta say, the variety of coins is kinda limited, wish they had more options. Had a small issue once, and the customer support was helpful but took a bit to sort. Fees are okay, not too crazy. Overall, a safe bet for trading.”

User 2:

“User 2: Yo, sharing my experience with Money Partners. Security's top-notch, got my mind at ease. They're regulated too, which is a big deal for me. The interface is clean and intuitive, trading's a breeze. Liquidity's decent, never had trouble with that. They cover the main cryptos, but a bit more variety would be cool. Customer support surprised me, quick responses and helpful. Fees are reasonable, didn't break the bank. Definitely a solid option if you're lookin' for a reliable exchange.”

Conclusion

In conclusion, Money Partners is an exchange that offers a platform for users to trade virtual currencies. Some of the advantages of using Money Partners include a user-friendly interface, a wide range of educational resources, and multiple trading platforms. The exchange is also regulated by the Financial Services Agency in Japan, providing a regulated environment for investors. However, there are also potential disadvantages to consider, such as varying user experiences with access speed and the trading platform, as well as potentially high fees. It is important for individuals to conduct thorough research and evaluate their own trading needs and preferences before choosing to use Money Partners or any other virtual currency exchange.

FAQs

Q: What is the registration process for Money Partners?

A: To register for Money Partners, users need to visit their website and click on the “Sign Up” or “Register” button. They will then be prompted to enter their personal information, create a username and password, verify their email address, complete the Know Your Customer process, and agree to the exchange's terms and conditions.

Q: What are the deposit and withdrawal methods supported by Money Partners?

A: Money Partners offers various deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. Users can choose the method that is most convenient for them.

Q: Does Money Partners provide educational resources for traders?

A: Yes, Money Partners offers educational resources such as trading guides, video tutorials, and webinars. These resources cover topics such as technical analysis, market trends, and risk management strategies.

Q: What are the customer support options available at Money Partners?

A: Money Partners provides customer support through various channels, including email support, phone support, and a dedicated support ticket system. Users can choose the contact method that suits them best.

Q: Is Money Partners suitable for beginner traders?

A: Yes, Money Partners offers educational resources and a user-friendly interface, making it suitable for beginner traders who want to learn about cryptocurrency trading.

Q: What are the advantages of using Money Partners?

A: Some advantages of Money Partners include a user-friendly interface, a wide range of educational resources, multiple trading platforms, and being regulated by the Financial Services Agency in Japan.

Q: Are there any potential disadvantages to consider with Money Partners?

A: Yes, potential disadvantages may include varying user experiences with access speed and the trading platform, as well as potential high fees. It is important for users to conduct their own research and evaluate their trading needs before using Money Partners.

Q: Can I trade cryptocurrencies on Money Partners in my local language?

A: Money Partners may offer customer support in Japanese and potentially other languages. The availability of different languages may vary, so it's advisable to verify with the exchange.

These FAQs provide general information about Money Partners, its features, and potential considerations. Users should always refer to the official website or contact customer support for the most accurate and up-to-date information.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Company Name

Company Name Phone of the company

Phone of the company Company Website

Company Website X

X Facebook

Facebook Customer Service Email Address

Customer Service Email Address Japan

Japan

11 ratings